Brookdale Senior Living Inc. Reports Substantial Growth in 2023, Boosted by Higher Occupancy ...

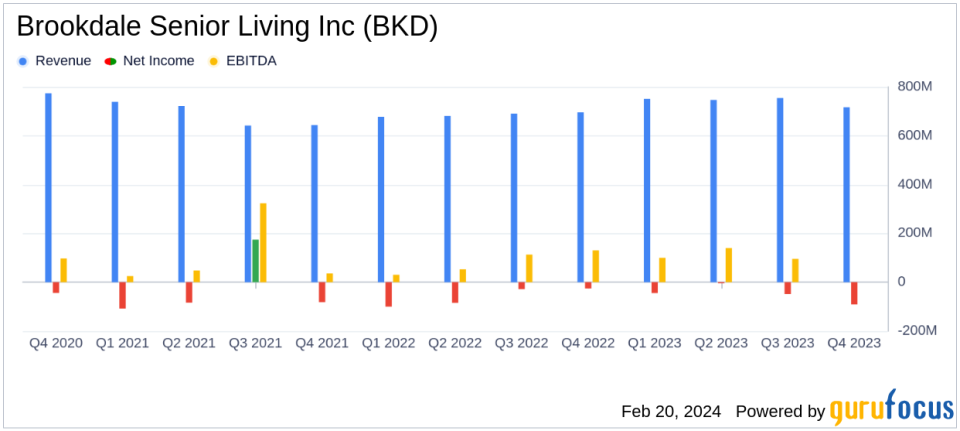

Revenue Growth: Full-year resident fee revenue increased by 10.5% to $2.857 billion in 2023.

Occupancy and Rates: Same community weighted average occupancy grew by 190 basis points year-over-year, with RevPAR and RevPOR rising by 11.4% and 8.6%, respectively.

Operating Income: Same community operating income surged by 25.9% compared to the previous year.

Adjusted EBITDA: Full-year Adjusted EBITDA improved by 39.1%, reaching $335.5 million.

Free Cash Flow: Adjusted Free Cash Flow saw a remarkable increase of 76.3%, amounting to an improvement of $154 million.

Liquidity: Total liquidity stood at $340.7 million as of December 31, 2023, including cash, marketable securities, and credit facility availability.

On February 20, 2024, Brookdale Senior Living Inc (NYSE:BKD) released its 8-K filing, announcing its fourth quarter and full year results for the period ending December 31, 2023. The company, a leading operator of senior living communities in the United States, reported significant growth in revenue and occupancy, reflecting the success of its strategic initiatives aimed at recovering from the pandemic's impact and enhancing value for stakeholders.

Company Overview

Brookdale operates senior living communities across the nation, catering to middle- to upper-income seniors over the age of 75. The company offers a range of services, including meals, housekeeping, and supplemental care, with a focus on assisted living and memory care. Brookdale's continuing-care retirement centers serve residents with varying health and physical abilities, with the majority of revenue generated from assisted living resident fees.

Financial Performance and Challenges

Brookdale's full-year results showcased a robust increase in same community weighted average occupancy, which grew by 190 basis points over the prior year. This growth, coupled with an 11.4% increase in RevPAR and an 8.6% rise in RevPOR, contributed to a 25.9% growth in same community operating income. When excluding government grants and credits, the adjusted operating income for the same community segment grew by an impressive 43.4%. The company's net cash provided by operating activities also saw a significant increase of $160 million, and Adjusted Free Cash Flow improved by $154 million, or 76.3%, compared to the prior year.

Despite these achievements, Brookdale faced challenges, including a net loss increase in the fourth quarter of 2023 compared to the same period in the previous year, primarily due to a non-cash gain on sale of communities recognized in the fourth quarter of 2022, an increase in asset impairment expense, and an increase in provision for income taxes. The company also experienced inflationary pressures and increased costs associated with higher occupancy.

Importance of Financial Achievements

The financial achievements of Brookdale are particularly important in the Healthcare Providers & Services industry, where consistent revenue growth and efficient cost management are critical for long-term sustainability. The improvements in occupancy and revenue per unit indicate a strong demand for Brookdale's services and an effective pricing strategy. The substantial increase in Adjusted Free Cash Flow demonstrates the company's improved operational efficiency and financial health, which is essential for future investments and shareholder returns.

Key Financial Metrics

Brookdale's financial performance is reflected in several key metrics:

"Full-year same community weighted average occupancy grew 190 basis points over the prior year; while same community revenue per available unit (RevPAR) and revenue per occupied unit (RevPOR) increased 11.4% and 8.6%, respectively."

These metrics are crucial as they provide insights into the company's ability to attract and retain residents, optimize pricing, and manage operational efficiency. Higher occupancy rates and increased revenue per unit are indicative of a strong market position and effective management strategies.

Analysis of Performance

Brookdale's performance in 2023 reflects a successful year marked by strategic execution and a focus on enhancing resident experiences. The company's ability to grow occupancy and revenue amidst ongoing challenges demonstrates resilience and a commitment to operational excellence. The significant improvement in Adjusted Free Cash Flow positions Brookdale to continue investing in its communities, pursue growth opportunities, and deliver value to shareholders.

For a more detailed analysis of Brookdale Senior Living Inc's financial results, including the full income statement, balance sheet, and cash flow statement, please visit the 8-K filing.

Brookdale's management will further discuss the financial results in an earnings conference call scheduled for February 21, 2024, providing an opportunity for investors to gain deeper insights into the company's performance and outlook for the future.

For more information on Brookdale Senior Living Inc and to stay updated on the latest financial news and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Brookdale Senior Living Inc for further details.

This article first appeared on GuruFocus.