Bridgewater Bancshares Inc (BWB) Reports Q4 Earnings Dip Amidst Market Challenges

Net Income: Bridgewater Bancshares Inc (NASDAQ:BWB) reported a net income of $8.9 million for Q4 2023, down from $13.7 million in Q4 2022.

Diluted Earnings Per Share (EPS): Diluted EPS for Q4 2023 stood at $0.28, compared to $0.45 in the same quarter the previous year.

Net Interest Margin: The net interest margin declined by 89 basis points year-over-year to 2.27% in Q4 2023.

Asset Quality: BWB maintained excellent asset quality with nonperforming assets to total assets at a mere 0.02%.

Deposits and Loans: Deposits grew by 8.6% year-over-year to $3.71 billion, while loan growth was more moderate at 4.3%, reaching $3.72 billion.

Capital Return: The company repurchased shares and declared a quarterly cash dividend on its Series A Preferred Stock.

On January 24, 2024, Bridgewater Bancshares Inc (NASDAQ:BWB) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, which operates within the Minneapolis-St. Paul-Bloomington, MN-WI Metropolitan Statistical Area, offers a variety of retail and commercial loan and deposit services. Despite facing market headwinds, BWB has continued to exhibit strong asset quality and deposit growth.

Financial Performance Overview

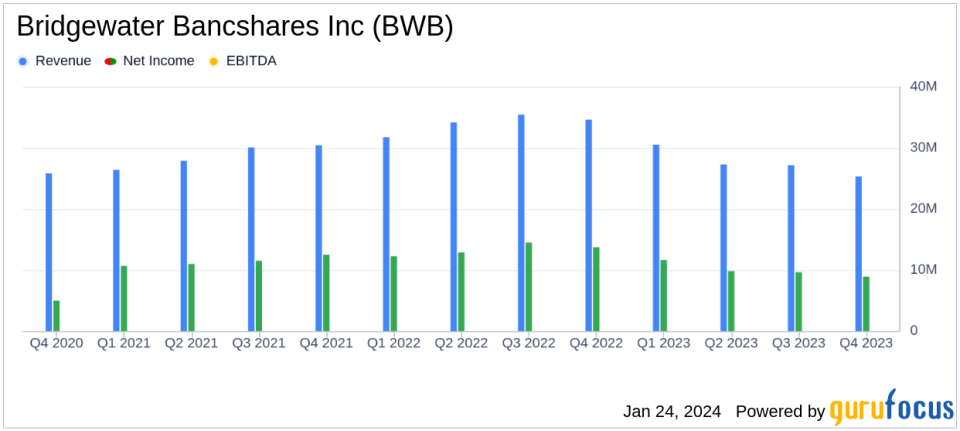

BWB's net income for the fourth quarter of 2023 was $8.9 million, a decrease from $9.6 million in the third quarter of 2023, and a significant drop from $13.7 million in the fourth quarter of 2022. Diluted earnings per share followed suit, decreasing to $0.28 from $0.30 in the previous quarter and down from $0.45 year-over-year. The company's net interest margin also saw a decline, dropping to 2.27% from 3.16% in the same quarter of the previous year.

Despite these challenges, BWB's deposit growth outpaced loan growth, and the company's asset quality remained strong. The loan to deposit ratio stood at 100.4%, reflecting a balanced approach to growth and risk management. Additionally, the company's tangible book value per share increased for the 28th consecutive quarter, signaling a consistent increase in shareholder value.

Asset Quality and Capital Management

Asset quality at BWB remained robust, with nonperforming assets to total assets at only 0.02%. This is indicative of the company's prudent risk management and underwriting standards. In terms of capital management, BWB repurchased 423,749 shares of its common stock at a weighted average price of $10.72 per share, totaling $4.5 million. The company also declared a quarterly cash dividend on its Series A Preferred Stock, reinforcing its commitment to returning value to shareholders.

Balance Sheet and Income Statement Highlights

The balance sheet showed total assets of $4.61 billion, with gross loans slightly increasing to $3.72 billion. Deposits saw a healthy year-over-year increase to $3.71 billion. On the income statement, net interest income was reported at $25.3 million for the quarter, a slight decrease from the previous quarter. Interest income, however, increased by $1.7 million from the third quarter of 2023, and the provision for credit losses on loans remained at zero, reflecting the strength of the loan portfolio.

"Bridgewater finished 2023 strong with the continuation of several positive trends as net interest margin continued to stabilize, deposit growth outpaced loan growth, and asset quality remained superb," said Chairman, Chief Executive Officer, and President, Jerry Baack.

In conclusion, Bridgewater Bancshares Inc (NASDAQ:BWB) faced a challenging quarter with a decrease in net income and diluted EPS. However, the company's strong deposit growth, excellent asset quality, and shareholder value initiatives demonstrate resilience in a tough economic environment. As BWB enters 2024, the balance sheet positioning and growing loan pipeline suggest a cautiously optimistic outlook for the company.

Explore the complete 8-K earnings release (here) from Bridgewater Bancshares Inc for further details.

This article first appeared on GuruFocus.