Breaking Down 21Vianet Group Inc’s (NASDAQ:VNET) Ownership Structure

Today, I will be analyzing 21Vianet Group Inc’s (NASDAQ:VNET) recent ownership structure, an important but not-so-popular subject among individual investors. When it comes to ownership structure of a company, the impact has been observed in both the long-and short-term performance of shares. Since the effect of an active institutional investor with a similar ownership as a passive pension-fund can be vastly different on a company’s corporate governance and accountability of shareholders, investors should take a closer look at VNET’s shareholder registry.

See our latest analysis for 21Vianet Group

Institutional Ownership

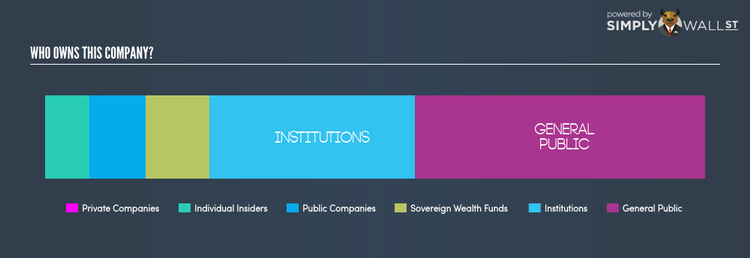

In VNET’s case, institutional ownership stands at 31.17%, significant enough to cause considerable price moves in the case of large institutional transactions, especially when there is a low level of public shares available on the market to trade. Although VNET has a high institutional ownership, such stock moves, in the short-term, are more commonly linked to a particular type of active institutional investors – hedge funds. In the case of VNET, investors need not worry about such volatility considering active hedge funds don’t have a significant stake. However, we should dig deeper into VNET’s ownership structure and find out how other key ownership classes can affect its investment profile.

Insider Ownership

I find insiders are another important group of stakeholders, who are directly involved in making key decisions related to the use of capital. In essence, insider ownership is more about the alignment of shareholders’ interests with the management. 6.77% ownership makes insiders an important shareholder group. This level of stake with insiders indicate highly aligned interests of shareholders and company executives. However, it would be interesting to take a look at their buying and selling activities lately. Buying may be sign of upbeat future expectations, but selling doesn’t necessarily mean the opposite as the insiders may be motivated by financial needs or they are simply diversifying their risk.

General Public Ownership

A substantial ownership of 43.88% in VNET is held by the general public. This size of ownership gives retail investors collective power in deciding on major policy decisions such as executive compensation, appointment of directors and acquisitions of businesses. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and potential acquisitions. This is a positive sign for an investor who wants to be involved in key decision-making of the company.

Public Company Ownership

Potential investors in VNET should also look at another important group of investors: other public companies, with a stake of 8.54%, who are primarily invested because of strategic and capital gain interests. With this size of ownership in VNET, this ownership class can affect the company’s business strategy. As a result, potential investors should further explore the company’s business relations with these companies and find out if they can affect shareholder returns in the long-term.

Next Steps:

The company’s high institutional ownership makes margin of safety a very important consideration to existing investors since long bull and bear trends often emerge when these big-ticket investors see a change in long-term potential of the company. This will allow investors to reduce the impact of non-fundamental factors, such as volatile block trading impact on their portfolio value. However, ownership structure should not be the only focus of your research when constructing an investment thesis around VNET. Rather, you should be examining fundamental factors such as 21Vianet Group’s past track record and financial health. I urge you to complete your research by taking a look at the following:

Financial Health: Is VNET’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

Past Track Record: Has VNET been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of VNET’s historicals for more clarity.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.