Brookdale Senior's (BKD) Q4 Loss Widens, Shares Drop 13%

Brookdale Senior Living Inc. BKD shares have declined 13.1% since it reported fourth-quarter 2023 results on Feb 20, 2024. A wider-than-expected loss is likely to have worried investors. Its net income was hurt by an increase in general and administrative expenses, and facility operating lease costs. Nevertheless, the downside was partly offset by improved resident fee revenues, interest income and occupancy rates.

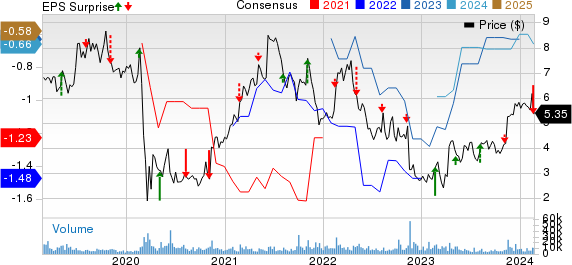

Brookdale Senior incurred a fourth-quarter adjusted loss of 40 cents per share, wider than the Zacks Consensus Estimate of a loss of 19 cents per share and the year-ago quarter’s loss of 13 cents per share.

Total revenues and other operating income rose 7.7% year over year to $754.5 million on the back of higher resident and management fee revenues.

Brookdale Senior Living Inc. Price, Consensus and EPS Surprise

Brookdale Senior Living Inc. price-consensus-eps-surprise-chart | Brookdale Senior Living Inc. Quote

Q4 Operational Update

Resident fees amounted to $716.6 million in the quarter under review, which advanced 8.9% year over year, attributable to an improved revenue per occupied unit ("RevPOR") and occupancy rate. However, the upside was partly offset by the divestiture of 20 communities.

RevPOR advanced 8.1% year over year on the back of rate increases. Meanwhile, weighted average occupancy improved 130 basis points year over year aided by BKD’s initiatives to restore occupancy levels.

Revenue per available unit (“RevPAR”) rose 10% year over year in the fourth quarter. Management fees of $2.5 million grew 4.7% year over year.

Facility operating expenses dipped 0.2% year over year to $530.5 million due to lower natural disaster expenses, lesser use of premium labor and the disposition of 20 communities. This was, however, partly offset by inflationary headwinds and higher occupancy rates that caused a rise in same-community facility operating expenses.

General and administrative costs, including certain items, were $41.9 million in the quarter under review. The figure rose 3.7% year over year. Facility operating lease expenses of $52.6 million escalated 28.7% year over year.

Brookdale Senior’s interest income climbed 39.1% year over year to $5.4 million. It incurred a net loss of $91.2 million, wider than the year-ago quarter’s loss of $25.7 million. The metric suffered a setback due to the recognition of a non-cash gain on the sale of communities in the year-ago quarter, elevated asset impairment expenses and higher income tax provision.

Adjusted EBITDA of $85.3 million soared 83.2% year over year in the fourth quarter on the back of improved resident fee revenues.

Financial Update (as of Dec 31, 2023)

Brookdale Senior exited the fourth quarter with cash and cash equivalents of $278 million, which dropped 30.3% from the 2022-end level. Total assets of $5.6 billion fell 6.1% from the figure at 2022 end.

Long-term debt, less of the current portion, was $3.7 billion, down 3.4% from the figure as of Dec 31, 2022. The current portion of long-term debt was $41.5 million.

Total equity of $405.2 million plunged 30.6% from the 2022-end figure.

BKD generated net cash flow from operations of $29.3 million in the fourth quarter, while $48.6 million was used in operations in the year-ago quarter.

There was an adjusted free cash outflow of $21.5 million in the quarter under review, which compares favorably with the $103.6 million outflow recorded in the year-ago quarter.

Business Update

In December 2023, BKD sold its leftover 20% equity stake in its Health Care Services unconsolidated venture and received proceeds of $27.4 million in return. In the same month, it completed two financing transactions, which were put to use for refinancing the leftover debt maturities of 2024.

In November 2023, Brookdale Senior closed the divestiture of a continuing care retirement community and received cash proceeds of $12.7 million, net of transaction costs, at the time of closing.

Full-Year Update

BKD incurred an adjusted loss of 84 cents per share in 2023, narrower than the year-ago quarter’s loss of $1.25 per share.

