Brookdale (BKD) Concludes Transactions to Extend Debt Repayment

Brookdale Senior Living Inc. BKD recently closed two financing transactions in a bid to refinance its leftover debt maturities of 2024. Post completion of these transactions, which is meant to extend the debt repayment timeline, the maturity of BKD’s upcoming debt has been pushed to September 2025 and cannot be extended further.

Out of the recently completed transactions, the first one relates to securing a $180 million loan by Brookdale in December 2023 under its Master Credit Facility Agreement, which dates back to Aug 31, 2017. The loan was obtained through Jones Lang LaSalle Multifamily, LLC, under Fannie Mae's Delegated Underwriting and Servicing Program. It carries a fixed interest rate of 5.97% and is scheduled to mature in 2031.

Furthermore, the proceeds from the newly obtained loan coupled with cash on hand were leveraged to pay off BKD’s 2024 due debt of $260 million under the facility. The new debt’s principal amount is collateralized by non-recourse first mortgages on 47 communities.

As part of the second transaction, Brookdale modified the terms of its revolving credit agreement initially inked with Capital One, National Association and other lenders in 2020. Per the original terms, the credit facility provided a commitment of up to $80 million and funds from this credit facility can be withdrawn either in cash or letters of credit. But the commitment capacity has been presently increased to up to $100 million. The amended facility is set to mature in January 2027 and holds two extension options to March 2028 and March 2029, contingent on meeting certain conditions.

Brookdale has a pending financing transaction in place concerning 11 of its presently unencumbered owned communities, which is expected to be finalized in the months ahead. This month, BKD divested the leftover 20% equity stake that it held in its Health Care Services unconsolidated venture, generating aggregate proceeds of around $27 million.

The recently completed financing transactions will undoubtedly relieve Brookdale of the burden associated with paying off debts at least for the next year and subsequently, sustain the strength of its liquidity position. BKD grapples with a significant debt burden of $3.5 billion as of Sep 30, 2023, and needless to say, a high debt level induces an increase in interest expenses. Interest expenses escalated 22.7% year over year in the first nine months of 2023. Devoid of immediate pressure of debt repayments, Brookdale can devote a greater amount of time and resources to growing its core business operations.

Through its affiliates, Brookdale operated and managed 672 senior living communities across 41 states as of Sep 30, 2023. Its scale, clinical prowess and innovative healthcare services impart it the power to cater to 60,000-plus residents. An aging U.S. population is expected to sustain the solid demand for the healthcare services provided by BKD.

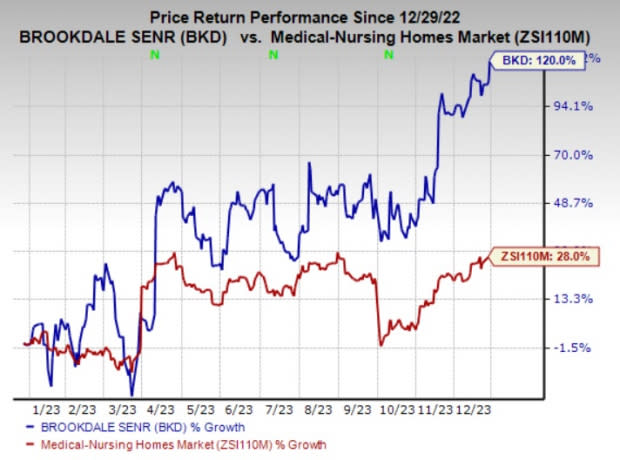

Shares of Brookdale have surged 120% in the past year compared with the industry’s 28% growth. BKD currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Medical space are DaVita Inc. DVA, Align Technology, Inc. ALGN and Encompass Health Corporation EHC. While DaVita currently sports a Zacks Rank #1 (Strong Buy), Align Technology and Encompass Health carries a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average beat being 36.55%. The Zacks Consensus Estimate for DVA’s 2023 earnings suggests an improvement of 22.3% from the year-ago reported figure. The consensus mark for revenues indicates growth of 3.3% from the year-ago reported figure.

The Zacks Consensus Estimate for DVA’s 2023 earnings has moved 9.2% north in the past 60 days. Shares of DaVita have gained 38.2% in the past year.

The bottom line of Align Technology outpaced the Zacks Consensus Estimate in three of the trailing quarters and missed the mark once, the average surprise being 6.53%. The Zacks Consensus Estimate for ALGN’s 2023 earnings implies a rise of 8.5% from the prior-year tally. The consensus mark for revenues indicates growth of 3.3% from the prior-year tally.

The Zacks Consensus Estimate for ALGN’s 2023 earnings has moved 0.1% north in the past 60 days. Shares of Align Technology have gained 29.7% in the past year.

Encompass Health’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 17.33%. The Zacks Consensus Estimate for EHC’s 2023 earnings indicates a rise of 23.5% from the year-ago reported figure.

The Zacks Consensus Estimate for EHC’s 2023 earnings has moved 1.1% north in the past 60 days. Shares of Encompass Health have gained 12.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Brookdale Senior Living Inc. (BKD) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report