Booz Allen Hamilton Holding Corp (BAH) Posts Robust Q3 FY2024 Results with Significant Revenue ...

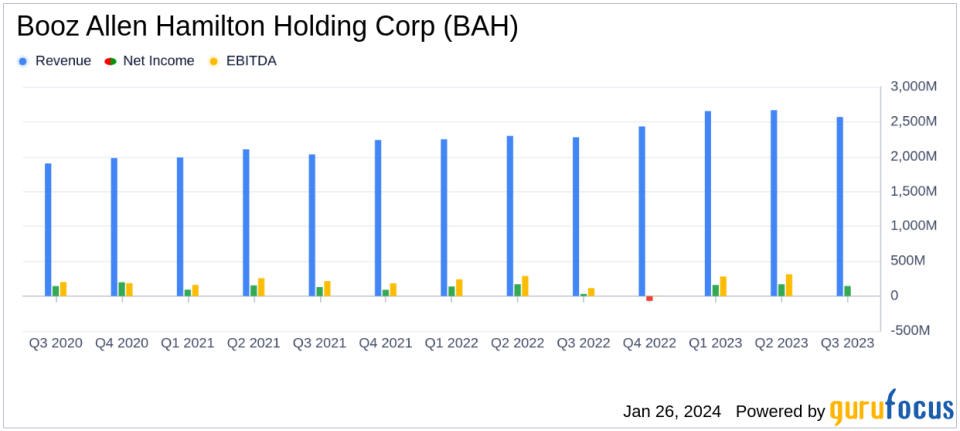

Revenue Growth: Quarterly revenue surged by 12.9% to $2.6 billion.

Net Income Spike: Net income soared by 374.6% to $145.6 million.

EPS Increase: Diluted EPS rose from $0.23 to $1.11, while Adjusted Diluted EPS climbed from $1.07 to $1.41.

Backlog Growth: Quarterly backlog increased by 14.2% to $34.3 billion.

Dividend Hike: Quarterly dividend increased by $0.04 to $0.51 per share.

Headcount Expansion: Client staff headcount grew by 9.2%, supporting future growth.

On January 26, 2024, Booz Allen Hamilton Holding Corp (NYSE:BAH) released its 8-K filing, announcing exceptional third-quarter fiscal 2024 results, including double-digit revenue growth and a significant increase in net income. The company, a leading provider of management and technology consulting services to the U.S. government, also raised its full-year guidance at both the top and bottom lines, reflecting confidence in its continued momentum.

Company Overview

Booz Allen Hamilton Holding Corp is a trusted advisor and long-term partner to clients, providing services that range from management consulting to technology and engineering. The company's expertise spans defense, intelligence, and civil markets, and it serves not only U.S. government agencies but also corporations, institutions, and nonprofit organizations globally.

Financial Highlights and Challenges

The company's third-quarter performance was marked by a 12.9% increase in revenue to $2.6 billion and a 374.6% surge in net income to $145.6 million. Adjusted EBITDA grew by 19.1% to $290.6 million, and the Adjusted EBITDA Margin on Revenue increased by 5.6% to 11.3%. These achievements underscore BAH's ability to scale and evolve its technology positions while investing in its people, creating exceptional value for clients and investors alike.

Despite these strong results, the company faces challenges inherent in government contracting, including the need to comply with numerous laws and regulations, the impact of U.S. government spending changes, and the competitive bidding process. These factors could potentially affect future performance.

Key Financial Metrics

Important metrics from the income statement include a 13.0% increase in Revenue, Excluding Billable Expenses, to $1.77 billion. The balance sheet reflects a healthy liquidity position with $601.8 million in cash and cash equivalents. Cash flow statements show net cash provided by operating activities at $115.1 million for the nine months ended December 31, 2023, with free cash flow at $64.5 million.

Management Commentary

"Our VoLT strategy is driving both excellent performance and increased resilience across the business. Strong demand and growing headcount are fueling continued momentum as we scale and evolve Booz Allens technology positions and invest in our people. We are creating exceptional value for clients and investors as we deliver ahead of pace on our Investment Thesis." HORACIO ROZANSKI, President and Chief Executive Officer

Analysis of Performance

BAH's performance in Q3 FY2024 reflects a robust business model and effective execution of its strategies. The company's growth in revenue and net income, combined with a strong backlog, positions it well for future success. The increase in headcount suggests an investment in capacity to support anticipated growth. The raised guidance indicates management's confidence in the company's trajectory.

For value investors, BAH's results demonstrate a solid financial position and the potential for sustained growth. The company's focus on expanding its technology offerings and investing in talent aligns with long-term industry trends in consulting and government services, making it an attractive option for those looking for stability and growth potential.

For more detailed information and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Booz Allen Hamilton Holding Corp for further details.

This article first appeared on GuruFocus.