Brookdale (BKD) Reports Occupancy Growth for 20 Straight Months

Brookdale Senior Living Inc. BKD recently unveiled that its weighted average occupancy improved 160 basis points (bps) year over year to 76.8% in June 2023. The reported figure also represented an increase of 20 bps from the May level.

The last month marked the rise in the weighted average occupancy level of BKD on a year-over-year basis for 20 straight months. Further, in the second quarter of 2023, the metric increased 190 bps year over year to 76.5%. It also denoted a 20 bps improvement from the first quarter of 2023.

Consistent growth in weighted average occupancy level implies growing patient volumes, which brings a ray of hope for healthcare facility operators like Brookdale whose primary revenue source depends on the patient base.

Through its affiliates, BKD operated and managed 672 senior living communities across 41 states as of Jun 30, 2023. Its scale, clinical prowess and innovative healthcare services position it well to cater to over 60,000 residents. An aging U.S. population is also likely to sustain the solid demand for healthcare services provided by BKD.

Results of Brookdale suffered a significant setback due to COVID-induced restrictions imposed on visitors and move-ins across several of its senior communities. As an evidence of the same, it suffered a loss of 1,330 bps of weighted average occupancy consolidated senior housing occupancy between March 2020 and February 2021, which in turn, resulted in a substantial loss of resident fee revenues. The adverse effect of the pandemic even led BKD to witness its lowest-ever weighted average occupancy of 69.4% in February 2021.

As the pandemic effects began to recede in 2022, the senior living community operator embarked on key initiatives to revive its occupancy levels and implement prudent rate increases for care and other services delivered. The efforts bore fruits, as BKD was able to realize 760 bps of weighted average consolidated senior housing occupancy by the end of December 2022. This year, Brookdale aims to restore its occupancy back to or above pre-pandemic levels.

Higher occupancy levels might boost resident fee revenues, the most significant contributor to Brookdale’s top line. It accounted for 94.7% of BKD’s overall revenues in the first quarter of 2023. An increase in resident fees is likely to provide an impetus to adjusted EBITDA, which is anticipated within $72 million and $77 million in the second quarter of 2023. The mid-point of the guidance implies 46.9% growth year over year.

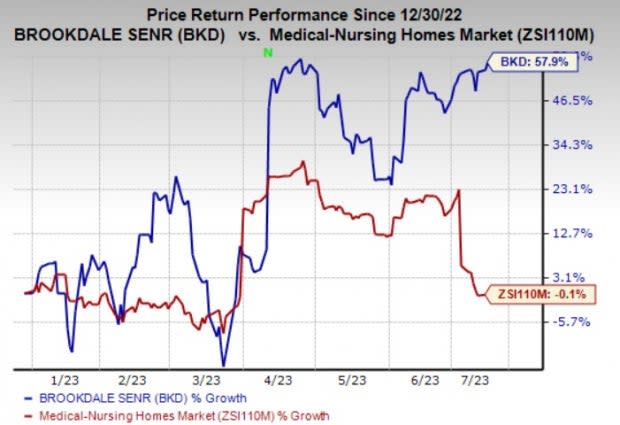

Shares of Brookdale have gained 57.9% year to date against the industry’s 0.1% decline. BKD currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Medical space are DaVita Inc. DVA, The Ensign Group, Inc. ENSG and Intuitive Surgical, Inc. ISRG. DaVita sports a Zacks Rank #1 (Strong Buy), and Ensign Group and Intuitive Surgical carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s earnings surpassed the Zacks Consensus Estimate in three of the last four quarters and missed the mark once, the average beat being 17.33%. The Zacks Consensus Estimate for DVA’s 2023 earnings suggests an improvement of 1.5%, while the same for revenues indicates growth of 1.4% from the respective year-ago reported figures.

The Zacks Consensus Estimate for DVA’s 2023 earnings has moved 3.1% north in the past 60 days. Shares of DaVita have gained 39.4% year to date.

The bottom line of Ensign Group outpaced the Zacks Consensus Estimate in one of the trailing four quarters, matched the mark twice and missed the same on the remaining one occasion, the average surprise being 0.45%. The Zacks Consensus Estimate for ENSG’s 2023 earnings implies a rise of 13.5%, while the same for revenues indicates growth of 22.2% from the respective year-ago reported figures.

ENSG boasts an impressive Value Score of A. Shares of Ensign Group have declined 5.2% year to date.

Intuitive Surgical’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters and missed the mark twice, the average surprise being 1.86%. The Zacks Consensus Estimate for ISRG’s 2023 earnings indicates a rise of 16.9%, while the same for revenues suggests an improvement of 14.3% from the corresponding year-ago reported estimates.

The Zacks Consensus Estimate for ISRG’s 2023 earnings has moved 0.2% north in the past 60 days. Shares of Intuitive Surgical have gained 29.1% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Brookdale Senior Living Inc. (BKD) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report