BP, Shell to Explore 3 Trinidad and Tobago Deepwater Blocks

BP Plc BP and Shell Plc SHEL entered an agreement to explore three deepwater blocks in Trinidad and Tobago for producing hydrocarbons, per Reuters.

Both companies have expressed interest in the potential gas reserves within these blocks. They could play a pivotal role in supporting Trinidad and Tobago’s liquefied natural gas project, and provide a vital source of feedstock for the petrochemical industries in the region.

The companies have successfully negotiated terms for the exploration of blocks 25a, 25b and 27 with the Trinidad and Tobago government. However, they are still finalizing an agreement for Block 23, which was also part of their bid.

The agreement would assist Trinidad in accelerating its offshore exploration and production efforts, with the aim of securing additional natural gas resources to bolster its liquefied natural gas and petrochemical industries.

The negotiations were complex primarily because the blocks had not undergone prior exploration. Also, there were considerable challenges associated with deepwater development. The consortium is near finalizing negotiations with the Trinidad and Tobago government for offshore deep-water blocks.

The agreement was reached nearly nine months after Trinidad’s government initially rejected the consortium’s bids as they did not meet the minimum thresholds required.

BP and Shell subsequently revised their initial bids to incorporate the drilling of at least three deepwater wells as part of a proposed work program, as well as acquiring 3D seismic data for the unexplored acreage.

BP and Shell hold the majority stakes in Trinidad's Atlantic LNG export project, which possesses an installed capacity of 15 million metric tons per year. However, the project has been operating at a reduced production rate of 10 million tons per year due to a lack of adequate gas supply.

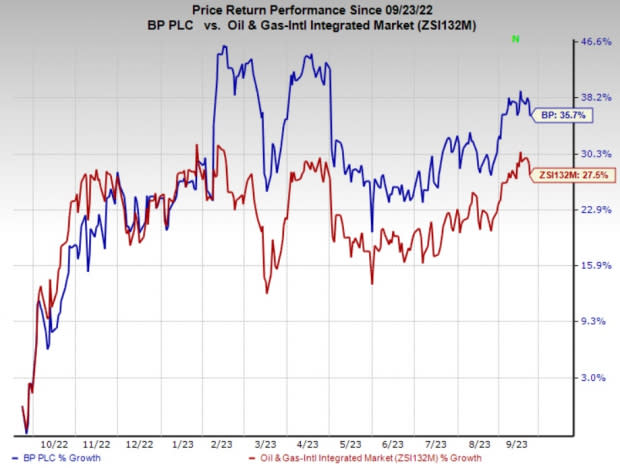

Price Performance

Shares of BP have outperformed the industry in the past year. The stock has gained 35.7% compared with the industry’s 27.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

BP currently carries a Zack Rank #5 (Strong Sell).

Investors interested in the energy sector might look at the following companies that presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

USA Compression Partners, LP USAC is one of the largest independent natural gas compression service providers across the United States in terms of fleet horsepower.

USA Compression Partners has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for USAC’s 2023 and 2024 earnings per share is pegged at 30 cents and 58 cents, respectively.

Pioneer Natural Resources Company PXD is an explorer and producer of oil, natural gas and natural gas liquid. The upstream energy player’s debt to capitalization has been persistently lower than the industry over the past few years, reflecting considerably lower debt exposure.

Pioneer has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for PXD’s 2023 and 2024 earnings per share is pegged at $20.60 and $24.20, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report