BOX Q4 Earnings Surpass Estimates, Revenues Increase Y/Y

Box, Inc. BOX reported fourth-quarter fiscal 2024 non-GAAP earnings per share of 42 cents, which beat the Zacks Consensus Estimate by 10.5%. The figure jumped 13.5% year over year.

Total revenues of $262.88 million lagged the consensus mark of $262.92 million. The top line increased 2% year over year (4% growth on a constant currency basis).

Strength in its go-to-market strategy and growing adoption of multi-product offerings contributed well.

Solid momentum in the Content Cloud platform and the growing adoption of Enterprise Plus Suites drove the top-line growth.

Further, the growing momentum of Box AI was positive. Also, Box witnessed signs of stabilization in IT budgets during the reported quarter, which remained a plus.

However, macroeconomic challenges were major concerns.

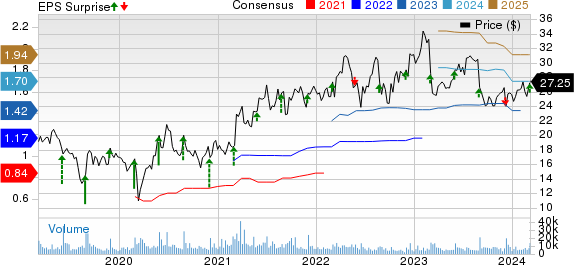

Box, Inc. Price, Consensus and EPS Surprise

Box, Inc. price-consensus-eps-surprise-chart | Box, Inc. Quote

Quarter in Detail

Billings were $379.3 million for the reported quarter, increasing 6% year over year (10% growth on a constant currency basis).

Deferred revenues were $586.9 million in the fiscal fourth quarter, increasing 4% from the prior fiscal-year quarter (7% growth on a constant currency basis).

BOX saw an 81% attach rate for its Suites, up 900 basis points (bps) year over year.

Box’s net retention rate was 101% at the end of the fiscal fourth quarter, down 700 bps year over year due to macroeconomic challenges.

The remaining performance obligations as of Jan 31, 2024, were $1.305 billion, up 5% on a year-over-year basis (9% growth on a constant currency basis).

Operating Results

Non-GAAP gross margin was 78.4%, contracting 10 bps from the same-quarter level in the previous year.

Box’s operating expenses of $178.99 million increased 1.8% year over year. As a percentage of revenues, the figure contracted 40 bps from the year-ago quarter’s level to 68.1%.

On a non-GAAP basis, the company recorded an operating margin of 26.7%, which expanded 70 bps from the prior-year quarter’s level.

Balance Sheet & Cash Flow

As of Jan 31, 2024, cash and cash equivalents were $383.7 million, up from $377.9 million as of Oct 31, 2023.

BOX’s short-term investments amounted to $96.9 million, up from $61.8 million in the previous fiscal quarter.

Accounts receivables amounted to $281.5 million at the end of the fiscal fourth quarter, which increased from $166.9 million at the end of the prior fiscal quarter.

Non-current debt was pegged at $370.8 million at the reported quarter’s end compared with $370.3 million at the previous quarter’s end.

Box generated $89.3 million in cash from operations in the fiscal fourth quarter, up from $71.8 million in the previous fiscal quarter.

BOX generated a free cash flow of $81.3 million in the reported quarter.

Guidance

For first-quarter fiscal 2025, Box expects revenues between $261 million and $263 million, suggesting a 4% rise at the high end of the range from the prior fiscal year’s reported figure. The constant currency growth rate is pegged at 7%. The Zacks Consensus Estimate for the same is pinned at $261.89 million.

On a non-GAAP basis, BOX projects earnings per share in the range of 35-36 cents. The guidance includes an expected foreign exchange headwind of 4 cents. The Zacks Consensus Estimate for the same is pegged at 38 cents.

The non-GAAP operating margin for the fiscal first quarter is expected to be 25%.

For fiscal 2025, the company expects revenue in the band of $1.08-$1.085 billion, indicating an increase of 5% from the last fiscal year’s reading at the high end of the range. The constant currency growth rate is pegged at 6%. The Zacks Consensus Estimate for the same is pinned at $1.08 billion.

BOX anticipates non-GAAP earnings per share in the band of $1.53-$1.57, including an expected foreign exchange headwind of 10 cents. The Zacks Consensus Estimate for the same is pegged at $1.70 per share.

The non-GAAP operating margin for the full fiscal year is expected to be 27%.

Zacks Rank & Stocks to Consider

Currently, Box carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are CrowdStrike CRWD, Badger Meter BMI and AMETEK AME. Each stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of CrowdStrike have gained 146.6% in the past year. The long-term earnings growth rate for CRWD is 36.07%

Shares of Badger Meter have gained 33.5% in the past year. The long-term earnings growth rate for BMI is 12.27%.

Shares of AMETEK have gained 26% in the past year. The long-term earnings growth rate for AME is 9.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Box, Inc. (BOX) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report