Brookfield Property REIT's (NASDAQ:BPYU) Stock Price Has Reduced35% In The Past Year

While not a mind-blowing move, it is good to see that the Brookfield Property REIT Inc. (NASDAQ:BPYU) share price has gained 18% in the last three months. But that is minimal compensation for the share price under-performance over the last year. After all, the share price is down 35% in the last year, significantly under-performing the market.

View our latest analysis for Brookfield Property REIT

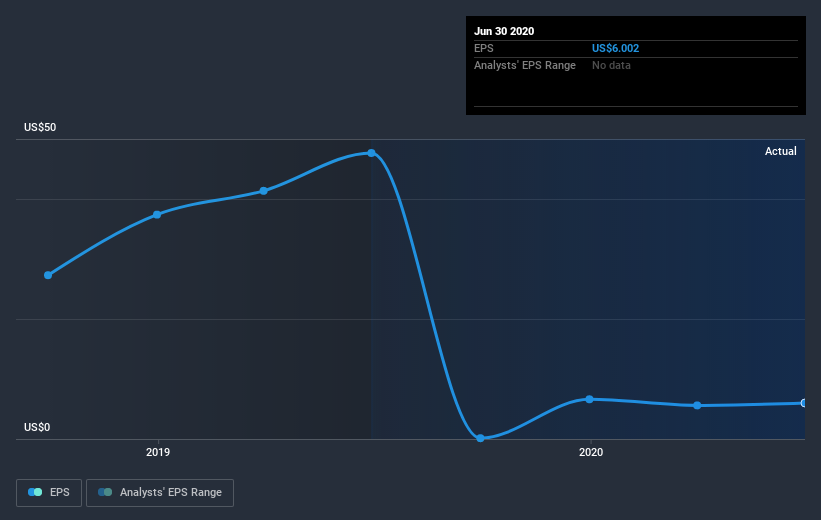

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately Brookfield Property REIT reported an EPS drop of 87% for the last year. This fall in the EPS is significantly worse than the 35% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Brookfield Property REIT's TSR for the last year was -29%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Given that the market gained 23% in the last year, Brookfield Property REIT shareholders might be miffed that they lost 29% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 18%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Brookfield Property REIT better, we need to consider many other factors. Take risks, for example - Brookfield Property REIT has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Brookfield Property REIT is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.