Brookline Bancorp Inc (BRKL) Reports Mixed Fourth Quarter Results Amidst Industry Headwinds

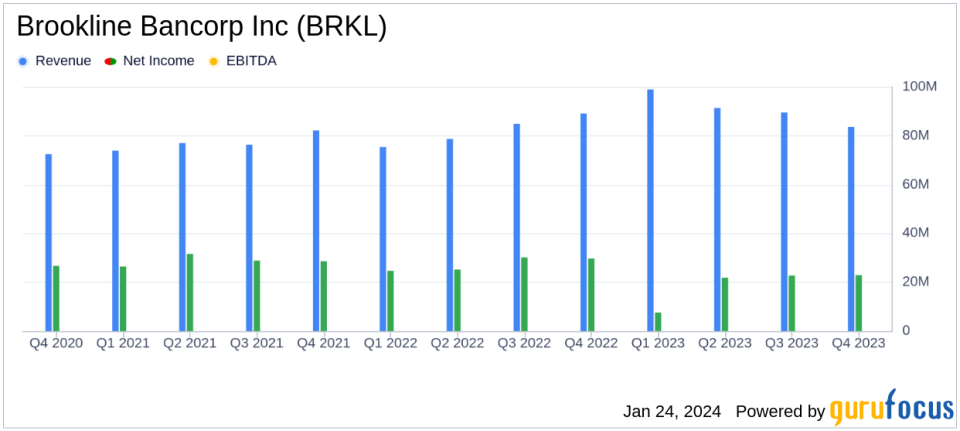

Net Income: $22.9 million for Q4 2023, consistent with Q3 but down from $29.7 million in Q4 2022.

Earnings Per Share (EPS): Remained at $0.26 for Q4, a decrease from $0.39 in the same quarter last year.

Net Interest Income: Slight decrease to $83.6 million in Q4 from $84.1 million in Q3.

Net Interest Margin: Declined to 3.15% in Q4, a drop from 3.18% in the previous quarter.

Asset Growth: Total assets grew to $11.4 billion, up from $11.2 billion in Q3 and a significant increase from $9.2 billion year-over-year.

Loan and Lease Growth: Increased to $9.6 billion, up $260.8 million from Q3 and $2.0 billion from the previous year.

Dividend: Declared a quarterly dividend of $0.135 per share.

On January 24, 2024, Brookline Bancorp Inc (NASDAQ:BRKL) released its 8-K filing, detailing its financial performance for the fourth quarter of 2023. The multi-bank holding company, known for its commercial, business, and retail banking services, reported a net income of $22.9 million, or $0.26 per basic and diluted share, for the fourth quarter of 2023. This figure is consistent with the third quarter of 2023 but represents a decline from the $29.7 million, or $0.39 per share, reported in the fourth quarter of the previous year.

For the full year of 2023, Brookline Bancorp Inc reported net income of $75.0 million, or $0.85 per basic and diluted share, a decrease from the $109.7 million, or $1.42 per share, recorded for 2022. The company's CEO and Chairman, Paul Perrault, acknowledged the challenging headwinds faced by the industry in 2023 but expressed confidence in the company's positioning for the future.

Financial Highlights and Challenges

Brookline Bancorp's net interest income saw a marginal decline to $83.6 million in the fourth quarter from $84.1 million in the third quarter, with the net interest margin also decreasing by 3 basis points to 3.15%. The company's balance sheet showed growth, with total assets increasing by $201.7 million to $11.4 billion from the third quarter and a significant $2.2 billion increase from the previous year. This growth was primarily driven by the acquisition of PCSB Financial Corporation ("PCSB").

Despite the overall asset growth, the company faced challenges, including a decrease in total deposits and an increase in borrowed funds, which was necessary to fund loan growth during the quarter. The ratio of stockholders equity to total assets decreased slightly year-over-year, from 10.80 percent at the end of 2022 to 10.53 percent at the end of 2023.

Asset Quality and Income Tax Provisions

Asset quality improved, with the ratio of total nonperforming loans and leases to total loans and leases decreasing to 0.45 percent at the end of December 2023 from 0.55 percent at the end of September 2023. The provision for credit losses recorded for the fourth quarter was $3.8 million, compared to $3.0 million for the previous quarter, driven by net charge-offs, an increase in specific reserves, and strong loan growth.

The effective tax rate for the company was 19.9 percent for the fourth quarter, a slight decrease from 21.4 percent in the third quarter. The annualized return on average assets remained flat at 0.81 percent for the fourth quarter, while the return on average tangible stockholders' equity increased to 10.12 percent.

Outlook and Dividend Declaration

Brookline Bancorp's Board of Directors approved a dividend of $0.135 per share for the quarter, payable on February 23, 2024, to stockholders of record on February 9, 2024. The company will conduct a conference call/webcast to discuss the results for the quarter, business highlights, and outlook.

Value investors may find Brookline Bancorp's stable quarterly performance, asset growth, and dividend declaration appealing, despite the year-over-year earnings decrease and industry challenges. The company's strategic positioning and improved asset quality could signal resilience in a turbulent market.

For a more detailed analysis and further information, investors are encouraged to review the full earnings report and listen to the upcoming conference call.

Explore the complete 8-K earnings release (here) from Brookline Bancorp Inc for further details.

This article first appeared on GuruFocus.