BP Plans to Drill Four Natural Gas Exploration Wells in Egypt

BP plc BP is planning to drill four natural gas exploration wells in Egypt in the fourth quarter of 2023.

Of the total, two wells are situated at the Raven gas field in the North Alexandria Concession. The remaining wells will be drilled at the King Mariout offshore exploration block.

BP and its natural gas partners also plan to invest $3.5 billion over three years to explore and develop natural gas resources in Egypt.

Egypt has been progressing toward developing the energy sector and positioning itself as an energy hub. The Egypt government intends to drill 45 natural gas exploratory wells in the Mediterranean and the Nile Delta, with $1.9 billion in investments until mid-2025.

The program aims to drill 35 wells for gas exploration to increase the field’s capacity, with 10 wells to be drilled between July 2022 and June 2023. In 2023, Egypt expects to produce 8 million tons of liquified natural gas, a year-over-year increase of more than 6.5%.

BP is working to diversify cooperation opportunities with Egypt, including capacity building, emission-reduction projects, sustainable energy projects and hydrogen projects. The latest move addresses BP’s interest in increasing its business and investments in the natural gas field in the Mediterranean region.

BP has been contributing to Egypt’s growth for six decades. It produces around 60% of the country’s gas. Expanding its business scope in Egypt validates BP’s long-term commitment to the country.

Last year, BP signed a memorandum of understanding with the government of Egypt to explore the possibilities for building a renewable hydrogen production facility in the country. BP will assess the technical and commercial feasibility of developing a large-scale green hydrogen export hub in Egypt.

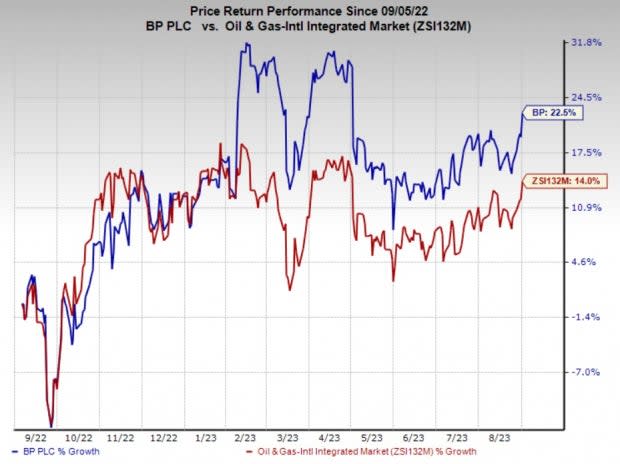

Price Performance

Shares of BP have outperformed the industry in the past year. The stock has gained 22.5% compared with the industry’s 14% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

BP currently carries a Zack Rank #5 (Strong Sell).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Evolution Petroleum Corporation EPM is an independent energy company. EPM has a Zacks Style Score of A for Growth and B for Value.

Evolution Petroleum has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for EPM’s 2023 and 2024 earnings per share is pegged at $1.11 and $1.08, respectively.

Core Laboratories N.V.’s CLB strong presence in the emerging shale plays and its global footprint will provide for steady growth rates going forward. CLB’s technology-heavy portfolio of proprietary products and services gives it the opportunity to optimize production from new and existing fields.

Core Labs has witnessed upward earnings estimate revision for 2023 and 2024 in the past 30 days. The consensus estimate for CLB’s 2023 and 2024 earnings per share is pegged at 88 cents and $1.17, respectively.

Sunoco LP SUN is among the biggest motor fuel distributors in the United States wholesale market in terms of volumes. For 2023, the partnership expects an adjusted EBITDA of $865-$915 million.

Over the past 30 days, Sunoco has witnessed upward earnings estimate revisions for 2023 and 2024, respectively. The Zacks Consensus Estimate for SUN’s 2023 and 2024 earnings per share is pegged at $4.37 and $3.81, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Core Laboratories Inc. (CLB) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report