Bright Horizons Family Solutions Inc (BFAM) Reports Mixed Results for Q4 and Full Year 2023

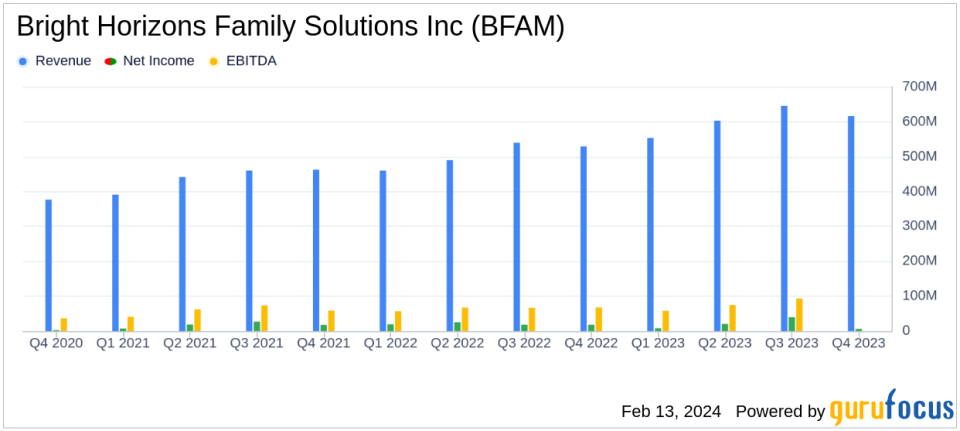

Revenue Growth: BFAM reported a 16% increase in Q4 revenue and a 20% increase for the full year.

Net Income Decline: Q4 net income fell by 69%, and full-year net income decreased by 8%.

Adjusted Earnings: Adjusted net income and diluted adjusted earnings per common share rose by 9% and 8% respectively in Q4.

Operational Challenges: Income from operations decreased due to impairment losses and reduced government support.

2024 Outlook: BFAM expects revenue between $2.6 billion to $2.7 billion and adjusted earnings per share between $3.00 to $3.20.

Liquidity Position: Cash and cash equivalents stood at $71.6 million with $380.7 million available under the revolving credit facility.

On February 13, 2024, Bright Horizons Family Solutions Inc (NYSE:BFAM) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a leading provider of high-quality early education and child care, family care solutions, and workforce education services, experienced a significant increase in revenue while facing a decline in net income.

Company Overview

Bright Horizons Family Solutions Inc operates in three business segments: full-service center-based child care, backup care, and educational advisory services. The majority of its revenue comes from full-service center-based child care, which includes traditional center-based child care and early education services. With over 1,450 client relationships and 1,049 early education and child care centers, BFAM has a significant presence in North America and other regions.

Financial Performance and Challenges

BFAM's revenue for Q4 2023 was $616 million, a 16% increase from Q4 2022. The full-year revenue reached $2 billion, marking a 20% rise from the previous year. This growth was attributed to enrollment gains, price increases, and expanded sales and utilization of back-up care services.

However, the company's income from operations saw a 29% decrease in Q4, primarily due to $21.8 million in impairment losses and reduced funding from pandemic-related government support programs. Net income for Q4 plummeted by 69% to $6 million, and diluted earnings per common share dropped by 71% to $0.09. For the full year, net income and diluted earnings per common share decreased by 8% and 7%, respectively.

Despite these challenges, BFAM's adjusted income from operations and adjusted EBITDA showed resilience, with increases of 15% and 10% in Q4, and 16% and 11% for the full year. Adjusted net income and diluted adjusted earnings per common share also saw improvements, indicating the company's ability to manage operational challenges effectively.

Financial Achievements and Importance

The company's financial achievements, particularly in its Full Service segment and Back-Up Care segment, underscore its capacity to grow amidst a competitive environment. The Full Service segment boasted a 15% revenue growth, while the Back-Up Care segment exceeded expectations with a 24% revenue increase year-over-year in Q4.

Analysis and Outlook

CEO Stephen Kramer expressed satisfaction with the solid financial results and the company's positive trajectory. The outlook for 2024 is optimistic, with expected revenue between $2.6 billion to $2.7 billion and diluted adjusted earnings per common share in the range of $3.00 to $3.20.

BFAM's balance sheet reflects a strong liquidity position, with $71.6 million in cash and cash equivalents and significant available credit. The company generated approximately $256.1 million of cash from operations in 2023, an increase from the previous year, and made net investments primarily in fixed assets and acquisitions totaling $126.9 million.

As Bright Horizons Family Solutions Inc navigates the complexities of the current economic landscape, its strategic focus on growth and operational efficiency positions it well for the future. Investors and stakeholders will be watching closely as the company continues to expand its services and capitalize on market opportunities.

For more detailed information, investors are encouraged to review the full earnings report and listen to the earnings conference call hosted by CEO Stephen Kramer.

Explore the complete 8-K earnings release (here) from Bright Horizons Family Solutions Inc for further details.

This article first appeared on GuruFocus.