Boston Properties Inc (BXP): A Comprehensive GF Score Analysis

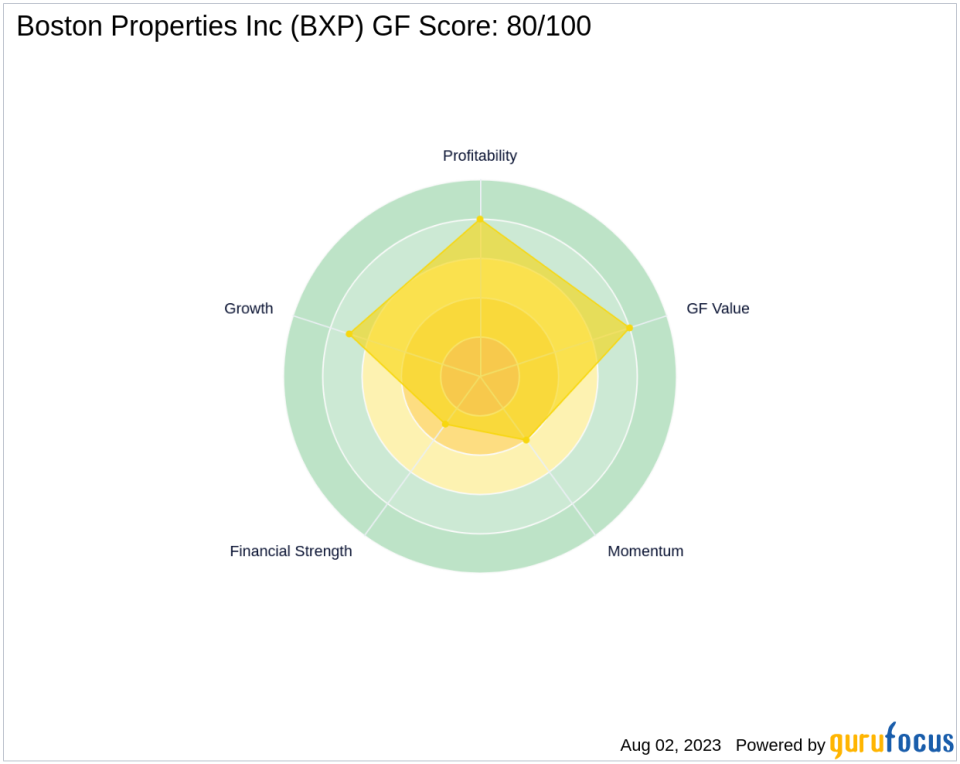

Boston Properties Inc (NYSE:BXP), a prominent player in the REITs industry, is currently trading at $67 per share. With a market capitalization of $10.51 billion, the company's stock has seen a gain of 3.54% today and a significant increase of 16.67% over the past four weeks. In this article, we will delve into the company's GF Score of 80/100, which indicates a likely average performance potential. The GF Score is a comprehensive stock performance ranking system developed by GuruFocus, which takes into account five key aspects: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank.

Financial Strength Analysis

Boston Properties Inc's Financial Strength rank stands at 3/10. This score is derived from several factors, including the company's debt burden, measured by its interest coverage of 2.22, and its debt to revenue ratio of 4.80. The company's Altman Z-Score, another crucial component of the Financial Strength Rank, is 0.76. These figures suggest that the company's financial situation is currently weak and needs improvement to avoid possible financial distress.

Profitability Rank Analysis

The company's Profitability Rank is 8/10, indicating a high level of profitability. This score is influenced by factors such as the company's operating margin of 33.02%, a Piotroski F-Score of 6, and a 5-year average operating margin trend of -0.70%. The company has also demonstrated consistent profitability over the past 10 years, as evidenced by its 3.5-star business predictability rank, contributing to its high profitability rank.

Growth Rank Analysis

Boston Properties Inc's Growth Rank is 7/10, reflecting a solid growth trajectory. This score is influenced by the company's 5-year revenue growth rate of 2.60%, a 3-year revenue growth rate of 1.20%, and a 5-year EBITDA growth rate of 5.60%. These figures suggest that the company has been able to consistently grow its revenue and profitability over the past few years.

GF Value Rank Analysis

The company's GF Value Rank is 8/10, indicating that the stock is reasonably valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples and an adjustment factor based on a company's past returns and growth.

Momentum Rank Analysis

Boston Properties Inc's Momentum Rank is 4/10, suggesting that the stock's price momentum is relatively weak. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its competitors in the REITs industry, Boston Properties Inc holds a competitive position. Vornado Realty Trust (NYSE:VNO) has a GF Score of 67, Kilroy Realty Corp (NYSE:KRC) has a GF Score of 83, and Cousins Properties Inc (NYSE:CUZ) has a GF Score of 77. This comparison suggests that Boston Properties Inc is performing well within its industry.

Conclusion

In conclusion, Boston Properties Inc's overall GF Score of 80/100 suggests a likely average performance potential. The company's strong profitability and growth ranks are particularly noteworthy. However, its financial strength and momentum ranks could be improved. Based on its GF Score, Boston Properties Inc's stock performance is expected to be average in the future.

This article first appeared on GuruFocus.