BorgWarner (BWA) to Report Q3 Earnings: What's in the Cards?

BorgWarner BWA is slated to release third-quarter 2023 results on Nov 2 before market open. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share and revenues is pinned at 90 cents and $3.72 billion, respectively.

For the third quarter, the consensus estimate for BWA’s earnings per share has moved up by a cent in the past seven days. Its bottom-line estimates imply a decline of 27.4% from the year-ago reported number.

The Zacks Consensus Estimate for its quarterly revenues suggests a year-over-year decline of 8.4%.

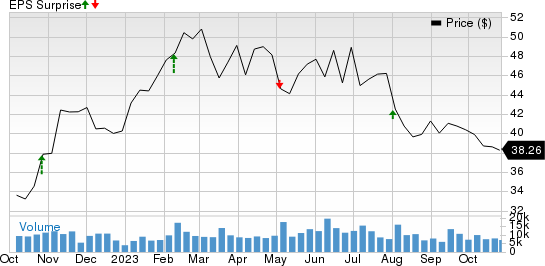

Over the trailing four quarters, BWA surpassed earnings estimates on three occasions and missed once, the average surprise being 14.4%. This is depicted in the graph below:

BorgWarner Inc. Price and EPS Surprise

BorgWarner Inc. price-eps-surprise | BorgWarner Inc. Quote

Q2 Highlights

In the second quarter of 2023, BWA reported adjusted earnings per share of $1.35, up from $1.05 recorded in the prior-year quarter. The bottom line also surpassed the consensus metric of $1.14.

The company reported net sales of $4,520 million, outpacing the Zacks Consensus Estimate of $4,395 million. The top line also increased by 20% year over year.

Things to Note

According to S&P Global, light vehicle production in the third quarter increased by nearly 4% compared to the previous year. The growth in production is likely to have aided the demand for BorgWarner’s offerings, which might positively impact the upcoming results.

Additionally, mergers & acquisitions and soaring EV popularity are likely to have bolstered BorgWarner’s third-quarter results. The company is likely to benefit from rising EV popularity and expects hybrid and electric technologies to be its major revenue drivers.

Here's a sneak peek at the firm’s revenues and EBIT projections for the to-be-reported quarter.

Our estimate for BorgWarner’s Air Management segment’s third-quarter sales is pinned at $2,055.6 million, suggesting a rise from $1,841 million reported in the year-ago quarter. EBIT from the segment is estimated at $293.2 million, indicating a slight drop from $294 million recorded in the year-ago quarter.

For the third quarter, our forecast for the Drivetrain & Battery Systems segment is pegged at $1,144.6 million, suggesting a rise from the $954 million registered in the year-ago quarter. Also, the segmental EBIT estimate of $131.2 million suggests a rise from $101 million generated in the third quarter of 2022.

Our forecast for the ePropulsion segment is pinned at $645.8 million, suggesting a rise from the $489 million registered in the year-ago quarter. Our estimate for loss before interest and taxes is pegged at $27.5 million, narrower than the loss of $32 million incurred in the third quarter of 2022.

Earnings Whispers

Our proven model predicts an earnings beat for the original equipment manufacturer for the quarter to be reported, as it has the right combination of the two key ingredients. A combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is the case here, as stated below.

Earnings ESP: BWA has an Earnings ESP of +4.03%. This is because the Most Accurate Estimate is 4 cents higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: It currently carries a Zacks Rank #3.

Earnings Whispers for Other Auto Stocks

Nikola NKLA is scheduled to post third-quarter earnings on Nov 2. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share is pegged at a loss of 15 cents per share. The company has an Earnings ESP of 0.00% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

NKLA surpassed earnings estimates in all of the trailing four quarters, the average surprise being 17.90%.

Lucid Group LCID is scheduled to post third-quarter earnings on Nov 7. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share is pinned at a loss of 27 cents per share. The company has an Earnings ESP of 0.00% and a Zacks Rank #2.

LCID missed earnings estimates in all of the trailing four quarters, the average negative surprise being 12.08%.

Rivian RIVN is scheduled to post third-quarter earnings on Nov 7. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share is pegged at a loss of $1.36 per share. The company has an Earnings ESP of -0.86% and a Zacks Rank #3.

RIVN surpassed earnings estimates in all of the trailing four quarters, the average surprise being 15.22%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Nikola Corporation (NKLA) : Free Stock Analysis Report

Lucid Group, Inc. (LCID) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report