Brink's Co (BCO) Reports Solid Revenue Growth and Record Free Cash Flow for Full-Year 2023

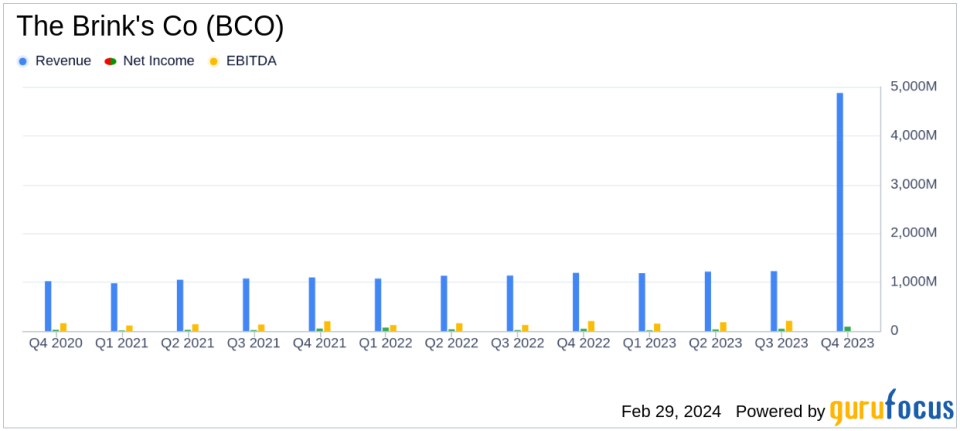

Revenue Growth: Full-year revenue increased by 7% with 9% organic growth, including a notable 21% growth in AMS and DRS segments.

Net Income: GAAP net income for the year stood at $88 million, with non-GAAP earnings per share (EPS) at $7.35.

Free Cash Flow: Record free cash flow of $393 million, a significant increase from the previous year.

Leverage Reduction: Reduced leverage to 2.9x Net Debt to Adjusted EBITDA, aligning with the target range of 2x-3x.

2024 Outlook: Management anticipates mid-single digit revenue growth and strong EBITDA margin expansion.

On February 29, 2024, The Brink's Co (NYSE:BCO) released its 8-K filing, detailing its financial performance for the fourth quarter and full-year 2023. The global provider of secure logistics and security solutions, including cash-in-transit and ATM services, reported a 7% increase in full-year revenue, reflecting strong organic growth, particularly in its Automated Managed Services (AMS) and Digital Retail Solutions (DRS) segments.

The Brink's Co (NYSE:BCO) is a global leader in cash and valuables management, with a significant presence in North America, Latin America, and Europe. The company's North America segment is the largest revenue contributor, followed by Latin America and Europe. The Brink's Global Services line specializes in secure transportation of high-value commodities, serving a diverse customer base that includes financial institutions, retailers, government agencies, mints, and jewelers.

Financial Performance and Challenges

For the full year of 2023, The Brink's Co (NYSE:BCO) reported GAAP net income of $88 million, with non-GAAP EPS of $7.35. The company achieved a record net cash from operations of $702 million and a free cash flow of $393 million. This performance underscores the company's operational efficiency and ability to generate cash. However, the fourth quarter saw operating profits impacted by geopolitical and economic uncertainties in certain markets, as well as slower than expected growth in high-margin services in North America.

Despite these challenges, the company's disciplined capital allocation policy and robust free cash flow allowed it to reduce leverage to 2.9x Net Debt to Adjusted EBITDA, which is within the targeted leverage range. This is a critical metric for the company as it reflects the ability to manage debt and finance operations effectively.

Financial Achievements and Industry Significance

The Brink's Co (NYSE:BCO)'s financial achievements, particularly in free cash flow and leverage reduction, are significant for the Business Services industry. These metrics indicate the company's strong cash generation capabilities and financial discipline, which are essential for sustaining operations and funding growth initiatives. The company's focus on high-margin AMS and DRS offerings is also noteworthy, as it aligns with the industry's shift towards digital and automated solutions.

Key Financial Metrics

Key financial details from the Income Statement and Cash Flow Statement highlight the company's robust performance:

"Revenue up 7%, reflecting 9% organic growth... Operating profit: GAAP $425M; non-GAAP $615M... GAAP net cash from operations up $223M to $702M; free cash flow up $190M to $393M... YTD Free Cash Flow conversion from Adjusted EBITDA up 20 percentage points to 45%"

These metrics are crucial as they demonstrate the company's ability to grow revenue organically, manage expenses, and convert earnings into cash effectively.

Analysis of Company's Performance

The Brink's Co (NYSE:BCO)'s performance in 2023 reflects a company that is successfully navigating a complex economic landscape. The growth in AMS and DRS segments suggests a strategic pivot towards areas with higher growth potential. The company's ability to generate record free cash flow and reduce leverage is indicative of strong operational control and positions it well for future investments and shareholder returns.

Looking ahead to 2024, The Brink's Co (NYSE:BCO) expects to continue its growth trajectory with mid-single digit revenue growth and further EBITDA margin expansion. The company's focus on productivity initiatives and a higher-margin revenue mix is expected to drive this performance.

For more detailed information on The Brink's Co (NYSE:BCO)'s financial performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from The Brink's Co for further details.

This article first appeared on GuruFocus.