Broker Revenue Forecasts For Agenus Inc. (NASDAQ:AGEN) Are Surging Higher

Agenus Inc. (NASDAQ:AGEN) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline. The stock price has risen 6.4% to US$1.50 over the past week, suggesting investors are becoming more optimistic. Could this big upgrade push the stock even higher?

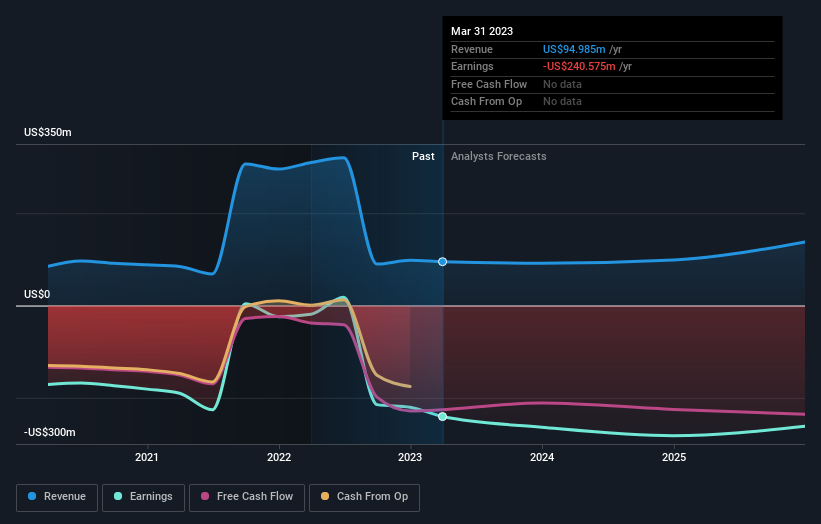

Following the upgrade, the current consensus from Agenus' four analysts is for revenues of US$107m in 2023 which - if met - would reflect a meaningful 12% increase on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$92m in 2023. It looks like there's been a clear increase in optimism around Agenus, given the nice gain to revenue forecasts.

See our latest analysis for Agenus

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Agenus' revenue growth will slow down substantially, with revenues to the end of 2023 expected to display 17% growth on an annualised basis. This is compared to a historical growth rate of 26% over the past five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 18% annually. Factoring in the forecast slowdown in growth, it looks like Agenus is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for Agenus this year. Analysts also expect revenues to grow approximately in line with the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Agenus.

Analysts are clearly in love with Agenus at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as a short cash runway. For more information, you can click through to our platform to learn more about this and the 3 other flags we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here