Breaking Down BRS Resources Ltd’s (TSXV:BRS) Ownership Structure

In this analysis, my focus will be on developing a perspective on BRS Resources Ltd’s (TSXV:BRS) latest ownership structure, a less discussed, but important factor. Ownership structure has been found to have an impact on shareholder returns in both short- and long-term. Differences in ownership structure of companies can have a profound effect on how management’s incentives are aligned with shareholder returns, which is why we’ll take a moment to analyse XYZ’s shareholder registry. All data provided is as of the most recent financial year end.

See our latest analysis for BRS

Insider Ownership

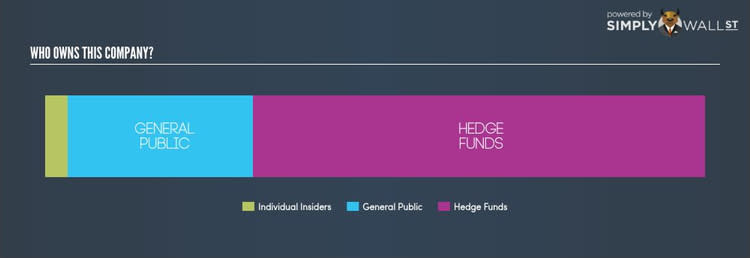

Another important group of shareholders are company insiders. Insider ownership has to do more with how the company is managed and less to do with the direct impact of the magnitude of shares trading on the market. BRS insiders hold a not-so-significant 3.58% stake in the company, which somewhat aligns their interests with that of shareholders. However, a higher level of insider ownership has been linked to management executing on high-returning projects instead of expansion projects for the sake of apparent growth. In addition to this, it may be interesting to look at insider buying and selling activities. Keep in mind that buying may be sign of upbeat future expectations, but selling doesn’t necessarily mean the opposite as the insiders might just be doing it out of their personal financial needs.

General Public Ownership

The general public holds a substantial 28.07% stake in BRS, making it a highly popular stock among retail investors. This size of ownership gives retail investors collective power in deciding on major policy decisions such as executive compensation, appointment of directors and acquisitions of businesses. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and potential acquisitions. This is a positive sign for an investor who wants to be involved in key decision-making of the company.

What this means for you:

Are you a shareholder? A relatively low shareholding by company insider could indicate potential misalignment of interest. However, on the other hand, this could also be a positive as the level of influence over the board of directors can also be limited. If you’re looking to diversify your holdings with high-quality stocks, our free analysis platform has a selection of high-quality stocks with a strong growth potential.

Are you a potential investor? Ownership structure should not be the only focus of your research when constructing an investment thesis around BRS. Rather, you should be examining fundamental factors like the intrinsic valuation of BRS, which is a key driver of BRS’s share price. Take a look at our most recent infographic report on BRS for a more in-depth analysis of these factors to help you make a more well-informed investment decision.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.