Brown & Brown's (BRO) Q2 Earnings & Revenues Top Estimates

Brown & Brown, Inc.’s BRO second-quarter 2023 adjusted earnings of 68 cents per share beat the Zacks Consensus Estimate by 15.2%. The bottom line increased 33.3% year over year.

The quarterly results reflected improved organic growth and higher net investment income, partly offset by higher expenses.

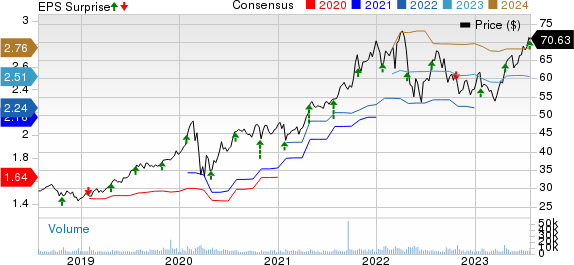

Brown & Brown, Inc. Price, Consensus and EPS Surprise

Brown & Brown, Inc. price-consensus-eps-surprise-chart | Brown & Brown, Inc. Quote

Q2 Details

Total revenues of $1.1 billion beat the Zacks Consensus Estimate by 5.1%. The top line improved 25% year over year. The upside can be primarily attributed to commission and fees, which grew 23.5% year over year to $1 billion. Our estimate for commission and fees growth was 13.7%.

Organic revenues improved 11.2% to $894.3 million in the quarter under review.

Investment income increased year over year to $10.3 million from $0.4 million in the year-ago quarter. The Zacks Consensus Estimate for the metric was pegged at $6.1 million and our estimate was $4.6 million.

Adjusted EBITDAC was $358.4 million, up 30.5% year over year. EBITDAC margin expanded 150 basis points year over year to 35.7%. Our estimate for adjusted EBITDAC was $207.5 million.

Total expenses increased 23.7% to $792.9 million due to a rise in employee compensation and benefits, other operating expenses, amortization, depreciation and interest expenses. Our estimate was $751.3 million.

Financial Update

Brown & Brown exited the second quarter with cash and cash equivalents of $ 627.9 million, down 3.4% from the 2022-end level.

Long-term debt was $3.8 billion as of Mar 31, 2023, up 1.9% from 2022 end.

Net cash provided by operating activities in the first half of 2023 was $388.5 million, up 12.2% year over year.

Dividend Update

The board of directors paid a regular quarterly cash dividend of 11.50 cents per share in the reported quarter.

Zacks Rank

Brown & Brown currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

The Travelers Companies TRV reported second-quarter 2023 core income of 6 cents per share, which missed the Zacks Consensus Estimate of $2.27. The bottom line decreased 97.7% year over year, primarily attributable to higher-than-expected catastrophe loss.

Travelers’ total revenues increased 9.8% from the year-ago quarter to $10.1 billion, primarily driven by higher premiums. The top-line figure was almost in line with the Zacks Consensus Estimate.

Net written premiums increased 14% year over year to a record $10.3 billion, driven by strong growth across all three segments. The figure was higher than our estimate of $9.1 billion.

Travelers witnessed an underwriting gain of $781 million, up 38% year over year, driven by record net earned premiums of $9.2 billion and a consolidated underlying combined ratio, which improved 170 basis points. The combined ratio deteriorated 820 basis points (bps) year over year to 106.5 due to higher catastrophe losses and lower net favorable prior-year reserve development, partially offset by a lower underlying combined ratio.

The Progressive Corporation’s PGR second-quarter 2023 earnings per share of 50 cents missed the Zacks Consensus Estimate of 88 cents. The bottom line declined 47.4% year over year.

Net premiums earned grew 19% to $14.5 billion and beat our estimate of $12.9 billion as well as the Zacks Consensus Estimate of $14.3 billion. The combined ratio deteriorated 480 bps from the prior-year quarter’s level to 104.

Policies in force were solid in the Personal Auto segment, increasing 17% from the year-ago month’s figure to 19.7 million. Special Lines improved 7% to 5.8 million.

W.R. Berkley Corporation’s WRB second-quarter 2023 operating income of $1.14 per share beat the Zacks Consensus Estimate by 6.5%. The bottom line increased 1.8% year over year.

Operating revenues came in at $2.9 billion, down 57.4% year over year, on the back of higher net premiums earned as well as higher net investment income. The top line missed the consensus estimate by 1.2%.

W.R. Berkley’s net premiums written were a record $2.8 billion, up 8.7% year over year, as market conditions remained favorable for most lines of business. Our estimate for the same was $2.7 billion.

Catastrophe losses totaled $53.5 million in the quarter. The consolidated combined ratio (a measure of underwriting profitability) deteriorated 100 basis points to 89.6, in line with the Zacks Consensus Estimate. Our estimate for the combined ratio was 91.3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report