BorgWarner Inc (BWA) Reports Growth in 2023, Eyes 25-40% eProduct Sales Increase in 2024

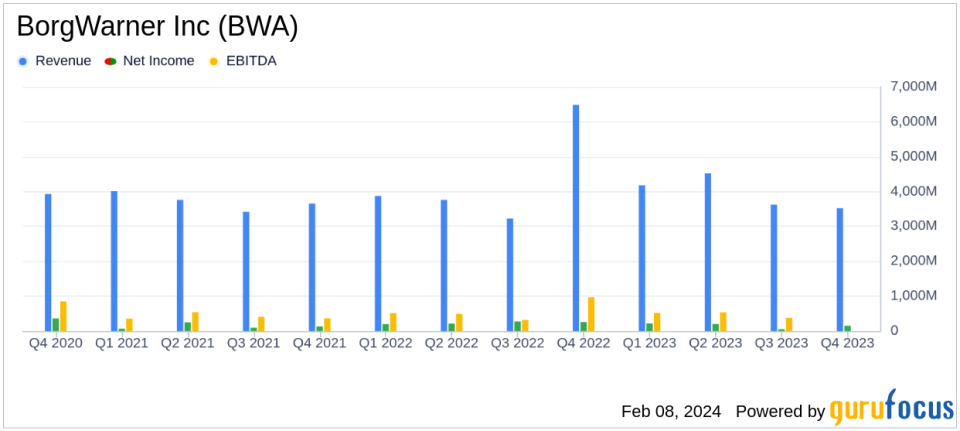

Net Sales: $14.2 billion in 2023, a 12.4% increase from 2022.

Net Earnings: $2.70 per diluted share on a U.S. GAAP basis in 2023.

Adjusted Net Earnings: $3.75 per diluted share in 2023, excluding non-comparable items.

Operating Income: $1.16 billion in 2023, representing 8.2% of net sales.

Free Cash Flow: $565 million in 2023, bolstering the company's financial flexibility.

2024 Guidance: Net sales expected to be $14.4 billion to $14.9 billion with eProduct sales projected to grow 25-40%.

BorgWarner Inc (NYSE:BWA) released its 8-K filing on February 8, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The company, a global leader in clean and efficient technology solutions for combustion, hybrid, and electric vehicles, reported a robust increase in net sales and a strategic focus on expanding its eMobility segment.

Company Overview

BorgWarner is a Tier I auto-parts supplier with a diversified product portfolio across three operating segments. The air management group specializes in turbochargers, e-boosters, emissions systems, and more. The drivetrain and battery systems group focuses on transmission components and battery modules, while the e-propulsion segment delivers e-motors and power electronics. With Ford and Volkswagen as its largest customers, BorgWarner has a significant presence in Europe, Asia, and North America.

Performance and Challenges

BorgWarner's performance in 2023 showcased a 12.4% increase in net sales to $14.2 billion, with organic sales up 12.5% from the previous year. The company's U.S. GAAP net earnings stood at $2.70 per diluted share, while adjusted net earnings were $3.75 per diluted share after excluding non-comparable items. Despite these strong results, BorgWarner faces the challenge of navigating a highly competitive and rapidly evolving automotive industry, particularly in the electric vehicle (EV) space. The company's ability to maintain growth in eProduct sales and manage operational costs will be critical in sustaining its market position.

Financial Achievements

The company's financial achievements in 2023, including a solid free cash flow of $565 million, underscore its ability to generate cash and invest in strategic growth areas. BorgWarner's focus on eMobility is evident in its partnerships and acquisitions, such as the strategic relationship with FinDreams Battery and the joint venture with Shaanxi Fast Auto Drive Group. These initiatives are expected to enhance the company's eProduct offerings and drive sales growth in the coming year.

Financial Details and Key Metrics

BorgWarner's income statement reflects a gross margin of 18.1% for the year, with operating income at $1.16 billion. The balance sheet shows a strong cash position with $1.53 billion in cash, cash equivalents, and restricted cash. The company's cash flow statement reports net cash provided by operating activities at $1.39 billion, highlighting its operational efficiency. Key metrics such as free cash flow and adjusted operating margin are crucial indicators of the company's financial health and its ability to sustain investments in innovation and growth.

Management Commentary

"BorgWarner's strategic focus on eMobility and our robust financial performance in 2023 position us well for continued growth. We expect our eProduct sales to grow approximately 25% to 40% in 2024, reflecting our commitment to innovation and leadership in the electric vehicle market."

Analysis and Outlook

Looking ahead, BorgWarner anticipates net sales for 2024 to range between $14.4 billion and $14.9 billion, with eProduct sales projected to significantly increase. The company expects an organic sales increase of 1% to 5% year-over-year and an adjusted operating margin between 9.2% and 9.6%. These projections reflect BorgWarner's strategic initiatives and its focus on expanding its presence in the electric vehicle sector, which is expected to be a key growth driver in the automotive industry.

For more detailed information and to listen to the conference call discussing these results and the 2024 guidance, visit BorgWarner's investor relations website at https://www.borgwarner.com/investors.

Explore the complete 8-K earnings release (here) from BorgWarner Inc for further details.

This article first appeared on GuruFocus.