Booz Allen Hamilton Holding Corp's Dividend Analysis

Understanding the Upcoming Dividend and Historical Performance

Booz Allen Hamilton Holding Corp (NYSE:BAH) recently announced a dividend of $0.51 per share, payable on 2024-03-01, with the ex-dividend date set for 2024-02-09. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Booz Allen Hamilton Holding Corp's dividend performance and assess its sustainability.

An Overview of Booz Allen Hamilton Holding Corp

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

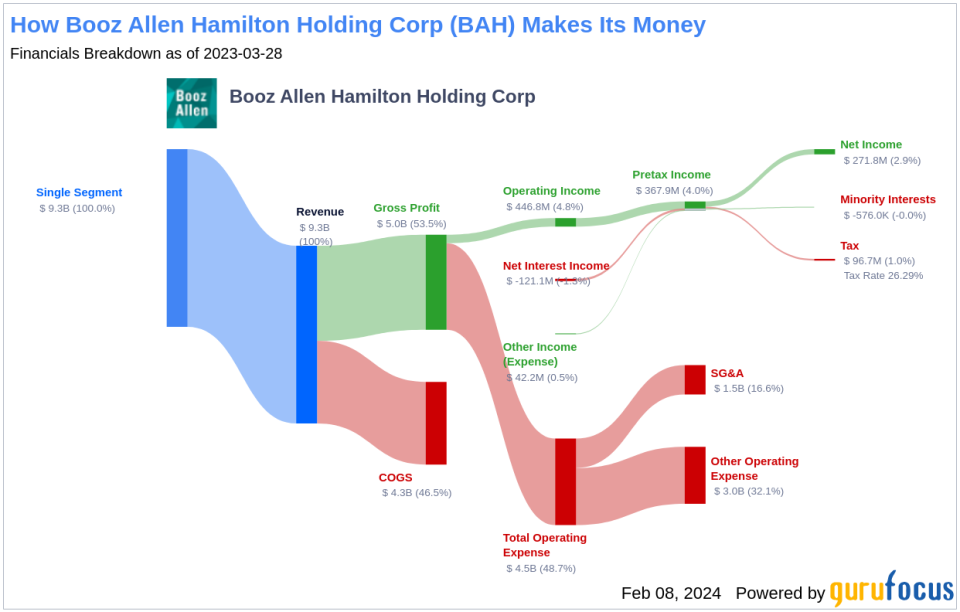

Booz Allen Hamilton Holding Corp provides management consulting services primarily to the U.S. government, focusing on defense, intelligence, and civil markets. It also offers technology solutions, including cloud computing and cybersecurity consulting, and engineering consulting. Besides serving the government, Booz Allen Hamilton caters to large corporations, institutions, and nonprofit organizations, engaging in long-term projects worldwide.

Booz Allen Hamilton Holding Corp's Dividend Consistency

Booz Allen Hamilton Holding Corp has maintained a consistent dividend payment record since 2012, distributing dividends quarterly. The company is recognized as a dividend achiever for increasing its dividend annually since 2012, reflecting a commitment to returning value to shareholders. Below is a chart showing the historical trend of annual Dividends Per Share.

Dividend Yield and Growth Insights

Booz Allen Hamilton Holding Corp currently has a 12-month trailing dividend yield of 1.31% and a forward dividend yield of 1.42%, indicating anticipated dividend increases over the next year. Over the past three years, the company's annual dividend growth rate was 19.20%, which increased to 21.40% per year over five years. The ten-year annual dividends per share growth rate stands at an impressive 17.80%. As a result, the 5-year yield on cost for Booz Allen Hamilton Holding Corp stock is approximately 3.45%.

Examining Dividend Sustainability

Assessing dividend sustainability involves looking at the dividend payout ratio, which for Booz Allen Hamilton Holding Corp is 0.36 as of 2023-12-31. This lower ratio indicates that the company retains a significant portion of its earnings, which supports future growth and provides a buffer for downturns. Booz Allen Hamilton Holding Corp's profitability rank of 8 out of 10 suggests strong earnings potential, supported by a decade of positive net income.

Prospective Growth and Revenue Metrics

Booz Allen Hamilton Holding Corp's growth rank of 8 out of 10 signals robust growth prospects relative to competitors. The company's revenue per share and 3-year revenue growth rate of 9.70% annually outperform approximately 65.2% of global competitors. Additionally, the 3-year EPS growth rate of 12.80% per year and the 5-year EBITDA growth rate of 17.40% outperform 53.37% and 70.02% of global competitors, respectively.

Concluding Thoughts on Booz Allen Hamilton Holding Corp's Dividend Outlook

The analysis of Booz Allen Hamilton Holding Corp's dividend payments, growth rates, payout ratio, profitability, and growth metrics paints a picture of a company with a strong commitment to shareholder returns and the financial health to support it. For investors seeking income and growth, BAH presents a compelling case. Will Booz Allen Hamilton Holding Corp continue its trajectory of dividend growth, and what might be the impact of global economic factors on its performance? For further insights, GuruFocus Premium users can explore high-dividend yield opportunities with the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.