Booz Allen (BAH) Surges 17% in Three Months: Here's How

Booz Allen Hamilton Holding Corp. BAH has had an impressive run in the past three months, gaining 17.1%. The gain significantly outperformed the 13.4% increase of the industry and the 8.8% rise of the Zacks S&P 500 composite.

The company has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

What’s Aiding the Stock?

Booz Allen has an impressive earnings surprise history with its earnings surpassing the Zacks Consensus Estimate in all four trailing quarters, the average surprise being 10.2%.

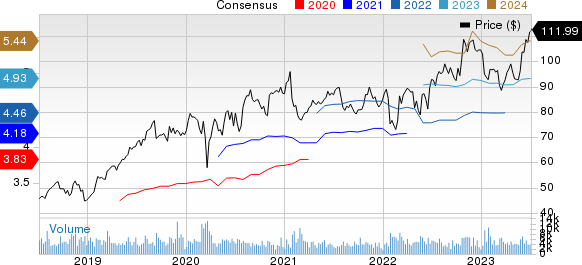

Booz Allen Hamilton Holding Corporation Price and Consensus

Booz Allen Hamilton Holding Corporation price-consensus-chart | Booz Allen Hamilton Holding Corporation Quote

The company has been focusing on innovation. It has also been focusing on artificial intelligence, advanced engineering, directed energy and modern digital platforms to bolster new and disruptive business models, thereby increasing client satisfaction and improving service quality.

Booz Allen serves a large addressable market including the U.S. government, which is one of the world’s largest consumers of technology and management consulting services. The company has an opportunity to grow in global markets where currently it has a lower presence.

For fiscal 2023, the Zacks Consensus Estimate for earnings and revenues is pegged at $4.93 per share and $10.03 billion, respectively. The earnings estimate indicates an 8.1% increase year over year while the revenue estimate implies 8.3% growth.

Zacks Rank and Stocks to Consider

BAH currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Business Services can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.8% year over year to $338.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value Score of A and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM Score of B along with a Zacks Rank of 1.

RollinsROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently carries a Zacks Rank of 2 and a Growth Score of A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report