Bristow Group Inc (VTOL) Faces Q4 Net Loss Despite Stable Revenues

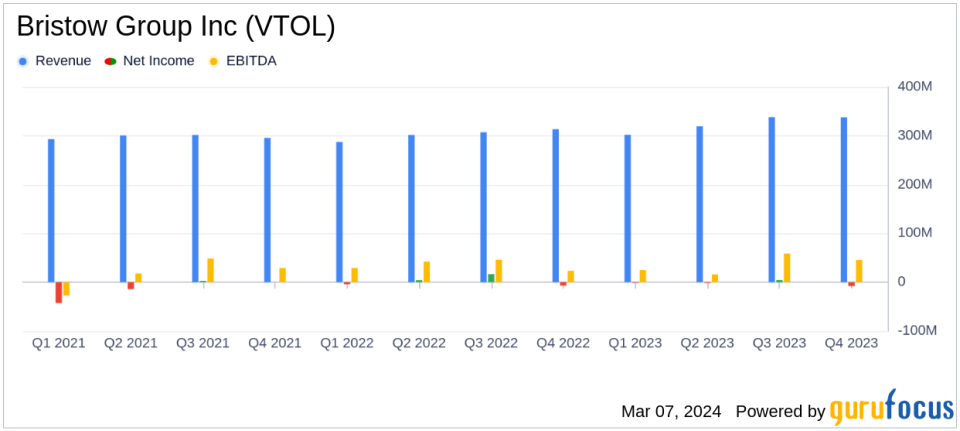

Revenue Stability: Q4 operating revenues nearly unchanged from Q3 at $329.6 million.

Net Loss Incurred: Q4 net loss of $7.9 million, a decline from Q3 net income of $4.3 million.

Adjusted EBITDA: Q4 Adjusted EBITDA at $46.0 million, down from $56.6 million in Q3.

Full Year Performance: Full year Adjusted EBITDA of $170.5 million, slightly above the revised outlook.

2024 Outlook: Bristow affirms its 2024 outlook with expected revenue and Adjusted EBITDA growth.

On March 5, 2024, Bristow Group Inc (NYSE:VTOL) released its 8-K filing, detailing the financial results for the fourth quarter and full fiscal year of 2023. Bristow Group Inc, a leading provider of vertical flight solutions, reported a net loss of $7.9 million, or $0.28 per diluted share, for the fourth quarter ended December 31, 2023. This compares to a net income of $4.3 million, or $0.15 per diluted share, in the preceding quarter. The company's operating revenues were marginally lower at $329.6 million compared to $330.3 million in the previous quarter.

Bristow Group Inc provides aviation services to a broad base of major integrated, national, and independent energy companies, as well as commercial search and rescue (SAR) services in multiple countries and public sector SAR services in the United Kingdom on behalf of the Maritime & Coastguard Agency (MCA). The company also offers fixed-wing transportation and other aviation-related solutions, with a customer base spanning across various countries including Australia, Brazil, Canada, Chile, Colombia, Guyana, India, Mexico, Nigeria, Norway, Spain, Suriname, Trinidad, the UK, and the United States.

The company's full-year Adjusted EBITDA, excluding special items, asset dispositions, and foreign exchange gains (losses), was $170.5 million, which slightly exceeded the upwardly revised outlook of $170.0 million. This performance underscores the company's resilience in a challenging environment and its ability to meet its increased outlook for the year.

Financial Performance and Challenges

Bristow's fourth-quarter performance was marked by stability in revenue but a notable decline in profitability. The net loss for the quarter was primarily driven by increased operating expenses, which rose by $8.8 million due to higher fuel costs, leased-in equipment costs, repairs, and maintenance costs, and personnel costs. General and administrative expenses decreased by $2.1 million, primarily due to lower compensation costs. The company also faced challenges such as supply chain shortages, particularly for S92 heavy helicopters, which are expected to continue through 2024.

The company's financial achievements, including the full-year Adjusted EBITDA growth, are significant in the context of the oil & gas industry, where efficient capital management and operational efficiency are critical for navigating market volatility and capital-intensive operations.

Key Financial Metrics

Important metrics from the financial statements include:

Financial Metric | Q4 2023 | Q3 2023 |

|---|---|---|

Net Income (Loss) | $(7.9) million | $4.3 million |

Operating Revenues | $329.6 million | $330.3 million |

EBITDA | $41.8 million | $54.9 million |

Adjusted EBITDA | $46.0 million | $56.6 million |

Adjusted EBITDA is a critical metric for Bristow Group Inc as it provides a clearer picture of the company's operational performance by excluding non-recurring items and other special charges. This measure is particularly important for value investors who focus on the underlying business performance rather than one-time gains or losses.

"We continued to progress our strategic goal to grow and diversify our leading government services business with the successful award of the 670 million Irish Coast Guard contract, building upon the recent addition of key government contracts in the United Kingdom (UKSAR2G), Dutch Caribbean, the Netherlands, and the Falkland Islands," said Chris Bradshaw, President and CEO of Bristow Group.

Analysis of Company's Performance

The company's performance in the fourth quarter indicates a challenging period with a net loss, despite maintaining stable revenues. The increased operating expenses and the impact of foreign exchange rates were key factors contributing to the loss. However, the full-year results show a company that has managed to exceed its adjusted EBITDA outlook, demonstrating the effectiveness of its strategic initiatives and operational management.

Bristow's affirmation of its 2024 outlook suggests confidence in its business model and market position. The company's focus on diversifying its services, particularly in government contracts, may provide a stable revenue stream and mitigate the volatility associated with the oil & gas sector.

For more detailed information on Bristow Group Inc's financial performance, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Bristow Group Inc for further details.

This article first appeared on GuruFocus.