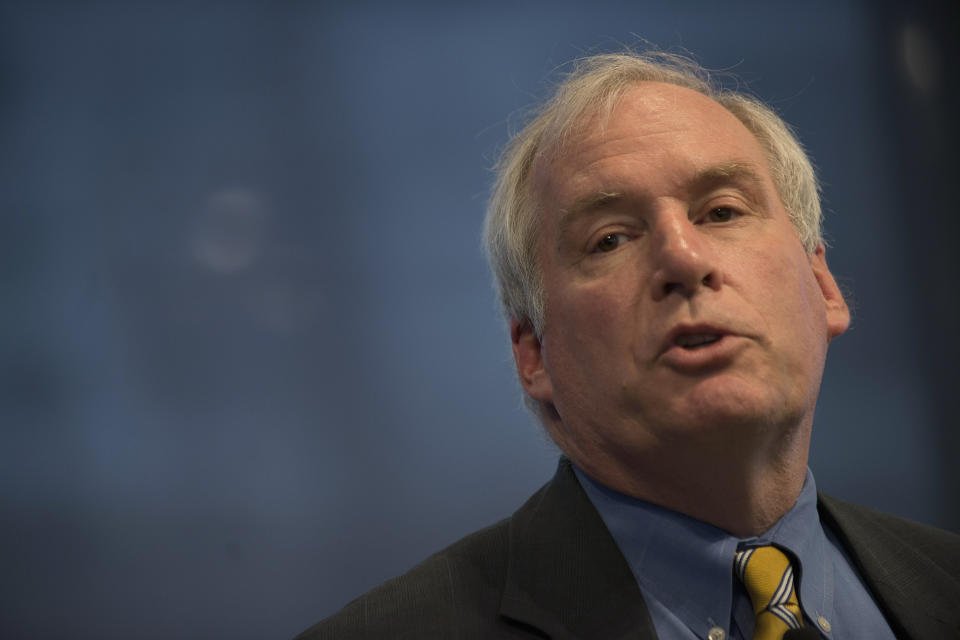

Boston Fed’s Rosengren: Lower rates could expose co-working companies like WeWork

Boston Fed President Eric Rosengren says he did not support the Federal Reserve’s decision to lower interest rates on Wednesday because the impacts of the trade dispute have not been “particularly large” on the U.S. economy.

Rosengren also worried that lower interest rates would invite more leverage in the financial system, expressing specific concern over whether cheap financing would expose co-working companies like WeWork in particular.

“The data we have in hand suggest instead that the recovery would continue apace even with little monetary policy accommodation,” Rosengren said in prepared remarks in New York on Friday morning.

On Wednesday afternoon, the Federal Open Market Committee moved to cut interest rates by 25 basis points. But a schism among the FOMC’s voting members revealed diverging views on the appropriate moves on monetary policy; Rosengren and Kansas City Fed President Esther George voted to hold rates steady while St. Louis Fed President James Bullard advocated for a 50 basis point cut.

Rosengren, who also opposed the July rate cut, pointed to a historically low unemployment rate and “firmer” readings on inflation this summer. He said that the Fed’s issues with inflation running below its 2% target (a widely cited reason for needing rate cuts) appear to be temporary.

Fed officials who moved to cut rates have described the move as a way to pre-empt data turning sour in the U.S. amid trade tensions and geopolitical concerns abroad. Although Rosengren acknowledged concerns over trade, Rosengren said the U.S. economy appeared to be weathering the headwinds fine.

“[W]hile the trade dispute has the potential for painful impacts on some industries in the U.S., in total the estimated direct impacts for the U.S. macroeconomy to date are not particularly large — perhaps several 10ths of a percentage point on GDP,” Rosengren said.

Higher leverage

In his speech Friday, Rosengren reiterated his concerns that lowering interest rates has its own risks, and could introduce more leverage into the system as risky assets ride higher on cheaper funding costs. Rosengren particularly cast light on leverage loans, the corner of risky borrowing undertaken by companies saddled with debt.

Rosengren also worried that too-low interest rates could result in a spillover of risk into real estate, arguing that co-working spaces like WeWork could be in jeopardy because of the term structures built into their business models.

Because co-working companies have long-term leases on buildings but re-lease office space to young and risky companies on short-term leases, Rosengren worries that in a downturn vacancies would rise dramatically as a drying-up of tenant income exposes the co-working company to default risk on their longer-term leases.

Rosengren added that because co-working companies also use a shell game of “special purpose entities” to hedge their losses on unprofitable lease arrangements, he worries about commercial real estate suffering substantial losses in the next downturn.

“The incentive to take on more leverage and to reach for yield can be costly – but the costs are apparent only when a downturn occurs,” Rosengren said.

The Fed’s next policy-setting meeting will take place October 29-30.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

St. Louis Fed's Bullard: 'Prudent risk management' would have been a 50 basis point cut

Powell faces record dissent as Fed splits further on interest rates

Trade tensions, oil shock cloud Fed efforts to steer clear of recession

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance