BRC Inc (BRCC) Reports Notable Revenue Growth and Improved Profitability in Q4 2023

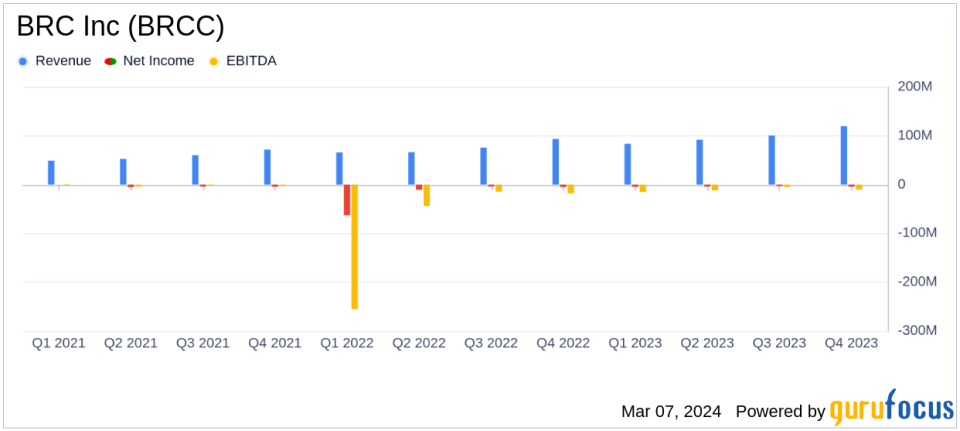

Net Revenue: Increased by 28% to $119.7 million in Q4 2023, primarily driven by the Wholesale channel's growth.

Gross Profit: Grew to $31.7 million, with gross margin experiencing a decrease due to product mix shift and inflationary pressures.

Net Loss: Improved to $14.0 million from a net loss of $20.0 million in Q4 2022.

Adjusted EBITDA: Turned positive at $12.1 million compared to an Adjusted EBITDA Loss of $11.4 million a year ago.

Free Cash Flow: The company issued guidance for an approximately 80% conversion of Adjusted EBITDA to Free Cash Flow in 2024.

Operational Efficiency: Decrease in marketing expenses and general and administrative costs as a percentage of revenue.

Future Outlook: BRC Inc (NYSE:BRCC) provides positive full-year guidance for 2024, with expected revenue growth and improved gross margins.

On March 6, 2024, BRC Inc (NYSE:BRCC), a veteran-controlled company known for its premium coffee and commitment to the military and first responder communities, released its 8-K filing, detailing financial results for the fourth quarter of fiscal year 2023. The company reported a significant increase in net revenue, which rose by 28% to $119.7 million, largely due to a 79% increase in Wholesale revenue. This growth outpaced the category by over 18 times within the Food, Drug, and Mass (FDM) coffee category and 4 times within the Ready-to-Drink (RTD) category.

Despite facing challenges such as a product mix shift towards lower-margin RTD products, increased inventory reserves, and inflationary pressures on raw materials and finished goods, BRC Inc (NYSE:BRCC) managed to improve its profitability. Adjusted EBITDA for Q4 2023 was $12.1 million, a significant turnaround from the Adjusted EBITDA Loss of $11.4 million in the same quarter of the previous year. The net loss also improved, decreasing to $14.0 million from a net loss of $20.0 million in Q4 2022.

Financial Performance and Strategic Focus

CEO Chris Mondzelewski expressed pride in the brand's momentum and its impact on the veteran and first responder community. The company's brand awareness increased to 29%, and it continues to hold the #1 Net Promoter Score among coffee brands. CFO Steve Kadenacy highlighted the company's inflection point, driven by a renewed focus on efficiency and effectiveness, which has instilled confidence in their first full-year guidance of positive profit and free cash flow.

Our strong performance during the past fiscal year demonstrates our commitment to excellence at every level of the company. Weve further refined operations to serve our greater vision for the company a vision that will allow us to strengthen and grow the business while creating value for our customers, partners, and investors," said BRCC Chief Financial Officer Steve Kadenacy.

Operational efficiency was evident in the reduction of marketing expenses, which decreased by 38.3% to $8.4 million, and general and administrative expenses, which decreased by 18.3% to $15.1 million. The company's strategic shift in advertising spend and channel mix contributed to these reductions, as did scale efficiencies and a focus on cost management.

Looking Ahead

For the full-year fiscal 2024, BRC Inc (NYSE:BRCC) expects net revenue to be between $430.0 million and $460.0 million, representing a growth of 9% to 16%. Gross margin is projected to improve to between 37% and 40%, and Adjusted EBITDA is anticipated to be between $27.0 million and $40.0 million. The company also forecasts a strong Free Cash Flow conversion of approximately 80% of Adjusted EBITDA.

Investors and analysts are invited to participate in a conference call scheduled for March 7, 2024, to discuss the company's fourth-quarter results. A webcast of the call will be available on the investor relations page of the company's website.

BRC Inc (NYSE:BRCC) remains dedicated to its mission of serving premium coffee and supporting the veteran and first responder communities. With a clear strategic focus and a commitment to operational excellence, the company is poised for continued growth and profitability in the coming year.

For a detailed analysis of BRC Inc (NYSE:BRCC)'s financial results and further insights into the company's performance and outlook, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from BRC Inc for further details.

This article first appeared on GuruFocus.