Boston Scientific Corp (BSX) Posts Strong Q4 and Full Year 2023 Results

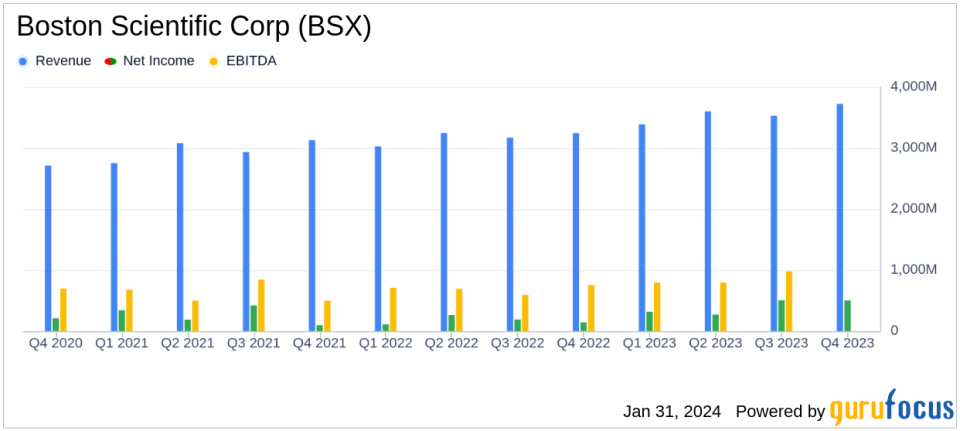

Q4 Revenue: $3.725 billion, a 14.9% increase year-over-year.

Full Year Revenue: $14.240 billion, up 12.3% from the previous year.

Q4 GAAP Net Income: $504 million, translating to $0.34 EPS.

Full Year GAAP Net Income: $1.570 billion, or $1.07 EPS.

Adjusted EPS: Q4 at $0.55, Full Year at $2.05, both showing significant growth.

Operational and Organic Growth: Both metrics show robust increases across segments and regions.

Future Outlook: Positive guidance for 2024 with expected continued revenue growth and EPS increase.

Boston Scientific Corp (NYSE:BSX) released its 8-K filing on January 31, 2024, revealing a robust performance for both the fourth quarter and the full year of 2023. The company, a leading manufacturer of less invasive medical devices, reported a significant increase in net sales and earnings per share, surpassing its own guidance and market expectations.

Company Overview

Boston Scientific is at the forefront of the Medical Devices & Instruments industry, specializing in the development of medical devices for a wide range of health conditions. Its products are vital for angioplasty, cardiac rhythm management, neuromodulation, and more, serving healthcare professionals and institutions worldwide. With nearly half of its sales generated internationally, the company's global presence is a key driver of its financial success.

Financial Highlights and Challenges

The company's financial achievements in Q4, including a 14.9% increase in net sales to $3.725 billion and a GAAP net income of $504 million, are significant indicators of its strong market position and operational efficiency. Full-year figures were equally impressive, with a 12.3% increase in net sales to $14.240 billion and a GAAP net income of $1.570 billion. Adjusted EPS for Q4 stood at $0.55, up from $0.45 in the prior year, while the full-year adjusted EPS climbed to $2.05 from $1.71.

These financial achievements underscore the importance of innovation and market expansion in the medical device industry. However, challenges such as competition, regulatory hurdles, and market dynamics could impact future performance. Despite these potential challenges, Boston Scientific's strong results demonstrate its ability to navigate a complex industry landscape effectively.

Segment and Regional Performance

Boston Scientific saw growth across all segments and regions. Notably, the Cardiovascular segment reported a 13.9% increase in net sales, while the MedSurg segment grew by 11.1%. Geographically, the Asia-Pacific region experienced a 14.8% increase in reported net sales, and the Latin America and Canada region saw a remarkable 20.8% growth. Emerging Markets also showed strong performance with a 16.3% increase in reported net sales.

Strategic Developments

The company's strategic initiatives, including FDA approvals for the FARAPULSE PFA System and the TENACIO Pump, as well as the acquisition of Relievant Medsystems, Inc., and the pending acquisition of Axonics, Inc., demonstrate its commitment to expanding its product portfolio and addressing unmet medical needs.

Outlook for 2024

Boston Scientific provided positive guidance for 2024, estimating net sales growth between 8.5 to 9.5 percent on a reported basis and 8 to 9 percent on an organic basis. The company also forecasts GAAP EPS in the range of $1.38 to $1.42 and adjusted EPS between $2.23 to $2.27.

The company's chairman and CEO, Mike Mahoney, expressed gratitude towards the global team and pride in the 2023 results, stating:

"We are excited about our future and long-range plans as we deliver on our mission to transform patient lives."

Overall, Boston Scientific's financial performance in 2023 paints a picture of a company that is not only growing but also innovating and strategically positioning itself for future success. For value investors and those interested in the medical devices sector, Boston Scientific Corp (NYSE:BSX) represents a company with strong fundamentals and a clear vision for growth.

Explore the complete 8-K earnings release (here) from Boston Scientific Corp for further details.

This article first appeared on GuruFocus.