BROWN BROTHERS HARRIMAN & CO Acquires New Stake in Westrock Coffee Co

On August 7, 2023, BROWN BROTHERS HARRIMAN & CO, a prominent private bank and investment firm, made a significant move in the stock market by acquiring 794,087 shares in Westrock Coffee Co. This article provides a detailed analysis of the transaction, the profiles of the guru and the traded company, and the potential implications for value investors.

Transaction Details

The firm purchased the shares at a price of $10 each, making the total value of the transaction approximately $7.94 million. This acquisition has increased the firm's total holdings in Westrock Coffee Co to 794,087 shares, representing 0.06% of their portfolio and 0.91% of the company's total shares.

Profile of BROWN BROTHERS HARRIMAN & CO

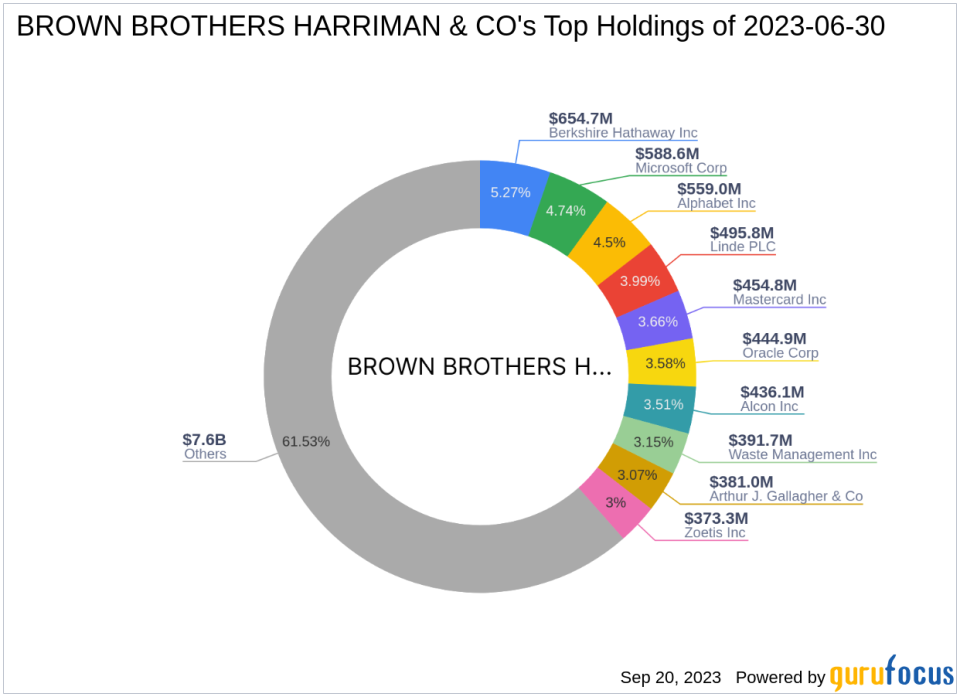

BROWN BROTHERS HARRIMAN & CO is the oldest and largest private bank in the United States, with a history dating back to 1800. The firm has over 5,000 employees and offers a wide range of services, including commercial banking, investment management, brokerage, and trust services. The firm's top holdings include Alphabet Inc(NASDAQ:GOOG), Microsoft Corp(NASDAQ:MSFT), Berkshire Hathaway Inc(NYSE:BRK.B), Mastercard Inc(NYSE:MA), and Linde PLC(NYSE:LIN). The firm's equity stands at $12.43 billion, with the financial services and technology sectors being their top sectors.

