Brookdale's (BKD) September 2023 Occupancy Volumes Increase

Brookdale Senior Living Inc. BKD recently announced that its September weighted average occupancy climbed 130 basis points (bps) from the year-ago level to 78.2%. This also indicates a 60-bps jump from the August level.

The company has witnessed a favorable start this year, with the first-half weighted average occupancy level rising 240 bps. For the third quarter, the metric rose to 77.6% from 76.4% a year ago. At the third-quarter end, it had the capacity to serve more than 60,000 residents in 41 states.

BKD has witnessed 23 straight months of year-over-year increases in weighted average occupancy. This highlights the company’s ongoing improvement in occupancy levels, which is expected to lead to higher resident fee revenues. In the first half of 2023, resident fee revenues increased 11.4% year over year. The momentum is likely to continue in the coming days and buoy its results.

The company experienced year-over-year RevPAR growth of 12.2% during the first half of 2023, contributing positively to its overall revenue. Anticipating the third quarter, it projected RevPAR growth to fall within the range of 10-10.5%. Additionally, it expects the adjusted EBITDA to be in the range of $73-$78 million.

The Zacks Consensus Estimate for third-quarter 2023 bottom line is pegged at a loss of 20 cents per share. Nevertheless, the estimate for 2023 stands at a loss of 62 cents per share, indicating an improvement of 50.4% from the year-ago loss of $1.25 per share.

The company is poised for a substantial revenue opportunity. BKD has witnessed a notable improvement in weighted average occupancy from the pandemic's low of 69.6% in the first quarter of 2021. Its objective is to restore occupancy and return to its pre-pandemic levels (84.5% observed in the fourth quarter of 2019). Achieving this target is projected to yield at least $295 million in additional revenues, according to its expectations.

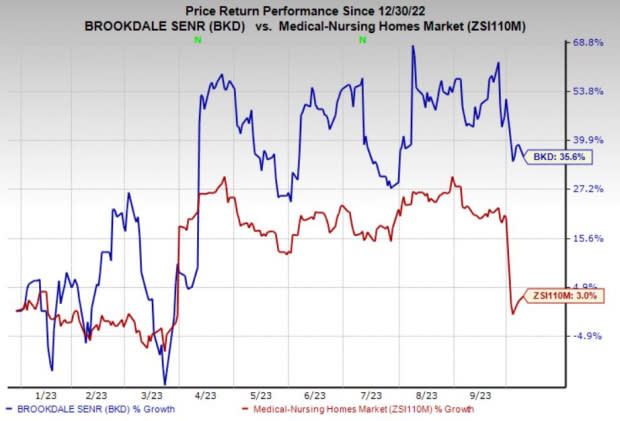

Price Performance

Brookdale shares have gained 35.6% in the year-to-date period compared with the industry’s rise of 3%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Medical space are Select Medical Holdings Corporation SEM, Tenet Healthcare Corporation THC and Atai Life Sciences N.V. ATAI. While Select Medical currently sports a Zacks Rank #1 (Strong Buy), Tenet Healthcare and Atai Life Sciences carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Select Medical’s 2023 earnings indicates a 56.9% year-over-year increase to $1.93 per share. It has witnessed one upward estimate revision over the past 60 days against no movement in the opposite direction. The consensus mark for SEM’s 2023 revenues indicates 4.2% growth from a year ago.

The Zacks Consensus Estimate for Tenet Healthcare’s 2023 bottom line is pegged at $5.73 per share, which rose 0.7% in the past 60 days. During this time, THC has witnessed one upward estimate revision against none in the opposite direction. It beat earnings estimates in all the last four quarters, with the average surprise being 25.9%.

The Zacks Consensus Estimate for Atai Life Sciences’ current-year earnings implies a 16.3% improvement from the year-ago reported figure. It has witnessed three upward estimate revisions over the past 60 days against no movement in the opposite direction. ATAI beat earnings estimates in two of the last four quarters, met once and missed on one occasion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tenet Healthcare Corporation (THC) : Free Stock Analysis Report

Brookdale Senior Living Inc. (BKD) : Free Stock Analysis Report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

atai Life Sciences N.V. (ATAI) : Free Stock Analysis Report