Brinker International Inc (EAT) Reports Robust Growth in Q2 Fiscal 2024 Earnings

Net Income Per Share: Increased to $0.94, a 51.6% rise from the previous year.

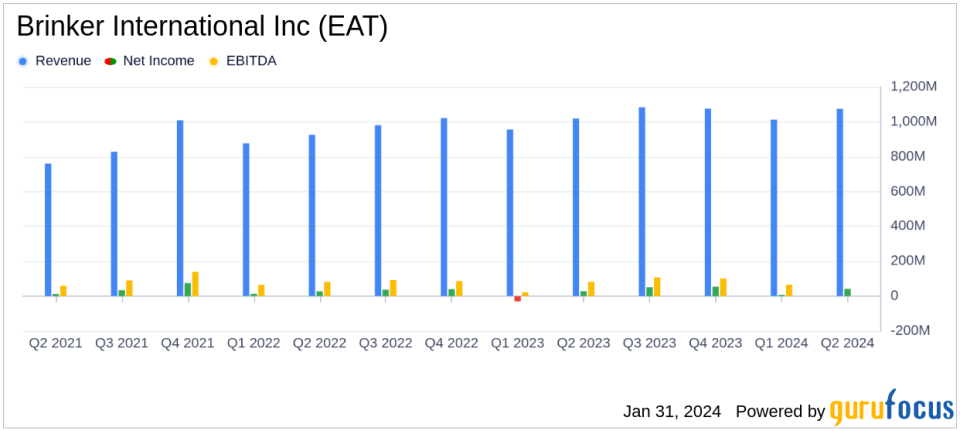

Revenue: Company sales climbed to $1.06 billion, marking a $54.3 million increase.

Operating Income: Grew significantly to $62.4 million, up $21.7 million.

Comparable Restaurant Sales: Saw a 5.2% rise, with Chilis at 5.0% and Maggianos at 6.7%.

Restaurant Operating Margin: Improved to 13.1%, a 1.5% increase.

Fiscal 2024 Guidance: Net income per diluted share expected to be $3.45 - $3.70 with total revenues projected between $4.30 billion - $4.35 billion.

On January 31, 2024, Brinker International Inc (NYSE:EAT) released its 8-K filing, revealing a substantial increase in net income per diluted share of $0.94 for the second quarter of fiscal 2024, a 51.6% increase compared to the same period last year. The company, known for its Chili's Grill & Bar and Maggiano's Little Italy restaurant brands, demonstrated a strong performance with a 5.2% increase in comparable restaurant sales.

Brinker International Inc operates casual dining restaurants under the brands Chili's and Maggiano's. Chili's is recognized for its Fresh Mex and Fresh Tex menus, featuring items like baby back ribs and fajitas, while Maggiano's offers a classic Italian dining experience. The majority of the company's revenue is generated from the Chili's segment.

The company's effective marketing and pricing strategies have been credited for the improved guest traffic and operating margins. Despite the decision to de-emphasize virtual brands, which created a headwind, the company's focus on simplifying operations and enhancing food, service, and atmosphere has paid off, allowing it to outpace industry growth.

Financial Performance and Challenges

Brinker International's financial achievements in the second quarter of fiscal 2024 are particularly noteworthy in the competitive restaurant industry. The increase in net income per diluted share, excluding special items, to $0.99, a 30.3% increase from the previous year, reflects the company's ability to navigate challenges such as economic headwinds and changing consumer preferences. The growth in operating income margin to 5.8% and restaurant operating margin to 13.1% underscores the company's operational efficiency and cost management.

However, the company is not without its challenges. The decision to scale back on virtual brands may impact future revenue streams, and the industry as a whole faces pressures from inflation, labor costs, and potential shifts in consumer spending. These challenges could lead to problems if not managed effectively, but Brinker International's current performance indicates a strong foundation to tackle these issues.

Key Financial Metrics

Understanding the importance of key financial metrics helps in evaluating Brinker International's health and potential for future growth. Here are some crucial figures from the latest earnings report:

"Our second quarter marked another quarter of year over year growth with continued margin improvement, driven by our strategy to simplify operations, improve our food, service, and atmosphere, and deploy an effective marketing plan," said Kevin Hochman, Chief Executive Officer and President of Brinker International. "Were pleased with our progress, which has allowed us to improve our traffic trends and now outpace the industry."

Brinker International's balance sheet shows a total asset value of $2.51 billion, with net property and equipment valued at $818.8 million. The company's current liabilities stand at $590.0 million, with long-term debt and finance leases at $882.4 million. The cash flow statement reveals the company's ability to generate revenue and manage its capital expenditures, which are projected to be between $175 million and $195 million for the full fiscal year 2024.

Analysis and Outlook

The company's performance in the second quarter of fiscal 2024 indicates a positive trajectory, with significant growth in net income and sales. The updated fiscal 2024 guidance suggests confidence in continued growth, with an expected increase in net income per diluted share and total revenues. Brinker International's strategic focus on operational efficiency and effective marketing appears to be yielding results, positioning the company well for the remainder of the fiscal year.

Investors and interested parties can find further details on Brinker International's performance and business updates on the company's website, where a webcast of the earnings conference call is available. The company's forward calendar includes the SEC Form 10-Q filing for the second quarter of fiscal 2024, expected on or before February 5, 2024, and the earnings release call for the third quarter of fiscal 2024 on April 30, 2024.

For value investors and potential GuruFocus.com members, Brinker International Inc (NYSE:EAT) presents a compelling case study in effective business strategy and financial growth within the restaurant industry. The company's latest earnings report reflects a robust financial position and a positive outlook for the future, making it a noteworthy consideration for investment portfolios.

Explore the complete 8-K earnings release (here) from Brinker International Inc for further details.

This article first appeared on GuruFocus.