Broadridge Financials (BR) Surges 22% Year to Date: Here's How

Broadridge Financial Solutions, Inc. BR has had an impressive run in the year-to-date period, gaining 22.2% against the 3.9% decrease of the Outsourcing industry and the 17% rise of the Zacks S&P 500 composite.

What’s Aiding the Stock?

Broadbridge is experiencing steady income from regular fees. The company is benefiting from a combination of new customers, internal expansion and synergies from acquisitions. In terms of revenues, the company earned $5.71 billion in fiscal year 2022, $4.99 billion in 2021 and $4.53 billion in 2020. These figures indicate year-over-year growth rates of around 14%, 10% and 4%, respectively.

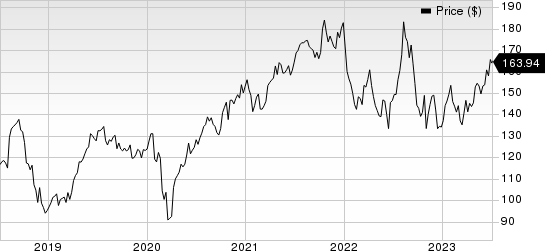

Broadridge Financial Solutions, Inc. Price

Broadridge Financial Solutions, Inc. price | Broadridge Financial Solutions, Inc. Quote

Broadridge's shareholder rewards have been impressive. Dividend payments of $290.7 million, $261.7 million and $241 million were made in 2022, 2021, and 2020 respectively, instilling investors’ confidence in the stock. The company also exhibits strong liquidity with a current ratio of 1.35 in the third quarter of fiscal 2023, higher than the previous year's ratio of 1.27. This ensures the company's ability to meet short-term debt obligations.

Broadridge's growth is driven by strategic acquisitions. In 2021, the acquisition of Itiviti expanded its back-office capabilities to the front office and strengthened its multi-asset class solutions. The AdvisorStream acquisition has also contributed to revenue growth by offering personalized client communications.

For fiscal 2023, the Zacks Consensus Estimate for earnings and revenues is pegged at $6.9 per share and $6.11 billion, respectively. The earnings estimate indicates 6.8% increase year over year while the revenue estimates indicate 7% growth.

Zacks Rank and Stocks to Consider

BR currently carries a Zacks Rank #4 (Sell).

Investors interested in the broader Zacks Business Services can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.8% year over year to $338.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value Score of A and a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM Score of B along with a Zacks Rank of 1.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently carries a Zacks Rank #2 (Buy) and a Growth Score of A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report