BrightView Holdings Inc (BV) Reports Mixed Q1 Fiscal 2024 Results Amid Strategic Divestiture

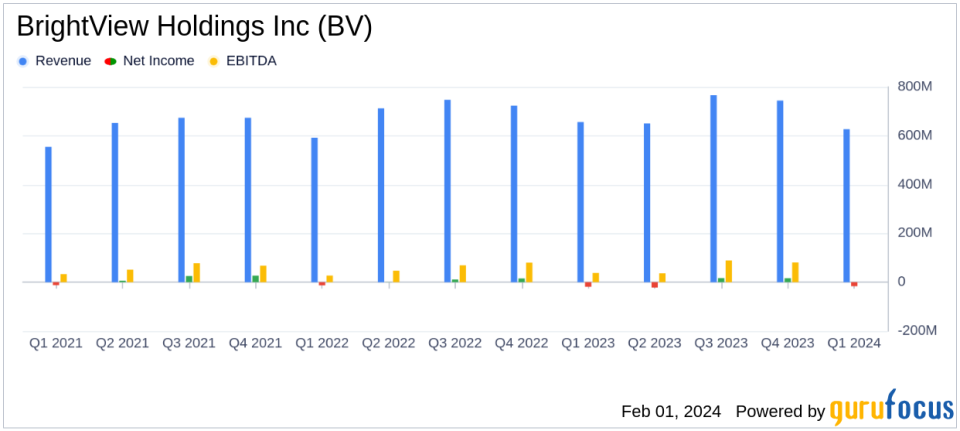

Total Revenue: Decreased by 4.5% year-over-year to $626.7 million.

Net Loss: Decreased by 13.2% year-over-year to $16.4 million.

Adjusted EBITDA: Decreased by 3.9% to $46.7 million; margin expanded by 10 basis points.

Operating Cash Flow: Increased by $55.8 million to a net inflow of $26.2 million.

Free Cash Flow: Improved by $72.7 million to an inflow of $17.3 million.

Strategic Sale: Non-core US Lawns franchise business sold for $51.6 million in cash proceeds.

Debt Metrics: Total Net Financial Debt decreased to $859.6 million; Net Debt to Adjusted EBITDA ratio stable at 2.9x.

BrightView Holdings Inc (NYSE:BV), the leading commercial landscaping services company in the United States, released its 8-K filing on January 31, 2024, detailing its first-quarter fiscal 2024 results. The company, known for its Maintenance and Development Services, reported a decrease in total revenue by 4.5% to $626.7 million compared to the same period last year. Despite this, BrightView saw a 13.2% decrease in net loss to $16.4 million, reflecting a 30-basis point improvement in net loss margin. Adjusted EBITDA also decreased slightly by 3.9% to $46.7 million, but with a margin expansion of 10 basis points.

Performance and Challenges

The company's performance in the first quarter of fiscal 2024 was a mixed bag, with a notable decrease in revenue driven by a $22.1 million drop in snow removal revenue and an $18.8 million decrease in commercial landscaping business. However, these were partially offset by an $11.0 million increase in Development services organic revenues year-over-year. The reduction in net loss and the improvement in cash flow metrics indicate a resilient operational strategy, despite the revenue challenges.

Financial Achievements and Industry Significance

BrightView's financial achievements, particularly the improvement in free cash flow and operating cash flow, are significant as they demonstrate the company's ability to manage its capital effectively and maintain liquidity in a challenging business environment. For a company in the Business Services industry, these metrics are crucial indicators of operational efficiency and financial health.

Key Financial Metrics

Key financial metrics from the Income Statement and Cash Flow Statement include a basic loss per share of $0.27, an improvement from the $0.20 loss per share in the previous year. The company also reported an adjusted net income of $3.0 million, a stark contrast to the $1.2 million loss in the prior year, and an adjusted earnings per share of $0.02. The balance sheet shows a strategic reduction in total financial debt to $924.1 million and a stable net debt to Adjusted EBITDA ratio of 2.9x.

"I am pleased to report that we are off to a solid start to fiscal 2024 as we achieved meaningful progress on our objectives outlined under One BrightView," said BrightView President and CEO Dale Asplund. "A continued focus on profitable growth in our core business, another quarter of strong performance converting our Development backlog, and execution of our cost efficiency plans led to EBITDA margin expansion for the quarter."

Analysis of Company's Performance

The strategic sale of the non-core US Lawns franchise business for $51.6 million aligns with BrightView's focus on its core operations and represents a savvy move to streamline the business and reinvest in growth areas. The reaffirmation of the fiscal year 2024 guidance suggests confidence in the company's strategic initiatives and its ability to navigate market fluctuations.

BrightView's performance in the first quarter of fiscal 2024 reflects the company's resilience in the face of industry challenges. While the decrease in revenue is a concern, the improvement in net loss and cash flow metrics, along with the strategic divestiture, position the company to continue its focus on profitable growth and operational efficiency. Investors and stakeholders will likely keep a close watch on BrightView's execution of its strategic initiatives and its ability to maintain the positive momentum in its core business segments.

Explore the complete 8-K earnings release (here) from BrightView Holdings Inc for further details.

This article first appeared on GuruFocus.