Braze's (NASDAQ:BRZE) Q4: Beats On Revenue, Next Quarter Sales Guidance Is Optimistic

Customer engagement software provider Braze (NASDAQ:BRZE) announced better-than-expected results in Q4 CY2023, with revenue up 32.7% year on year to $131 million. Guidance for next quarter's revenue was also optimistic at $131.5 million at the midpoint, 2.9% above analysts' estimates. It made a non-GAAP loss of $0.04 per share, improving from its loss of $0.14 per share in the same quarter last year.

Is now the time to buy Braze? Find out by accessing our full research report, it's free.

Braze (BRZE) Q4 CY2023 Highlights:

Revenue: $131 million vs analyst estimates of $124.6 million (5.1% beat)

EPS (non-GAAP): -$0.04 vs analyst estimates of -$0.05

Revenue Guidance for Q1 CY2024 is $131.5 million at the midpoint, above analyst estimates of $127.8 million

Management's revenue guidance for the upcoming financial year 2025 is $572.5 million at the midpoint, in line with analyst expectations and implying 21.3% growth (vs 32.7% in FY2024)

However, Management's operating loss guidance for the upcoming financial year 2025 is a loss of $22.0 million at the midpoint, worse than analyst expectations

Gross Margin (GAAP): 67.2%, up from 66.1% in the same quarter last year

Free Cash Flow was -$3.54 million compared to -$5.91 million in the previous quarter

Net Revenue Retention Rate: 117%, in line with the previous quarter

Customers: 2,044, up from 2,011 in the previous quarter

Market Capitalization: $4.93 billion

"Fiscal 2024 marked another significant year for Braze, as we strengthened our position as the leading customer engagement platform and grew revenue by 33%, helping over 2,000 global brands foster growth, loyalty, and retention," said Bill Magnuson, cofounder and CEO of Braze.

Founded in 2011 after the co-founders met at NYC Disrupt Hackathon, Braze (NASDAQ:BRZE) is a customer engagement software platform that allows brands to connect with customers through data-driven and contextual marketing campaigns.

Marketing Software

Whether or not companies market their products through social media, all businesses need to meet customers where they are; and increasingly, that is social media. As more and more people use a greater number of social media platforms, social media management software become more valuable to their customers.

Sales Growth

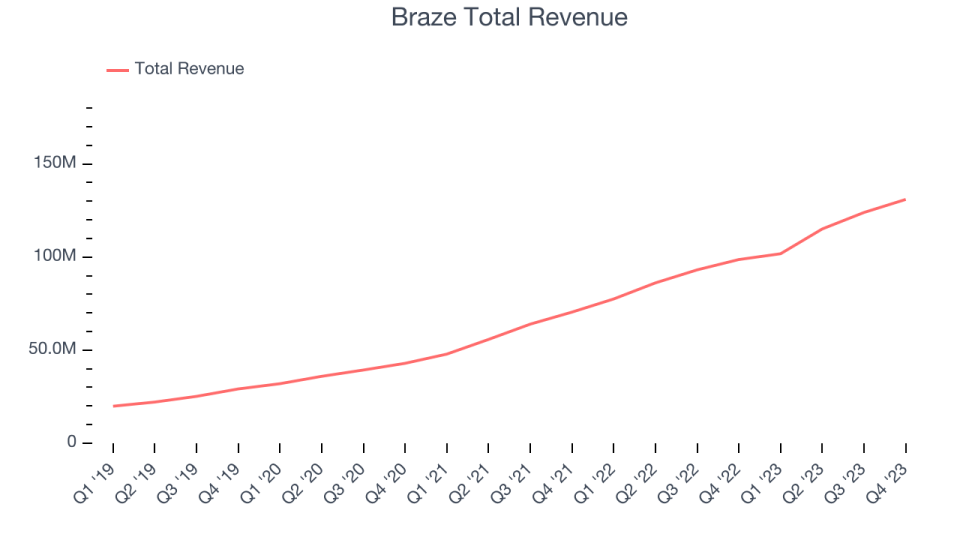

As you can see below, Braze's revenue growth has been impressive over the last three years, growing from $42.93 million in Q4 2021 to $131 million this quarter.

Unsurprisingly, this was another great quarter for Braze with revenue up 32.7% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $7.00 million in Q4 compared to $8.85 million in Q3 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Braze is expecting revenue to grow 29.2% year on year to $131.5 million, in line with the 31.3% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $572.5 million at the midpoint, growing 21.3% year on year compared to the 32.7% increase in FY2024.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Customer Growth

Braze reported 2,044 customers at the end of the quarter, an increase of 33 from the previous quarter. , suggesting that the company's customer acquisition momentum is slowing.

Key Takeaways from Braze's Q4 Results

We enjoyed seeing Braze exceed analysts' revenue expectations this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. On the other hand, its revenue guidance for next year suggests a significant slowdown in demand and its gross margin shrunk. An additional negative is that full year operating loss guidance was worse than expectations. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $50.5 per share.

So should you invest in Braze right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.