Boston Beer Co Inc (SAM) Faces Headwinds Despite Margin Improvements in Q4 and Full Year 2023

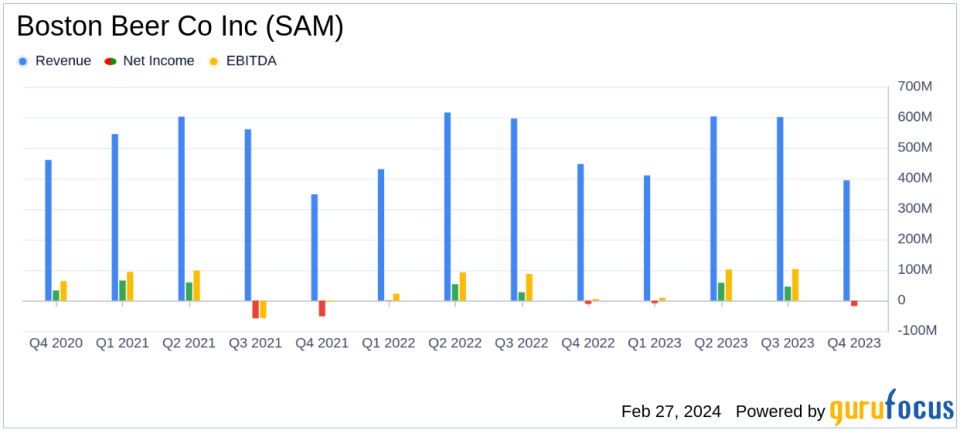

Net Revenue: $393.7 million in Q4, down 12.0% year-over-year; $2.009 billion for full year, down 3.9%.

Net Loss: Reported a net loss of $18.1 million in Q4; however, net income for the full year was $76.3 million.

Gross Margin: Improved to 37.6% in Q4, up 60 basis points; full year gross margin increased to 42.4%, up 120 basis points.

Operating Cash Flow: Generated $265 million for the full 2023 fiscal year.

Stock Repurchase: Repurchased $128.5 million in shares from January 2, 2023, to February 23, 2024.

On February 27, 2024, Boston Beer Co Inc (NYSE:SAM) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full fiscal year of 2023. The company, known for its leading craft beer and "beyond beer" products, faced a challenging year with decreases in depletions and shipments, yet managed to improve its gross margin and maintain a strong cash position.

Company Overview

Boston Beer is a prominent figure in the U.S. high-end malt beverage market, boasting a portfolio that includes Samuel Adams, Angry Orchard, Twisted Tea, and Truly Hard Seltzer. The company operates through a hybrid production model and a robust salesforce of 500 representatives. With over 95% of sales generated domestically, Boston Beer's performance is a significant indicator of trends within the alcoholic beverage industry.

Performance and Challenges

For Q4 2023, Boston Beer reported a 9% decrease in depletions and a 12.2% decrease in shipments, translating to a net revenue decline of 12.0% to $393.7 million. The company attributed approximately 8.9 percentage points of the decrease to the extra week in Q4 2022. Adjusting for comparable weeks, net revenue decreased by 3.1%. The company faced a net loss of $18.1 million, with a GAAP diluted loss per share of $1.49. Despite these challenges, Boston Beer saw an improvement in gross margin, which increased by 60 basis points to 37.6% in Q4, reflecting the company's ability to manage costs and improve operational efficiency.

For the full year, Boston Beer's net revenue decreased by 3.9% to $2.009 billion, with depletions and shipments both declining by 6% and 6.2%, respectively. However, the company's full-year gross margin increased to 42.4%, up 120 basis points from the previous year, indicating a stronger control over production costs and pricing strategies.

Financial Achievements and Importance

The company's ability to generate $265 million in operating cash flow and end the year with $298.5 million in cash and no debt is a testament to its financial resilience. The share repurchase program, which saw $128.5 million in shares bought back, underscores management's confidence in the company's intrinsic value and commitment to delivering shareholder returns.

Management Commentary

We were pleased to deliver steady improvement in comparable weeks depletions, solid progress on gross margin expansion and strong cash flow generation for the full 2023 fiscal year, said Chairman and Founder Jim Koch. President and CEO Dave Burwick added, The investments we made in our brands, marketing mix changes and supply chain enhancements drove improvement in operational and financial performance in 2023 and position us well to further fortify our business in 2024 and beyond.

Looking Ahead

Boston Beer's performance in 2023, despite the headwinds, shows a company adapting to market dynamics. The improvements in gross margin and strong cash flow generation are positive signs for investors. However, the declines in depletions and shipments highlight the competitive and volatile nature of the beverage industry. As the company continues to innovate and optimize its operations, it remains to be seen how these strategies will translate into performance in 2024.

Value investors and potential GuruFocus.com members interested in the beverage industry and Boston Beer Co Inc's financial journey can find more in-depth analysis and up-to-date information on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Boston Beer Co Inc for further details.

This article first appeared on GuruFocus.