Brown & Brown (BRO) Rises 25% YTD: Will the Bull Run Continue?

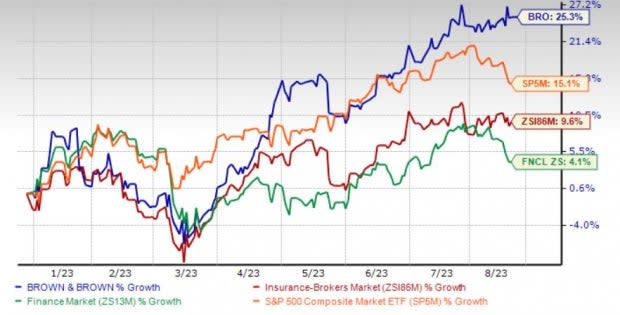

Brown & Brown’s BRO shares have gained 25.3% year to date, outperforming the industry’s increase of 9.6%. The Finance sector increased 4.1%, while the Zacks S&P 500 composite gained 15.1% in the same period. With a market capitalization of $20.2 billion, the average volume of shares traded in the last three months was 1.1 million.

New businesses, better customer retention, premium-rate increases across the majority of business lines, strategic acquisitions and a strong financial position continue to drive BRO’s performance. This Zacks Rank #1 (Strong Buy) insurance broker has a decent history of delivering earnings surprises in the last four reported quarters. Earnings of the insurer increased 16.8% in the last five years, better than the industry average of 12.6%.

BRO’s total shareholder return has outperformed its peer group and the S&P 500 in the last five years. The 10-year average total shareholders' return was 399%.

Image Source: Zacks Investment Research

Can it Retain the Momentum?

The Zacks Consensus Estimate for 2023 earnings is pegged at $2.69, suggesting a year-over-year increase of 18% on 17.6% higher revenues of $4.2 billion. The consensus estimate for 2024 earnings is pegged at $2.94, indicating a year-over-year increase of 9.3% on 7.7% higher revenues of $4.5 billion.

Increasing new business, strong retention and continued rate increases for most lines of coverage should continue to drive Brown and Brown’s commissions and fees and, in turn, drive the top line. The top line witnessed a five-year annual growth rate of 14%.

Brown & Brown boasts an impressive inorganic story that helps strengthen its compelling products and service portfolio, expands global reach and accelerates the growth rate. Strategic buyouts also help BRO capitalize on growing market opportunities.

Backed by a sustained operational performance, Brown & Brown has maintained a strong liquidity position. BRO has strong cash conversion due to the strength of its operating model and diversity of businesses. This, in turn, should enable BRO to make consistent investments in boosting organic growth and margin expansion.

A solid capital position supported BRO in increasing dividends over the last 29 years. Dividends increased at a five-year (2019-2023) CAGR of 6.57%, making it an attractive pick for yield-seeking investors.

Attractive Valuation

The price-to-book value multiple is 3.99, much lower than the industry average of 6.8. Before valuation expands, it is advisable to take a position in the stock.

Other Stocks to Consider

Some other top-ranked stocks from the insurance industry are Erie Indemnity ERIE, Ryan Specialty Holdings, Inc. RYAN and Marsh & McLennan Companies MMC.

The Zacks Consensus Estimate for Erie Indemnity’s 2023 and 2024 earnings indicates a respective 32.9% and 16.7% year-over-year increase. It has a Growth Score of B. The consensus estimate has risen 5.4% for 2023 and 8.3% for 2024 in the past 30 days. ERIE delivered a four-quarter average earnings surprise of 2.05%. Shares have risen 14% year to date. It sports a Zacks Rank #1 You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ryan Specialty’s 2023 and 2024 EPS indicates a 20.9% year-over-year increase each. The consensus estimate has risen 4.5% for 2023 and 2.4% for 2024 in the past 30 days. RYAN delivered a four-quarter average earnings surprise of 2.37%. It has a Growth Score of B and carries Zacks Rank #2. Shares have risen 8.7% year to date .

Marsh & McLennan delivered a four-quarter average earnings surprise of 3.44%. The Zacks Consensus Estimate for 2023 and 2024 earnings indicates a respective 12.6% and 9.2% year-over-year increase. The consensus estimate has risen 0.1% for 2023 and 1.3% for 2024 in the past 30 days. The expected long-term earnings growth rate is pegged at 10.5%. MMC carries a Zacks Rank #2. Its shares have risen 14.1% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Erie Indemnity Company (ERIE) : Free Stock Analysis Report

Ryan Specialty Holdings Inc. (RYAN) : Free Stock Analysis Report