Braze Inc (BRZE) Earnings: Aligns with EPS Projections and Reports 33% Revenue Growth

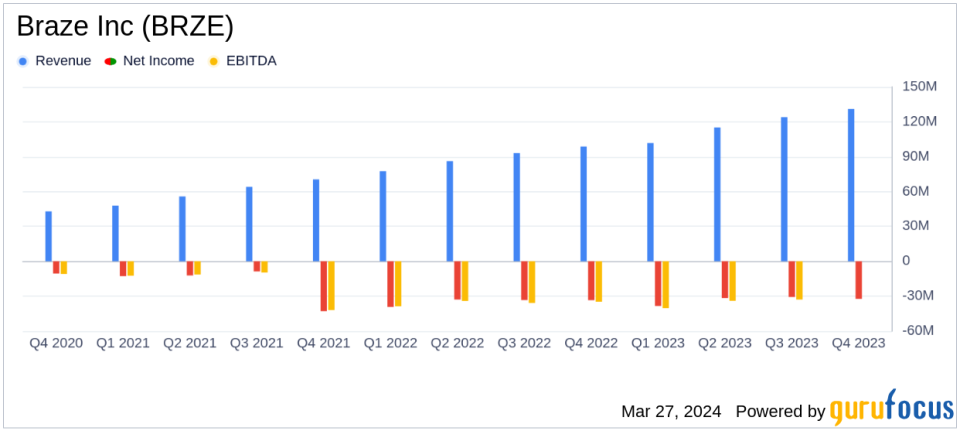

Revenue: Q4 revenue increased by 33% year-over-year to $131.0 million, surpassing the estimated $127.8238 million.

Net Income: Reported a GAAP net loss of $28.3 million, with a non-GAAP net loss per share of $0.04, aligning with analyst estimates of -$0.0481.

Gross Margin: Improved GAAP gross margin to 67.2% in Q4, reflecting a year-over-year increase and emphasizing operational efficiency.

Operating Loss: GAAP operating loss narrowed to $32.3 million from $36.5 million in the same quarter last year, showing reduced losses over time.

Customer Growth: Total customers grew to 2,044, up from 1,770 year-over-year, indicating strong market penetration and product adoption.

Cash Position: Maintained a robust cash and equivalents balance of $480.0 million, providing a solid foundation for future investments.

Guidance: Introduced FY 2025 guidance with expected revenue between $570.0 million and $575.0 million, forecasting continued growth.

Braze Inc (NASDAQ:BRZE) released its 8-K filing on March 27, 2024, detailing its fiscal year and fourth quarter 2024 results. The company, a leading customer engagement platform, has reported a significant 33% increase in fourth-quarter revenue, reaching $131.0 million, and has successfully aligned with analyst earnings per share (EPS) projections.

Braze Inc is a customer engagement platform that powers interactions between consumers and brands across various industries, including Retail & E-commerce, Media & Entertainment, Financial Services, and Travel & Hospitality. The company's solutions are designed to foster growth, loyalty, and retention by leveraging first-party data, machine learning, and artificial intelligence.

Financial Performance and Challenges

The company's fiscal fourth-quarter performance reflects a strong year-over-year revenue growth, driven by new customer acquisitions, upsells, and renewals. Subscription revenue saw a significant increase, while professional services and other revenue also grew. Despite these achievements, Braze Inc reported a GAAP net loss per share of $0.29, which improved from the previous year's $0.35 loss per share. The non-GAAP net loss per share was $0.04, consistent with analyst expectations.

Challenges for Braze Inc include managing operating losses and free cash flow, which was negative $3.5 million for the quarter. The company's dollar-based net retention rate decreased to 117% from 124% in the previous year, indicating a potential area for improvement in customer retention and expansion.

Financial Achievements and Industry Impact

The improved gross margins, both GAAP and non-GAAP, highlight Braze Inc's increased operational efficiency and its ability to scale effectively. The growth in total customers and those with annual recurring revenue (ARR) of $500,000 or more demonstrates the company's strong market presence and the value it provides to large-scale clients.

In the software industry, where recurring revenue and customer retention are critical, Braze Inc's performance showcases its potential for sustained growth. The company's robust cash position also indicates a capacity for strategic investments and resilience in a competitive market.

Financial Outlook and Commentary

Looking ahead, Braze Inc has provided guidance for the fiscal first quarter ending April 30, 2024, and the fiscal year ending January 31, 2025. The company anticipates revenue to be in the range of $131.0 to $132.0 million for the first quarter and $570.0 to $575.0 million for the full year. The non-GAAP operating loss is expected to be between $13.0 and $14.0 million for the first quarter and $20.0 to $24.0 million for the full year.

CEO Bill Magnuson commented on the company's performance, stating:

"Fiscal 2024 marked another significant year for Braze, as we strengthened our position as the leading customer engagement platform and grew revenue by 33%, helping over 2,000 global brands foster growth, loyalty, and retention."

This statement emphasizes the company's commitment to enhancing customer engagement and its success in achieving substantial revenue growth.

Analysis of Company Performance

Braze Inc's earnings report indicates a company in a strong growth phase, with substantial revenue increases and an expanding customer base. The alignment with EPS estimates and improved operating loss figures suggest effective cost management and a trajectory towards profitability. The company's investment in product development and market expansion, as reflected in its guidance, positions Braze Inc for continued success in the customer engagement sector.

For value investors and potential GuruFocus.com members, Braze Inc presents a compelling case of a growth-oriented company with a solid financial foundation and strategic focus on customer-centric solutions.

For more detailed financial analysis and insights into Braze Inc's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Braze Inc for further details.

This article first appeared on GuruFocus.