Broadridge Financial Solutions Inc (BR) Reports Solid Q2 Fiscal 2024 Results

Recurring Revenue Growth: 7% increase to $899 million in Q2; 6% growth in constant currency.

Diluted and Adjusted EPS: Diluted EPS rose by 23% to $0.59, and Adjusted EPS increased by 1% to $0.92.

Year-to-Date Closed Sales: Increased by 12%, signaling strong sales execution.

Operating Income: Grew by 15% to $124 million in Q2, with a margin improvement to 8.9%.

Full-Year Guidance: Reaffirmed, including 6-9% Recurring revenue growth in constant currency and 8-12% Adjusted EPS growth.

On February 1, 2024, Broadridge Financial Solutions Inc (NYSE:BR) released its 8-K filing, detailing the financial results for the second quarter ended December 31, 2023, of its fiscal year 2024. Broadridge, a global Fintech leader spun off from ADP in 2007, is known for its investor communications and technology-driven solutions to banks, broker/dealers, asset managers, wealth managers, and corporate issuers. The company operates through two segments: investor communication solutions (ICS) and global technology and operations (GTO).

Financial Performance and Challenges

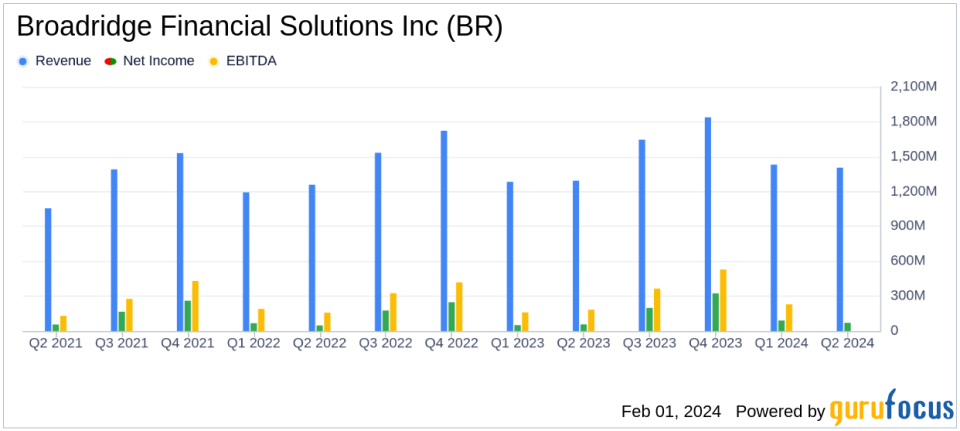

Broadridge's second quarter showcased a 7% increase in recurring revenues, reaching $899 million, with a constant currency growth of 6%. Total revenues saw a 9% rise to $1,405 million. Operating income improved significantly by 15% to $124 million, with the operating margin expanding to 8.9% from 8.3% in the prior year. Adjusted operating income saw a modest increase of 1% to $174 million, while the adjusted operating margin slightly declined to 12.4% from 13.4%.

The company's diluted earnings per share (EPS) increased by 23% to $0.59, and adjusted EPS grew by 1% to $0.92. Year-to-date closed sales rose by 12%, although Q2 closed sales dipped by 11% to $58 million from $65 million in the previous year. Despite these challenges, Broadridge's CEO, Tim Gokey, emphasized the company's progress toward growth objectives and its focus on driving growth and returns, which is translating into higher free cash flow and positions to return additional capital to shareholders.

Financial Achievements and Importance

The company's financial achievements, particularly in recurring revenue growth and EPS, underscore its robust business model and ability to generate stable cash flows. These metrics are crucial for Broadridge as they reflect the company's success in retaining and growing its customer base in the competitive financial technology industry. The reaffirmation of the full-year guidance indicates management's confidence in the company's strategic direction and operational execution.

Key Financial Details

Broadridge's balance sheet remains solid with cash and cash equivalents of $277 million as of December 31, 2023. The company's net earnings increased by 22% to $70 million, and adjusted net earnings saw a slight increase of 1% to $110 million. The effective tax rate was marginally reduced to 19.9% from 20.0% in the prior year period. The company's focus on cost management and operational efficiency is evident in the improved operating margins and disciplined investment spending.

"Our results, including 6% organic Recurring revenue growth constant currency, demonstrate continued execution on our goals to democratize and digitize governance, simplify and innovate trading in capital markets, and modernize wealth management," said Tim Gokey, Broadridge CEO.

Analysis of Company's Performance

Broadridge's performance in Q2 fiscal 2024 reflects its resilience and adaptability in a dynamic financial services landscape. The company's strategic investments in technology and innovation have enabled it to maintain a competitive edge and drive organic growth. The increase in recurring revenues and the solid performance of the ICS and GTO segments suggest that Broadridge is effectively leveraging its scale and expertise to meet the evolving needs of its clients.

While the company faces challenges such as fluctuations in event-driven revenues and increased investment spending, its strong financial position and reaffirmed guidance for the fiscal year 2024 indicate a positive outlook for sustained growth and profitability.

For more detailed information and to access the full earnings report, investors and interested parties can view the 8-K filing.

Stay tuned to GuruFocus.com for further updates and analysis on Broadridge Financial Solutions Inc (NYSE:BR) and other market-moving financial news.

Explore the complete 8-K earnings release (here) from Broadridge Financial Solutions Inc for further details.

This article first appeared on GuruFocus.