Booz Allen (BAH) Stock Gains 35% in 6 Months: Here's Why

Booz Allen Hamilton Holding Corporation BAH has had an impressive run on the bourse over the past six months. The stock gained 35.2%, outperforming 25% and 9.3% growth of the industry it belongs to and 9.3% growth of the Zacks S&P 500 composite.

The company has an expected long-term (three to five years) EPS growth rate of 12%. Its earnings for fiscal 2024 and 2025 are anticipated to grow 10.1% and 9.9%, respectively, year over year.

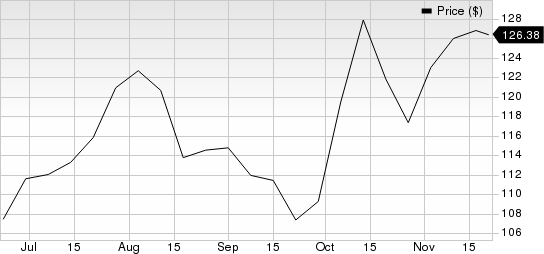

Booz Allen Hamilton Holding Corporation Price

Booz Allen Hamilton Holding Corporation price | Booz Allen Hamilton Holding Corporation Quote

Driving Factors

Vision 2020 was Booz Allen’s transformation strategy for creating sustainable expansion. The strategy focused on getting closer to clients’ core missions, increasing the technical content of work, attracting and retaining talent from diverse areas of expertise, increasing innovation, creating a wide network of external partners and alliances and expanding into commercial and international business. Its implementation has accelerated the company’s organic revenue growth, strengthened its profitability position and fetched significant headcount and backlog growth.

Booz Allen’s next strategy, VoLT, focuses on integrating velocity, leadership and technology in the process of transformation. Key focus areas on the velocity front are increasing innovation, strengthening market position through mergers, acquisitions and partnerships, and client-centric decision making. The leadership front involves initiatives to promptly utilize leadership in identifying client needs and scaling businesses. On the technology front, the company focuses on developing and expanding next-generation technology and solutions.

Booz Allen has a large addressable market as it serves the government, which is one of the world’s largest consumers of technology and management consulting services. Also, the agencies of the U.S. intelligence community offer an additional market. Further, the company has a lot of opportunities in global commercial markets where it has relatively low penetration.

Zacks Rank

Booz Allen's currently carries a Zacks Rank #3 (Hold)

Stocks to Consider

Investors can consider the following better-ranked stocks:

Rollins ROL currently carries a Zacks Rank #2 (Buy). For the fourth quarter of 2023, the Zacks Consensus Estimate for earnings is pegged at 20 cents, indicating year-over-year growth of 17.7%.You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

ROL has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and matching once, the average surprise being 7.2%.

FTI Consulting FCN also carries a Zacks Rank of 2. The consensus mark for fourth-quarter 2023 earnings is pegged at $1.57 per share, implying 3.3% year-over-year rise.

FCN has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and missing once, the average surprise being 8.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report