Broadcom (AVGO) Q2 Earnings & Revenues Surpass Estimates

Broadcom AVGO reported second-quarter fiscal 2020 non-GAAP earnings of $5.14 per share, which surpassed the Zacks Consensus Estimate by 0.2%. However, the figure declined 1.3% from the year-ago quarter’s reported quarter.

Net revenues came in at $5.742 billion, up 4% from the year-ago quarter’s tally. Moreover, the top line beat the Zacks Consensus Estimate of $5.701 billion.

Segmental Revenues

Beginning first-quarter fiscal 2020, the company clubbed reporting of revenues from Intellectual property licensing with Semiconductor solutions segment. The company now reports in two reporting segments — Semiconductor solutions and Infrastructure software.

Semiconductor solutions’ revenues (70% of total net revenues) totaled $4.027 billion, down 2% from the year-ago quarter’s level. The downside was due to coronavirus-induced supply chain constraints and product cycle delay across wireless vertical. Moreover, increasing lead times is a headwind. Nonetheless, robust demand for high capacity drives, networking, and broadband products, limited the decline to a certain extent.

The company witnessed strength in networking end market driven by uptick in demand for latest Tomahawk 3 and Trident 3 switch products across cloud customers. In network routing, growing clout of Jericho 2 across telco customers was noteworthy. The company is also optimistic regarding rise in demand for latest deep learning inference chips across cloud customers.

Markedly, during the reported quarter, Baidu BIDU adopted Broadcom’s Stingray Ethernet-based adapter, 100G SmartNIC, to boost server performance and utilization of its cloud platform.

Solid demand from CSPs or cloud service providers for the company’s PCI Express switches was driven by the need to accelerate complex AI applications, with solid state memory capabilities. In industrial domain, management noted recovery in resales.

Infrastructure software revenues (30%) increased 21% year over year to $1.715 billion. The company is benefiting from synergies from acquisitions of CA and Symantec’s enterprise security business.

Notably, Symantec’s enterprise security business contributed more than $400 million to revenues in the reported quarter.

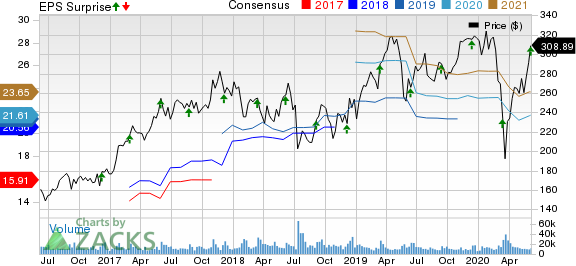

Broadcom Inc. Price, Consensus and EPS Surprise

Broadcom Inc. price-consensus-eps-surprise-chart | Broadcom Inc. Quote

Operating Details

Non-GAAP gross margin expanded 100 basis points (bps) on a year-over-year basis to 73%. The increase can be attributed to improving mix of infrastructure software sales.

Total operating expenses on a non-GAAP basis increased 14% year over year to $1.165 billion. As a percentage of net revenues, the figure expanded 180 bps to 20.3%.

Consequently, non-GAAP operating margin contracted 70 bps from the year-ago quarter’s figure to 53%, due to costs pertaining to Symantec acquisition.

Adjusted EBITDA (excluding $147 million of depreciation) came in at $3.209 billion, representing 55.9% of net revenues in the fiscal second quarter.

Balance Sheet & Cash Flow

As of May 3, 2020, cash & cash equivalents were $9.207 billion compared with $6.444 billion reported as of Feb 2, 2020.

As of May 3, long-term debt (including current portion) was $45.863 billion compared with $44.718 billion as of Feb 2.

Broadcom generated cash flow from operations of $3.213 billion compared with $2.322 billion in the previous quarter. Capital expenditure totaled $148 million compared with the last reported quarter’s figure of $108 million. Free cash flow during the quarter was $3.065 billion compared with $2.214 billion in the prior quarter.

During the reported quarter, Broadcom returned $1.381 billion in form of dividends to shareholders during the fiscal second quarter.

On Jun 4, the company announced a quarterly dividend of $3.25 per share. The quarterly dividend is payable on Jun 30 to shareholders as on Jun 22.

Guidance

For third-quarter fiscal 2020, the company anticipates revenues of $5.75 billion (+/- $150 million). The Zacks Consensus Estimate is currently pegged at $5.84 billion. Adjusted EBITDA is anticipated at $3.22 billion (+/- $75 million) in the fiscal third quarter.

Broadcom Inc. Revenue (Quarterly)

Broadcom Inc. revenue-quarterly | Broadcom Inc. Quote

Wrapping Up

Broadcom delivered stellar fiscal second-quarter results. Moreover, revenues increased year over year. Further, synergies from acquisitions of CA and Symantec’s enterprise security business are expected to boost Broadcom’s presence in infrastructure software vertical, in the days ahead.

However, the chipmaker provided a bleak revenue guidance for the fiscal third quarter. The company estimates semiconductor revenues, in wireless domain, to decline in fiscal third quarter, as its “large North American mobile phone customer”, likely indicating Apple AAPL, delays ramp of its next-generation smartphone. Management expects to witness uptick in wireless revenues in the fiscal fourth quarter.

Further, increasing lead times, particularly in leading-edge processes is an overhang.

The company is striving to reduce channel inventory globally, especially in Europe and Japan, amid market uncertainty led by the COVID-19 pandemic. This is expected to lead to a “double-digit sequential decline” in recognized shipping revenues in the fiscal third quarter.

Nevertheless, resales in Asia Pacific, particularly, China, are anticipated to be up sequentially, while remaining regions are expected to be down.

Increasing demand across server storage connectivity, and robust adoption of data protection controllers from enterprise customers, is expected to boost growth in fiscal third quarter.

In broadband end-market, management projects sequential growth in revenues driven by robust adoption of Wi-Fi 6 in next-generation access gateway, with solid demand from enterprises, telcos and other service providers.

Also, solid uptick of DSL and PON and next-generation cable DOCSIS 3.1 products is encouraging. However, growth is likely to be limited by sharp decline in video, particularly in satellite set-top boxes, amid the existing constraints on live sporting events.

Zacks Rank & Stock to Consider

Currently, Broadcom carries a Zacks Rank #3 (Hold).

Coupa Software COUP is a better-ranked stock worth considering in the broader computer and technology sector. The company carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Coupa Software is scheduled to report quarterly results on Jun 8.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Coupa Software, Inc. (COUP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research