Boston Scientific (BSX) Hits 52-Week High: What's Aiding It?

Shares of Boston Scientific Corporation BSX scaled a new 52-week high of $56.55 on Dec 13, before closing the session marginally lower at $56.48.

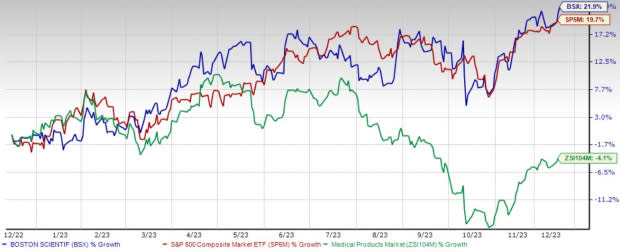

Over the past year, this Zacks Rank #3 (Hold) stock has gained 21.9% against a 4.1% decline of the industry. The S&P 500 has witnessed 19.7% growth in the said time frame.

Over the past five years, the company registered earnings growth of 5.9% compared with the industry’s 7.4% rise. The company’s long-term expected growth rate of 12.5% compares with the industry’s growth projection of 11.8%. Boston Scientific’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 4.3%.

Boston Scientific is witnessing an upward trend in its stock price, prompted by its impressive market share gain in the MedSurg segment. The optimism led by a solid third-quarter 2023 performance and continued geographical expansion are expected to contribute further. However, a competitive landscape and exposure to currency movement continue to concern the company.

Image Source: Zacks Investment Research

Let’s delve deeper.

Key Growth Drivers

Geographic Expansion: Boston Scientific successfully continues with its expansion of operations across different geographies outside the United States, raising investors’ optimism. Within its international regions, the company is putting additional efforts to expand its foothold in emerging markets, which are holding strong growth potentials based on their economic conditions, healthcare sectors, and global capabilities.

In the third quarter of 2023, despite the ongoing weaknesses in Russia, emerging markets registered sturdy growth, primarily banking on strong performance in China. During this period, emerging markets net sales grew 19% on an operational basis, year over year.

MedSurg Market Share Gain Impressive: Investors are upbeat about Boston Scientific’s consistent fast recovery within its MedSurg segment following the pandemic-led mayhem. The Endoscopy business within MedSurg is gaining from strong worldwide demand for its broad range of gastrointestinal and pulmonary treatment options.

In third-quarter 2023, the company reported strong organic growth contributions from single-use imaging and AXIOS technologies. Endoscopy demonstrated notable strength in the United States, Latin America and Asia-Pacific, with new product momentum and healthy procedure demand during the third quarter.

Strong Q3 Results: Boston Scientific’s robust third-quarter 2023 results raise optimism. The company registered a strong year-over-year improvement in organic sales, indicating a solid rebound in the legacy business even amid several macroeconomic issues. Organic and operational revenues at its core business segments and geographies were also up in the reported quarter.

Downsides

Exposure to Currency Movement: With Boston Scientific recording 40% of its sales from the international market, it remains highly exposed to currency fluctuations. Unfavorable currency movements have been a major dampener over the last few quarters, as in the case of other important MedTech players too.

Competitive Landscape: The presence of a large number of players has made the medical devices market highly competitive. The company participates in several markets, including Cardiovascular, Cardiac Rhythm Management, Endosurgery and Neuromodulation, where it faces competition from large and well-capitalized companies, apart from several other smaller companies.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and DexCom, Inc. DXCM.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 49.1% compared with the industry’s 7.8% rise in the past year.

HealthEquity, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 27.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 16.5%.

HealthEquity has gained 9.4% against the industry’s 9.1% decline over the past year.

DexCom, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 33.6%. DXCM’s earnings surpassed estimates in all the trailing four quarters, with an average of 36.4%.

DexCom’s shares have gained 5.2% against the industry’s 2.5% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report