Brixmor Property Group Inc (BRX) Reports Mixed Results for Q4 and Full Year 2023

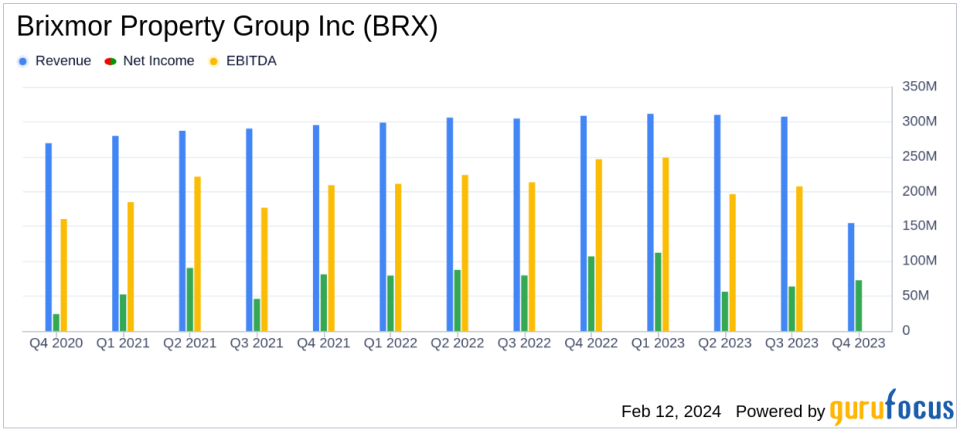

Net Income: Q4 net income was $0.24 per diluted share, down from $0.35 in Q4 2022. Full-year net income also decreased to $1.01 per diluted share from $1.17.

Leased Occupancy: Total leased occupancy reached a record 94.7%, with small shop occupancy at a record 90.3%.

Rent Spreads: Executed new and renewal leases with rent spreads on comparable space of 19.6% for Q4 and 19.3% for the full year.

Same Property NOI: Increased by 3.1% for Q4 and 4.0% for the full year, indicating healthy operational performance.

Nareit FFO: Q4 Nareit FFO was $154.7 million, or $0.51 per diluted share, compared to $147.0 million, or $0.49 per diluted share in Q4 2022.

Dividend: Declared a quarterly cash dividend of $0.2725 per common share for the first quarter of 2024.

Guidance: Provided 2024 Nareit FFO per diluted share expectations of $2.06 - $2.10 and same property NOI growth expectations of 2.50% - 3.50%.

On February 12, 2024, Brixmor Property Group Inc (NYSE:BRX) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. As a real estate investment trust (REIT) with a portfolio of grocery-anchored community and neighborhood shopping centers, Brixmor's performance is a bellwether for the retail real estate sector.

Financial Performance Overview

Brixmor reported a decrease in net income per diluted share for both the fourth quarter and the full year compared to the same periods in 2022. Despite this, the company achieved record total and small shop leased occupancy, demonstrating the strength of its leasing strategy and the appeal of its properties to tenants.

The company's same property net operating income (NOI) showed growth, which is a key metric for assessing the operating efficiency and profitability of income-generating real estate. The increase in same property NOI reflects the company's ability to grow income from its properties, which is crucial for sustaining dividend payments and reinvestment in the portfolio.

Operational Highlights and Challenges

Brixmor's operational highlights include the execution of 1.7 million square feet of new and renewal leases in Q4, with significant rent spreads on comparable space. This indicates the company's ability to negotiate favorable lease terms, which is important for maintaining and growing revenue. The company also reported a robust pipeline of reinvestment projects, which are expected to yield attractive returns and contribute to the long-term value of the portfolio.

However, the company faces challenges, including a decline in net income per diluted share, which may raise concerns among investors about the company's profitability. Additionally, the guidance for 2024 indicates a cautious outlook with modest growth expectations, which could be influenced by broader economic conditions and the retail sector's ongoing evolution.

Strategic Moves and Capital Structure

Brixmor made strategic moves during the year, including the promotion of key executives and the publication of its Corporate Responsibility Report. The company also managed its capital structure effectively, with a credit rating upgrade and the repurchase of senior notes. These actions demonstrate Brixmor's commitment to corporate governance and financial prudence.

The company's liquidity and debt profile remain strong, with $1.2 billion in liquidity and a net principal debt to adjusted EBITDA ratio of 6.0x. The issuance of $400.0 million of 5.500% Senior Notes due 2034 post the reporting period further solidifies the company's financial position.

Investor Considerations

For investors, Brixmor's performance presents a mixed picture. The record leased occupancy rates and positive same property NOI growth are encouraging signs of operational strength. However, the decline in net income per diluted share may warrant a closer look at the company's profitability and cost management strategies.

Value investors may find Brixmor's stable dividend and strategic reinvestment opportunities appealing, especially given the company's solid track record in leasing and property management. The company's guidance for 2024, while conservative, suggests a steady approach to growth amid uncertain market conditions.

As Brixmor continues to navigate the dynamic retail landscape, investors should monitor the company's ability to maintain occupancy rates, manage costs, and execute its reinvestment strategy to drive long-term value.

For further details and analysis, interested parties can access the full earnings report and supplemental information on Brixmor's website or contact their investor relations team.

Explore the complete 8-K earnings release (here) from Brixmor Property Group Inc for further details.

This article first appeared on GuruFocus.