Boyd Gaming Corp (BYD) Reports Mixed Results Amid Record Revenues and Impairment Charges

Revenue: Full-year revenue increased to $3.7 billion in 2023, up from $3.6 billion in 2022.

Net Income: Net income for 2023 was $620.0 million, or $6.12 per share, a slight decrease from $639.4 million, or $5.87 per share, in 2022.

Adjusted Earnings: Adjusted earnings for 2023 stood at $639.9 million, or $6.31 per share, compared to $662.0 million, or $6.07 per share, in 2022.

Impairment Charges: The results were impacted by non-cash, pretax goodwill and intangible asset impairment charges of $107.8 million in 2023 and $40.8 million in 2022.

Dividends and Share Repurchases: Boyd Gaming paid a quarterly cash dividend of $0.16 per share and repurchased $100 million in shares in Q4 2023.

Balance Sheet: As of December 31, 2023, the company had $304.3 million in cash and $2.9 billion in total debt.

On February 8, 2024, Boyd Gaming Corp (NYSE:BYD) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The multi-jurisdictional gaming company, which operates across several states and is known for its diverse portfolio of gaming and entertainment properties, reported a mixed set of financial figures characterized by record revenues but also significant impairment charges.

Performance Overview

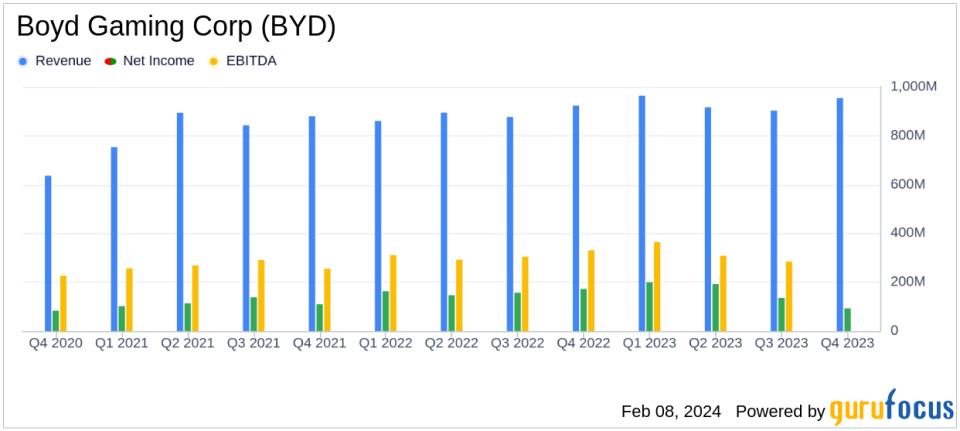

Boyd Gaming's fourth-quarter revenues rose to $954.4 million, up from $922.9 million in the same period of the previous year. However, net income for the quarter fell to $92.6 million, or $0.94 per share, from $172.7 million, or $1.63 per share, in Q4 2022. The decline was largely due to $103.3 million in non-cash, pretax goodwill and intangible asset impairment charges.

For the full year, Boyd Gaming's revenues increased to $3.7 billion from $3.6 billion in 2022. Net income for the year was $620.0 million, or $6.12 per share, compared to $639.4 million, or $5.87 per share, in the previous year. The full-year results were also impacted by impairment charges, which totaled $107.8 million in 2023, up from $40.8 million in 2022.

Adjusted EBITDAR for the fourth quarter was $355.5 million, slightly down from $360.1 million in the prior year's quarter. For the full year, Adjusted EBITDAR was $1.4 billion, maintaining a level similar to the previous year. Adjusted Earnings for the full year were $639.9 million, or $6.31 per share, compared to $662.0 million, or $6.07 per share, in 2022.

Financial Highlights and Challenges

Boyd Gaming's financial achievements in 2023 reflect the company's ability to generate growth in a challenging environment. The company's diversified portfolio and consistent customer trends contributed to the revenue increase. However, the impairment charges indicate potential areas of concern, reflecting adjustments to the carrying value of certain assets that may have been affected by market conditions or other operational challenges.

Keith Smith, President and Chief Executive Officer of Boyd Gaming, commented on the results, stating, "The fourth quarter's strong performance was a fitting conclusion to another record year for our Company." He highlighted the company's efficient management and the strategic balance between returning capital to shareholders and investing in property enhancements.

The fourth quarter's strong performance was a fitting conclusion to another record year for our Company. Our fourth-quarter and full-year results were driven by our diversified portfolio, consistent core customer trends and solid returns from our recent property investments.

Boyd Gaming's performance in the Las Vegas Locals and Downtown Las Vegas segments showed consistency, with the Midwest & South segment returning to growth in the fourth quarter. The company's Online segment also benefited from the introduction of sports betting in Ohio.

From a balance sheet perspective, Boyd Gaming ended the year with a strong cash position and continued to demonstrate financial discipline by managing its debt levels.

Looking Ahead

Looking forward, Boyd Gaming remains confident in its ability to deliver profitable growth and create long-term shareholder value. The company's strategic investments and operational efficiencies are expected to continue driving performance, despite the challenges posed by impairment charges and a competitive market landscape.

Investors and analysts can access more details about Boyd Gaming's financial results and future outlook during the company's conference call, which will be available on the company's investor relations website.

For a comprehensive analysis of Boyd Gaming Corp's financial results, including detailed financial tables and metrics, please visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from Boyd Gaming Corp for further details.

This article first appeared on GuruFocus.