Breaking Down These S&P 500 'Overbought' Indicators

In the past week, I encountered a couple of intriguing facts, both related to the strong performance of the S&P 500 Index (SPX), which currently sits near all-time highs. The index is high above its 200-day moving average, and it's been roughly one year since it experienced a 2% decline in a single day. In this article, I will dive into these facts to explore their historical significance.

Sharp Moves Above the 200-Day Trendline

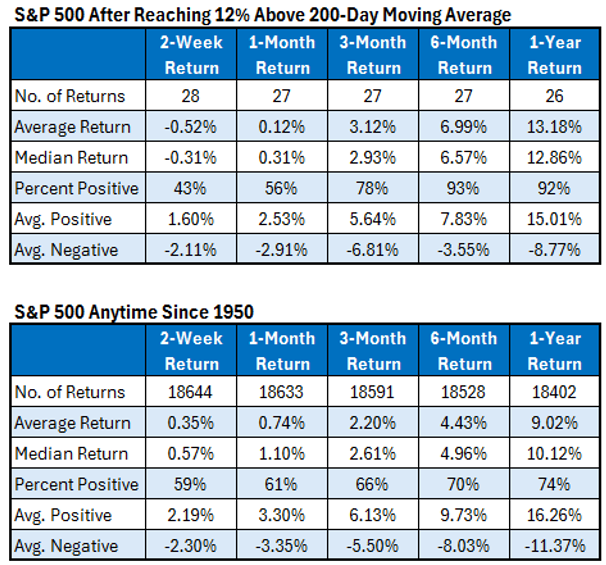

The SPX has fallen significantly in the past after it got 13% above its 200-day moving average. And while it hasn’t yet quite reached 13%, it did get to 12% recently. The table below shows how the SPX has performed after moving 12% above the 200-day moving average for the first time in at least six months.

There have been no fewer than 27 instances since 1950, typically leading to initial losses. Over the next two weeks, the SPX averaged a loss of 0.5%, with 43% of the returns positive. By contrast, the SPX typically gained 0.35% over two-week periods, with 59% of the returns positive. However, extending the timeframe yielded better results.

Six months after these signals, the index gained on average about 7%, with 93% of the returns positive. This beats the typical return of 4.43%, with 70% of the returns positive. Notably, these signals were followed by lower than usual volatility, with average positive returns slightly below average (7.83% vs. 9.73%).

The average negative return exhibited a significant decrease in downside, with losses averaging 3.55% in the next six months, compared to the typical average negative return of -8%. On the bright side, this officially signaled two weeks ago, during which the S&P 500 lost 0.3%, so we’re past the worst performing timeframe. Hopefully, it’s smooth sailing going forward which has tended to be the case in the past.

No 2% Losses in Sight?

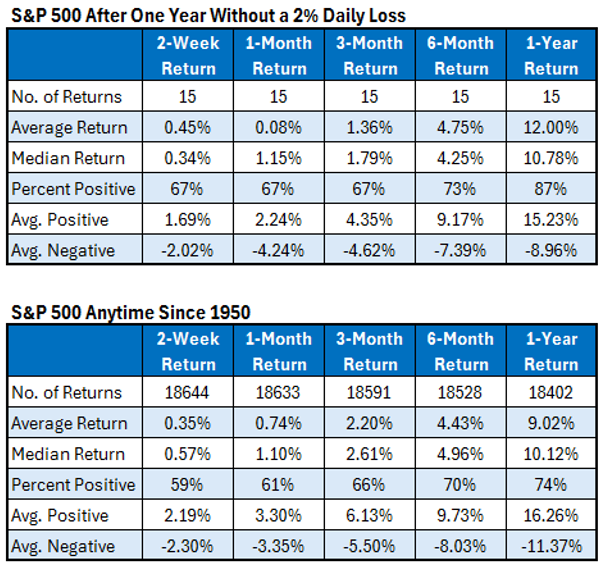

It’s also been one year since the SPX suffered a 2% daily loss, which seemed rare. The first table below shows there have been 15 prior instances when the SPX has gone one year (252 trading days) without a 2% drop.

Comparing the returns in that first table to typical index returns, nothing stands out, with both looking relatively similar. One thing I noticed is that when the index went one year without a 2% drop, on average, it has gone another 257 trading days before seeing it again. Based on this, we could go another year before the SPX drops 2% in a single day.