About Westrock Coffee Co

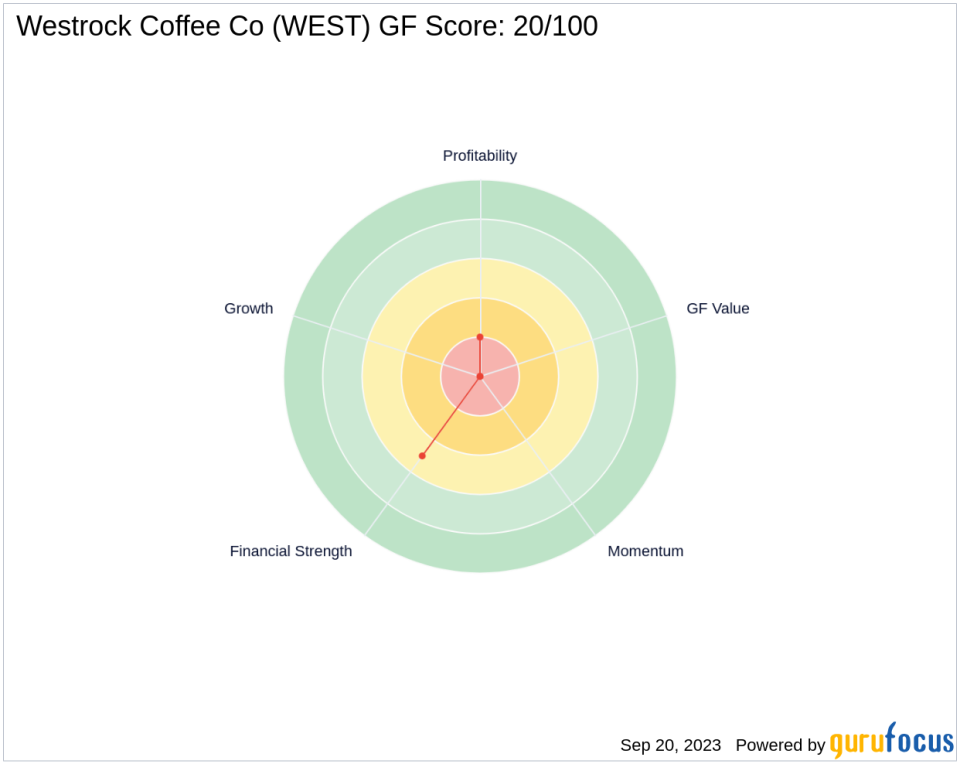

Westrock Coffee Co, listed under the symbol WEST, is a leading provider of integrated coffee, tea, flavors, extracts, and ingredients solutions in the U.S. The company's business segments include Beverage Solutions and Sustainable Sourcing & Traceability. As of the date of this article, the company's market cap stands at $856.837 million, with a stock price of $9.78. However, due to the lack of sufficient data, the GF Valuation cannot be evaluated. The company's GF Score stands at 20/100, indicating poor future performance potential.

Financial Health and Performance of Westrock Coffee Co

Westrock Coffee Co's financial health and performance can be evaluated using various metrics. The company's balance sheet rank is 5/10, indicating moderate financial strength. The profitability rank is 2/10, suggesting low profitability. The growth rank is 0/10, indicating no growth. The company's Z score is 1.39, which is below the safe zone of 2.99, suggesting potential financial distress. The cash to debt ratio is 0.09, which is relatively low, indicating high debt levels.

Momentum and Predictability of Westrock Coffee Co

The company's RSI 5 Day is 17.36, RSI 9 Day is 25.57, and RSI 14 Day is 31.25, indicating a bearish trend. The momentum index 6 - 1 month is -9.42, suggesting a negative momentum. The predictability rank is not available due to insufficient data.

Other Gurus' Involvement

Southeastern Asset Management is the largest guru holding shares in Westrock Coffee Co. Other notable gurus holding shares in the company include Mario Gabelli (Trades, Portfolio).

Conclusion

The acquisition of Westrock Coffee Co by BROWN BROTHERS HARRIMAN & CO is a significant move that could potentially influence the stock's performance and the firm's portfolio. However, given the company's low GF Score and financial health indicators, investors should exercise caution. As always, it is crucial to conduct thorough research and consider various factors before making investment decisions.

This article first appeared on GuruFocus.