Here’s What BorgWarner Inc.’s (NYSE:BWA) P/E Is Telling Us

This article is written for those who want to get better at using price to earnings ratios (P/E ratios). We’ll show how you can use BorgWarner Inc.’s (NYSE:BWA) P/E ratio to inform your assessment of the investment opportunity. BorgWarner has a P/E ratio of 15.21, based on the last twelve months. That corresponds to an earnings yield of approximately 6.6%.

See our latest analysis for BorgWarner

Want to participate in a short research study? Help shape the future of investing tools and receive a $60 prize!

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for BorgWarner:

P/E of 15.21 = $40.4 ÷ $2.66 (Based on the year to September 2018.)

Is A High P/E Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each $1 of company earnings. That isn’t necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the ‘E’ will be lower. That means even if the current P/E is low, it will increase over time if the share price stays flat. A higher P/E should indicate the stock is expensive relative to others — and that may encourage shareholders to sell.

Notably, BorgWarner grew EPS by a whopping 91% in the last year. Unfortunately, earnings per share are down 10% a year, over 5 years.

How Does BorgWarner’s P/E Ratio Compare To Its Peers?

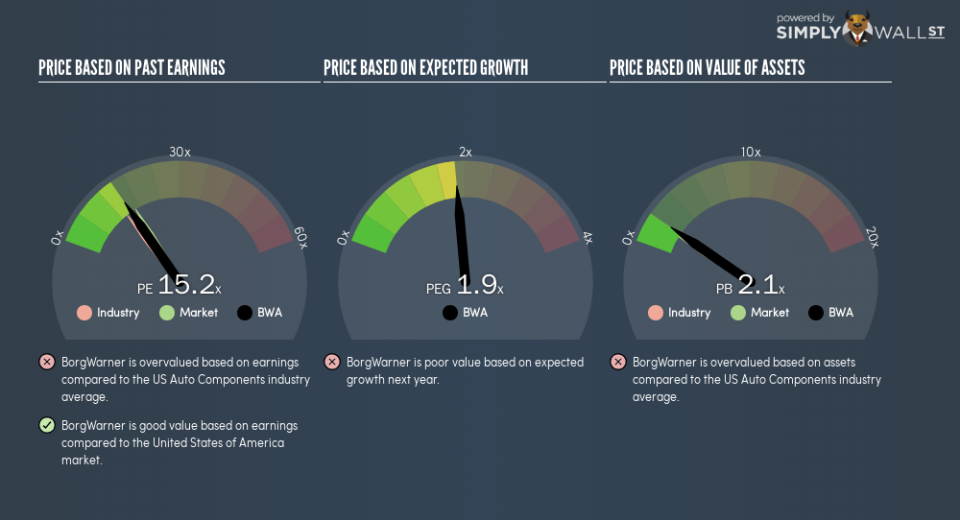

We can get an indication of market expectations by looking at the P/E ratio. The image below shows that BorgWarner has a higher P/E than the average (13.5) P/E for companies in the auto components industry.

BorgWarner’s P/E tells us that market participants think the company will perform better than its industry peers, going forward. Clearly the market expects growth, but it isn’t guaranteed. So investors should delve deeper. I like to check if company insiders have been buying or selling.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The ‘Price’ in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

BorgWarner’s Balance Sheet

Net debt totals 21% of BorgWarner’s market cap. This could bring some additional risk, and reduce the number of investment options for management; worth remembering if you compare its P/E to businesses without debt.

The Bottom Line On BorgWarner’s P/E Ratio

BorgWarner’s P/E is 15.2 which is below average (16.7) in the US market. The company does have a little debt, and EPS growth was good last year. If it continues to grow, then the current low P/E may prove to be unjustified. Given analysts are expecting further growth, one might have expected a higher P/E ratio. That may be worth further research.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, ‘In the short run, the market is a voting machine but in the long run, it is a weighing machine.’ So this free report on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than BorgWarner. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.