Boyd Gaming (BYD) Benefits From Robust Online Betting Growth

Boyd Gaming Corporation BYD is gaining from an expansion of online betting, the FanDuel partnership and the robust performance of the Las Vegas operation. However, increased expenses across food and beverage, and total operating costs along with intense industry competition are concerns.

The Zacks rank #3 (Hold) company’s earnings and sales in 2023 are likely to witness growth of 4% and 3.2% year over year, respectively.

Let’s delve deeper.

Growth Drivers

Boyd Gaming has been undertaking efforts to expand online betting offerings. One of its notable initiatives has been regarding the legalization of sports gambling. BYD has been witnessing a solid performance by the interactive gaming platform. Thanks to the strategic partnership with FanDuel, the company is optimistic about its future in the iGaming industry.

In the second quarter, the Online segment generated $85 million in revenues, up 49.6% year over year. Segmental EBITDAR came in at approximately $13.4 million, reflecting 74.5% growth on a year-over-year basis. The upside was backed by the launch of online gaming in Ohio, growth in Pennsylvania and the acquisition of Pala Interactive (in fourth-quarter 2022).

For 2023, management expects EBITDAR of the Online segment in the range of $55-$60 million, up from the prior expectation of $50 million. It expects solid contributions from FanDuel operations (in Ohio and Kansas) and Boyd Interactive's portfolio.

During second-quarter 2023, BYD relaunched Starts branded online casinos in Pennsylvania and New Jersey, marking the first leveraging of the Boyd Interactive platform to manage its online casino operations.

The company considers the local market in Las Vegas as a major driver for its portfolios. With restaurants and bars open, frequent visitations by locals are likely to spur its growth. For the first six months of 2023, Boyd Gaming reported positive customer trends with respect to guest counts, frequency and spending along with growth in the convention business. Segmental revenues and EBITDAR rose 1.5% and 0.2%, respectively, year over year in the same time frame.

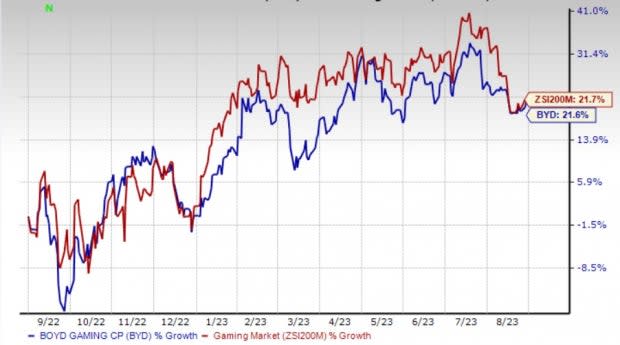

Image Source: Zacks Investment Research

Concerns

Despite several margin-enhancing initiatives, Boyd Gaming has been grappling with higher expenses across project development, preopening and writedowns, online as well as food and beverage. Total operating costs and expenses during the quarter were $672.9 million compared with $649.4 million reported in the prior-year quarter.

Going forward, management intends to monitor the economic situation to gauge the impacts of interest rate hikes and inflationary pressures. For 2023, our model predicts room and online expenses to witness year-over-year growth of 1.5% to $69.4 million and 17.8% to $252.1 million, respectively.

Key Picks

Some better-ranked stocks from the Consumer Discretionary sector are Royal Caribbean Cruises Ltd. RCL, Live Nation Entertainment, Inc. LYV and Strategic Education, Inc. STRA.

Royal Caribbean presently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

RCL has a trailing four-quarter earnings surprise of 28.5%, on average. The stock has gained 132.1% in the past year. The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates growth of 54.5% and 180.3%, respectively, from the year-ago period’s levels.

Live Nation presently flaunts a Zacks Rank of 1. LYV has a trailing four-quarter earnings surprise of 34.6%, on average. The stock has declined 11.8% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests rises of 21% and 57.8%, respectively, from the year-ago period’s levels.

Strategic Education currently sports a Zacks Rank of 1. STRA has a trailing four-quarter earnings surprise of 12.1%, on average. The stock has jumped 11.9% in the past year.

The Zacks Consensus Estimate for STRA’s 2023 sales and EPS implies improvements of 4.9% and 27.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report