BridgeBio Pharma Inc (BBIO) Reports Q4 and Full Year 2023 Financials, Advances Key Clinical Trials

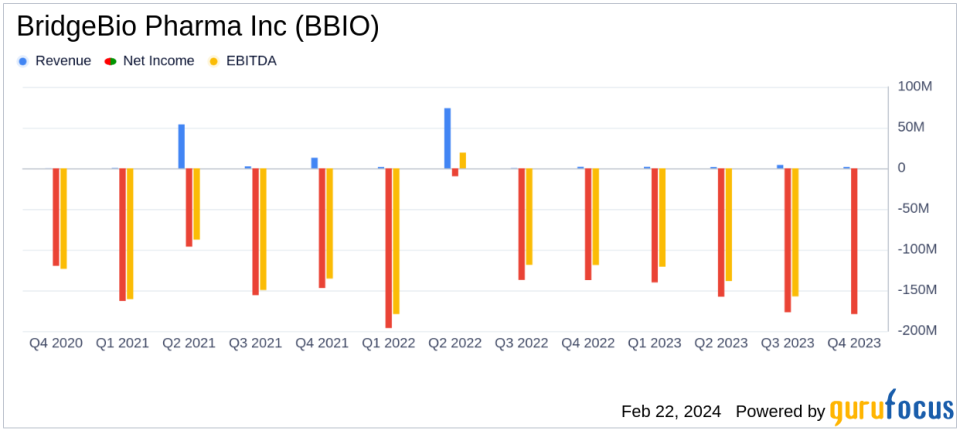

Revenue: Reported a decrease to $9.3 million for the full year 2023 from $77.6 million in the previous year.

Operating Costs and Expenses: Increased to $616.7 million for the full year 2023, up from $589.9 million in the previous year.

Net Loss: Grew to $(653.3) million for the full year 2023, compared to $(484.7) million in the previous year.

Cash Position: Ended the year with $393 million in cash, cash equivalents, and short-term restricted cash.

Strategic Capital: Secured up to $1.25 billion from Blue Owl and CPP investments, enhancing financial flexibility.

Clinical Advancements: Progressed with key clinical trials, including the Phase 3 study of infigratinib for achondroplasia and the Phase 3 study of BBP-418 for LGMD2I.

On February 22, 2024, BridgeBio Pharma Inc (NASDAQ:BBIO) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023, and providing a business update. The company, which focuses on genetic diseases and cancers, has made significant strides in advancing its clinical trials and securing strategic partnerships and capital to bolster its pipeline and commercial readiness.

Company Overview

BridgeBio Pharma Inc is dedicated to discovering and developing transformative medicines for patients with genetic diseases and cancers with clear genetic drivers. The company's product pipeline spans across Mendelian, Genetic Dermatology, Oncology, and Gene therapy categories. By targeting genetic diseases, BridgeBio addresses areas of high unmet patient need and tractable biology.

Financial Performance and Challenges

The company reported a decrease in revenue to $9.3 million for the full year 2023, down from $77.6 million in the previous year. This decline was primarily due to license revenue recognized in 2022 from the Navire-BMS License Agreement. Operating costs and expenses saw an uptick to $616.7 million for the full year 2023, compared to $589.9 million in the previous year, driven by increased research and development efforts and commercialization readiness activities. The net loss widened to $(653.3) million for the full year 2023, from $(484.7) million in the previous year.

The financial achievements, including the securing of up to $1.25 billion of capital from Blue Owl and CPP investments, are crucial for BridgeBio as they provide the necessary resources to launch acoramidis for ATTR-CM and to continue advancing their late-stage pipeline. This capital infusion is particularly important in the biotechnology industry, where significant funding is required for research, development, and commercialization of new therapies.

Key Financial Metrics

BridgeBio ended the quarter with $393 million in cash, cash equivalents, and short-term restricted cash, and $59 million of investments in equity securities. The company's cash position is vital for sustaining its operations and funding ongoing clinical trials. The capital raise, including a $500 million cash injection for a 5% royalty on future global net sales of acoramidis, and a $450 million credit facility, extends the company's financial runway and demonstrates investor confidence in its strategic direction.

"Coming off of our recent royalty financing, we find ourselves well capitalized to launch acoramidis this year alongside strong new partners who share our confidence in acoramidis potential in the ATTR-CM market," said Brian Stephenson, Ph.D., CFA, Chief Financial Officer of BridgeBio.

Analysis of Company's Performance

BridgeBio's strategic focus on executing the launch of acoramidis for patients with ATTR cardiomyopathy is underscored by the acceptance of its New Drug Application by the FDA, with a PDUFA date set for November 29, 2024. The company's ongoing Phase 3 clinical trials are expected to be fully enrolled by the end of 2024, which is a critical step towards bringing new treatments to market.

The company's partnership with Kyowa Kirin, which includes an upfront payment of $100 million and potential royalties, exemplifies BridgeBio's ability to forge strategic alliances that provide immediate capital and future revenue streams. These collaborations, along with the company's robust pipeline and capital raises, position BridgeBio to potentially deliver long-term value to patients and investors alike.

BridgeBio's commitment to addressing genetic diseases through its diverse pipeline is evident in its progress across multiple clinical trials. The company's financial strategy, including its recent capital raise, positions it to continue its mission of delivering transformative medicines to patients with unmet medical needs.

For a more detailed analysis and further information on BridgeBio Pharma Inc's financials and operational updates, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from BridgeBio Pharma Inc for further details.

This article first appeared on GuruFocus.