Total revenues and other operating income were $3 billion, which improved 6.7% year over year. Resident fee revenues rose 10.5% year over year in 2023.

RevPOR grew 8.6% year over year, while RevPAR increased 11.3% year over year. Weighted average occupancy improved 180 basis points year over year.

It incurred a net loss of $189.1 million, narrower than the loss of $238.3 million reported in 2022. Adjusted EBITDA climbed 39.1% year over year to $335.5 million in 2023.

1Q24 Guidance

Management anticipates 6.25-6.75% year-over-year growth in RevPAR, lower than the year-ago quarter’s recorded growth of 12.9%. Adjusted EBITDA is projected to lie within $90 and $95 million, the mid-point of which indicates an improvement of 4.4% from the prior-year quarter’s reported figure.

2024 View

It estimates non-development capital expenditures, net of anticipated lessor reimbursements, to be roughly $180 million.

Zacks Rank

Brookdale Senior currently has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported fourth-quarter 2023 results so far, the bottom-line results of Inspire Medical Systems, Inc. INSP, The Cigna Group CI and Tenet Healthcare Corporation THC beat the respective Zacks Consensus Estimate.

Inspire Medical delivered an earnings per share (EPS) of 49 cents in fourth-quarter 2023, up 390% year over year. The metric is in contrast to the Zacks Consensus Estimate of a loss of 4 cents per share. It registered revenues of $192.5 million in the fourth quarter, up 39.6% year over year. The figure beat the consensus estimate by 0.1%. U.S. revenues of $189.4 million reflected an increase of 41% from the year-ago quarter on a reported basis. During the reported quarter, Inspire Medical activated 78 new U.S. centers, thus bringing the total to 1,180 U.S. medical centers providing Inspire therapy.

INSP also created 13 new U.S. sales territories in the quarter, bringing the total to 287 U.S. sales territories. Revenues from outside the United States totaled $3.1 million, down 16% year over year on a reported basis. In the fourth quarter, gross profit increased 42.1% to $164.5 million. The gross margin expanded 149 basis points to 85.4%. Operating profit totaled $9.3 million against the year-ago quarter’s operating loss of $0.3 million.

Cigna’s fourth-quarter 2023 adjusted EPS of $6.79 beat the Zacks Consensus Estimate by 4.1%. The bottom line improved 36.9% year over year. Adjusted revenues of $51.2 billion advanced 4.8% year over year in the quarter under review. The top line outpaced the consensus mark by 4.8%. CI’s medical customer base was 19.8 million as of Dec 31, 2023, which witnessed a 9.9% year-over-year increase. The adjusted selling, general and administrative expense ratio deteriorated 30 basis points (bps) year over year to 7.9%.

The Evernorth Health Services unit generated adjusted revenues of $40.5 billion, which advanced 12% year over year. Adjusted operating income on a pretax basis rose 10% year over year to $1.9 billion in the fourth quarter. The Cigna Healthcare unit’s adjusted revenues climbed 17% year over year to $13 billion. The segment’s MCR improved 160 bps year over year to 82.2% at the fourth-quarter end,

Tenet Healthcare reported fourth-quarter 2023 adjusted EPS of $2.68, which beat the Zacks Consensus Estimate by 69.6%. The bottom line jumped 36.7% year over year. Net operating revenues amounted to $5.4 billion, which improved 7.8% year over year in the quarter under review. The top line outpaced the consensus mark by 2.2%. Adjusted net income from continuing operations of $283 million rose 32.9% year over year in the fourth quarter. Adjusted EBITDA of THC increased 12.8% year over year to more than $1 billion.

The Hospital Operations and Services segment’s net operating revenues rose 6% year over year to $4.3 billion in the fourth quarter. Adjusted EBITDA rose 11.8% year over year to $548 million in the quarter under review. The Ambulatory Care unit reported net operating revenues of $1.1 billion, which climbed 15.4% year over year in the fourth quarter. Adjusted EBITDA of $464 million advanced 14% year over year in the quarter under review and beat our estimate of $434.1 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cigna Group (CI) : Free Stock Analysis Report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

Brookdale Senior Living Inc. (BKD) : Free Stock Analysis Report

Inspire Medical Systems, Inc. (INSP) : Free Stock Analysis Report