Broadridge's (BR) Business Model Aids Growth Amid Competition

Broadridge Financial Solutions, Inc. BR is gaining from its strong business model and strategic acquisitions. The company’s strong liquidity position and shareholder-friendly policies are praiseworthy. The rising cost has been pressuring Broadridge’s bottom line.

Broadridge Financial Solutions, Inc. reported mixed third-quarter fiscal 2023 results with earnings beating the Zacks Consensus Estimate but revenues missing the same. Adjusted earnings of $2.05 per share beat the consensus mark by 2% and increased 6.2% year over year. Total revenues of $1.65 billion missed the consensus mark by a slight margin but were up 7.3% year over year. Recurring revenues of $1.08 billion increased 8% from the year-ago quarter’s level. The company generated closed sales of $62 million in the quarter, up 8% year over year.

Current Situation of Broadridge

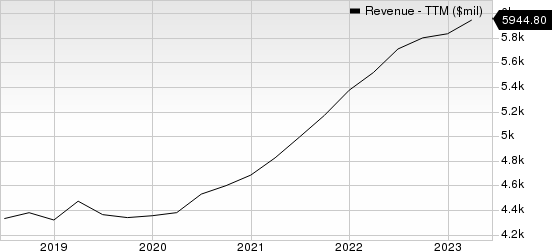

Broadridge’s strong business model, which enables it to earn recurring revenues, includes contributions from net new business, internal growth and acquisition-related synergies. Revenues for fiscal 2022, 2021 and 2020 were $5.71 billion, $4.99 billion and $4.53 billion, respectively, representing corresponding year-over-year growth of approximately 14%, 10% and 4%, respectively.

Broadridge Financial Solutions, Inc. Revenue (TTM)

Broadridge Financial Solutions, Inc. revenue-ttm | Broadridge Financial Solutions, Inc. Quote

Broadridge has been active on the strategic acquisition front, investing in companies to expand back-office capabilities and increase multi-asset class solutions offerings. The 2021 acquisition of Itiviti helped in the same. The buyback of AdvisorStream helped in providing personalized and consistent client communications.

The company has been consistently returning value to shareholders in the form of dividends. In 2022, 2021 and 2020, the company paid $290.7 million, $261.7 million and $241 million in dividends, respectively. Broadridge has a strong liquidity situation with its current ratio at the end of third-quarter fiscal 2023 being 1.35, higher than the current ratio of 1.27 reported at the end of the prior-year quarter. It indicates that the company will have no problem meeting its short-term debt obligations.

Some Concerning Points

Broadridge operates in an industry with high competition from several large firms. We believe that strong competition could affect Broadridge’s ability to maintain or increase its market share and profitability.

The company has been strategically acquiring which adds to its ability to generate revenues but also exposes it to several costs and integration related risks. Moreover, frequent acquisitions are a distraction for management, which could impact organic growth.

Zacks Rank and Stocks to Consider

BR currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.5% year over year to $339.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of A along with a Zacks Rank of 1.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently sports a Zacks Rank of 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report