Brilliant Earth (BRLT) Q3 Earnings Beat Estimates, Decline Y/Y

Brilliant Earth Group, Inc. BRLT delivered third-quarter 2023 results, wherein the top line fell short of the Zacks Consensus Estimate, while the bottom line beat the same. This global leader in ethically sourced fine jewelry registered year-over-year net sales growth but a decline in earnings.

The quarterly results underscore the effectiveness of Brilliant Earth's brand in driving increased market share and sustainable profitable growth. Also, the company’s unique strengths, such as the comprehensive omnichannel, data-driven model, and the curation and customization of products, place it favorably to continue surpassing industry performance during the holiday season and beyond.

Brilliant Earth Group, Inc. Price, Consensus and EPS Surprise

Brilliant Earth Group, Inc. price-consensus-eps-surprise-chart | Brilliant Earth Group, Inc. Quote

Q3 in Detail

The Zacks Rank #3 (Hold) company posted adjusted earnings from continuing operations of 5 cents per share in the third quarter of 2023, down from 7 cents in the year-ago quarter. The metric beat the Zacks Consensus Estimate by a penny.

Net sales were $114.2 million, up 2.5% year over year. However, the top line missed the Zacks Consensus Estimate of $119 million. Additionally, the company experienced a notable surge in orders to 43.2 thousand, marking a 16.7% year-over-year increase. The Zacks Consensus Estimate for total orders was pegged at 44.3 thousand for the quarter under review.

Gross profit increased 9.7% year over year to $66.8 million. The uptick was a consequence of increased sales attributed to a higher volume of orders. We note that the gross margin expanded 380 basis points (bps) to 58.5% from the prior-year period.

The company has been experiencing robust growth in fine jewelry bookings from the last year, accompanied by a year-over-year rise in the average sales price of fine jewelry. Additionally, it surpassed its 2023 objective, boasting 37 showrooms as of Sep 30, 2023, exceeding the initial goal of at least 35 showrooms.

Selling, general and administrative expenses increased 18.7% to $64.8 million. As a percentage of net sales, selling, general and administrative expenses deleveraged 770 bps to 56.7% in the third quarter of 2023.

Adjusted EBITDA came in at $7.6 million compared with $10 million in the year-ago period. We note that the adjusted EBITDA margin contracted 220 bps to 6.7% in the third quarter.

Image Source: Zacks Investment Research

Other Financials

Brilliant Earth ended the quarter with cash and cash equivalents of $147.1 million, long-term debt (net of debt issuance costs) of $56.7 million, and a total equity of $93.4 million.

2023 Outlook

Management revised its 2023 guidance, taking into account the current normalizing jewelry industry conditions.

Brilliant Earth envisions net sales between $444 million and $450 million versus the earlier mentioned $460-$490 million. Notably, it had delivered net sales of $439.9 million in 2022.

The company revised its outlook for adjusted EBITDA, anticipating $22-$24 million. This compared with the previous guidance of $22-$35 million. Notably, the company had reported $39 million in the prior year.

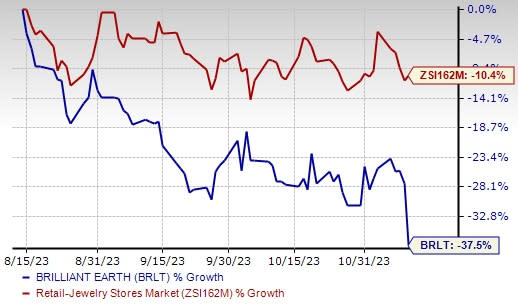

This jewelry retailer’s stock movement shows that its shares have lost 37.5% in the past three months compared with the industry’s 10.4% decline.

3 Promising Stocks

A few better-ranked stocks in the same sector are Costco Wholesale Corporation COST, Ross Stores Inc. ROST and Walmart Inc. WMT.

Costco Wholesale sells high volumes of food and general merchandise. It has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Costco Wholesale’s current fiscal-year earnings and sales indicates growth of 6.9% and 4.3% from the year-ago period’s reported figures. COST has a trailing four-quarter average earnings surprise of 2.1%.

Ross Stores is an off-price retailer of apparel and home accessories. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Ross Stores’ current fiscal-year sales and EPS suggests growth of 7.1% and 19.4%, respectively, from the year-ago reported figures. ROST has a trailing four-quarter earnings surprise of 11.4%, on average.

Walmart operates a chain of hypermarkets, discount department stores and grocery stores. It has a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Walmart’s current fiscal-year sales and earnings suggests growth of 5% and 2.5%, respectively, from the year-ago reported numbers. WMT has a trailing four-quarter earnings surprise of 11.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Brilliant Earth Group, Inc. (BRLT) : Free Stock Analysis Report