BP to Offer Access to Charging to Help Uber Drivers Go Electric

BP plc BP signed an agreement to help drivers on Uber Technologies’ UBER platform shift to electric vehicles (EVs) by granting access to its high-speed charging network.

The companies will utilize their global footprints to help drivers switch to EVs by providing access to reliable and convenient charging, including those at ultra-fast speeds.

Uber intends to have all rides on its platform be carried through EVs, micro-mobility or public transport by 2040. The agreement will boost Uber’s strategy to be a zero-tailpipe emissions mobility platform in the United States, Canada and Europe by 2030, and globally by 2040.

The incentives will be initially offered in markets, including the United States, the U.K. and parts of Europe. Per the contract, BP will provide bespoke deals to drivers on the Uber platform, which are tailored to each market. This includes incentives for drivers to charge their cars at stations that are part of the BP Pulse charging network.

Beside this, BP and Uber will explore work on convenience and fuel offers. BP has a global network of 21,000 branded retail sites offering fuel as well as food.

The companies have been working together since BP opened its first rapid commercial charging hub in London in 2021. Uber was BP’s first ride-hailing platform partner to get access to the new hub, which provides charging points to drivers on the Uber platform.

Access to EV charging will help develop a sustainable future for people of all socioeconomic backgrounds. BP is investing billions of dollars in EV infrastructure, with an aim to have more than 100,000 charging points globally by 2030. BP aims to become a net-zero company by 2050 or sooner.

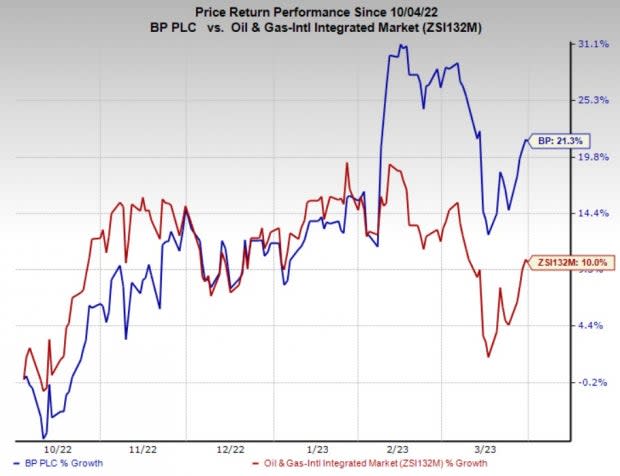

Price Performance

Shares of BP have outperformed the industry in the past six months. The stock has gained 21.3% compared with the industry’s 10% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

BP currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Liberty Energy Inc.’s LBRT fourth-quarter 2022 earnings per share of 82 cents handily beat the Zacks Consensus Estimate of 71 cents. The outperformance reflects the impacts of strong execution and increased service pricing.

As part of its shareholder return policy, LBRT repurchased $125 million of its stock at an average price of $15.29 a piece since July and reinstated a quarterly cash dividend of 5 cents per share in the fourth quarter.

Marathon Petroleum Corporation’s MPC adjusted earnings per share of $6.65 comfortably beat the Zacks Consensus Estimate of $5.54. The bottom line was favorably impacted by the stronger-than-expected performance of its key Refining & Marketing segment.

In the fourth quarter, MPC repurchased $1.8 billion of shares and another $700 million worth of shares from the start of this year till Jan 27. Marathon Petroleum, which gave an additional $5 billion share repurchase approval, currently has a remaining authorization of $7.6 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report