Broadstone Net Lease Inc (BNL) Reports Full Year and Q4 2023 Results Amidst Economic Challenges

Annual AFFO: Reported $1.41 per share, consistent with guidance expectations.

Investment Activity: Completed investments totaling $165.6 million for the year.

Operating Results: Achieved a high rent collection rate of 99.8% and maintained a 99.4% leased portfolio.

Capital Markets Activity: Ended the year with a strong balance sheet and a Net Debt to Annualized Adjusted EBITDAre ratio of 5.0x.

Dividends: Declared dividends of $1.12 in 2023, marking a 3.7% increase over the prior year.

Healthcare Portfolio Strategy: Executed contracts to sell 37 healthcare properties, aiming to focus on core net lease assets.

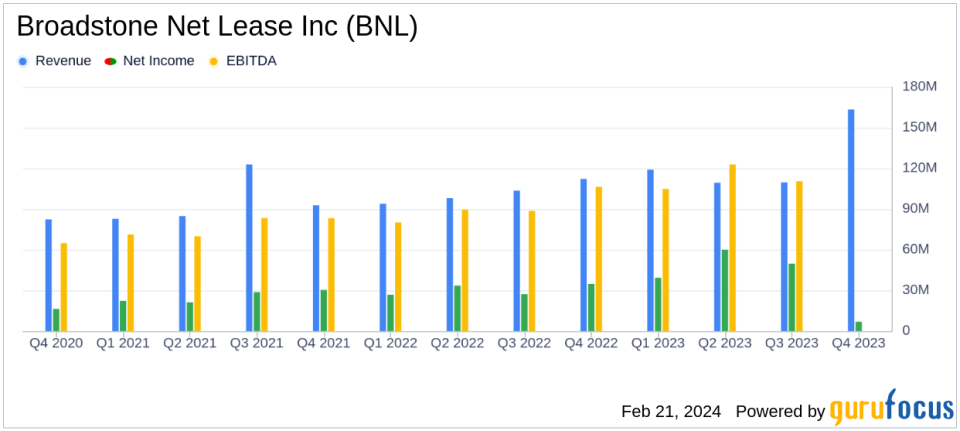

Broadstone Net Lease Inc (NYSE:BNL) released its 8-K filing on February 21, 2024, detailing its full-year and fourth-quarter results for 2023, and introducing its healthcare portfolio simplification strategy. BNL, an internally-managed real estate investment trust (REIT), focuses on long-term net leased commercial properties to a diversified tenant base. Despite a challenging economic landscape, BNL delivered a solid performance with an Adjusted Funds from Operations (AFFO) of $1.41 per share, aligning with the midpoint of its guidance range.

Performance Amidst Challenges

BNL's Chief Executive Officer, John Moragne, expressed pride in the company's ability to navigate through economic headwinds and capital market volatility. The company's disciplined investment approach and portfolio management have been pivotal in maintaining a high-quality property portfolio with strong operating metrics. BNL's strategic dispositions and investments have been instrumental in achieving a fortified balance sheet with low leverage and ample liquidity for future opportunities.

"We employed a disciplined and selective approach to all aspects of our investment cycle: intentionally evading risk and creatively sourcing investment opportunities that were created by the distressed lending environment and complementary to our core competencies and asset classes," said John Moragne.

Financial Achievements and Strategic Focus

BNL's investment activity for the year included $165.6 million in development fundings, revenue-generating capital expenditures, and new property acquisitions. The company's operating results showcased a 99.8% collection of base rents and a portfolio that was 99.4% leased. Net income generated was $163.3 million, translating to $0.83 per share, and the AFFO reached $277.7 million. These results underscore BNL's resilience and strategic execution in a volatile market.

The company's capital markets activities ended on a strong note, with total outstanding debt of $1.9 billion and a leverage ratio of 5.0x. BNL's board of directors approved a $150.0 million common stock repurchase program, although no shares were repurchased during the year. The company also declared dividends of $1.12 in 2023, representing a 3.7% increase over the previous year.

Healthcare Portfolio Simplification Strategy

In a strategic move to focus on core net lease assets, BNL has decided to sell its clinically-oriented healthcare properties. This decision is aimed at reducing complexities associated with these assets and enhancing the company's focus on industrial, retail, and restaurant sectors. The sale of these assets is expected to reduce BNL's healthcare assets from 17.6% to 7.5% of its portfolio based on annualized base rent (ABR).

"Our healthcare portfolio simplification strategy is an extension of our focus on portfolio quality and evolution, which we believe will result in meaningful value creation for investors," commented John Moragne.

BNL's strategic shift underscores its commitment to optimizing its portfolio and focusing on assets that align with its investment thesis. This move is expected to streamline operations and potentially enhance shareholder value as the company continues to navigate the evolving real estate landscape.

For detailed financial tables and further information on BNL's performance, please refer to the full 8-K filing.

Investors are encouraged to join BNL's earnings conference call and webcast on February 22, 2024, for additional insights into the company's results and strategies moving forward.

For more information on Broadstone Net Lease Inc's financial performance and strategic initiatives, visit GuruFocus.com, where we provide in-depth analysis and insights for value investors and potential members.

Explore the complete 8-K earnings release (here) from Broadstone Net Lease Inc for further details.

This article first appeared on GuruFocus.