Brown-Forman (BF.B) Q1 Earnings & Sales Miss on Soft Trends

Brown-Forman Corporation (BF.B) has reported dismal first-quarter fiscal 2024 results, wherein sales and earnings missed the Zacks Consensus Estimate. Meanwhile, sales improved year over year, while earnings declined.

In the fiscal first quarter, earnings per share (EPS) of 48 cents declined 7% year over year and lagged the Zacks Consensus Estimate of 52 cents.

Net sales of $1,038 million missed the Zacks Consensus Estimate of $1,053 million. The top line increased 3% year over year on a reported basis. On an organic basis, net sales were up 2% from the prior-year level. Lower-than-expected sales mainly resulted from the impacts of difficult shipment comparisons from the prior-year quarter, when the company rebuilt inventory to overcome the glass supply challenges.

Brown-Forman Corporation Price, Consensus and EPS Surprise

Brown-Forman Corporation price-consensus-eps-surprise-chart | Brown-Forman Corporation Quote

In the first quarter of fiscal 2024, Brown-Forman’s gross profit amounted to $651 million, up 5% year over year. On an organic basis, the gross profit rose 5%. Meanwhile, the gross margin expanded 90 basis points (bps) to 62.7%. The favorable gross margin resulted from improved price/mix and reduced supply-chain disruptions due to lower costs and lower tariff-related expenses. This was partly negated by higher input costs and adverse currency rates.

SG&A expenses of $200 million rose 14% year over year and 12% on an organic basis. The increase stemmed from higher compensation expenses. Advertising expenses increased 19% year over year to $131 million for the fiscal first quarter. On an organic basis, advertising expenses increased 14%. Elevated advertising costs mainly resulted from the launch of Jack Daniel’s and Coca-Cola RTDs, increased investments in Jack Daniel’s Tennessee Whiskey, and the acquisition of Gin Mare and Diplomatico.

We expected total operating expenses to increase 15.6% year over year to $322.5 million in the fiscal first quarter, driven by a 1.9% rise in advertising expenses and a 3.9% increase in selling, general and administrative expenses.

The operating income fell 4% year over year to $327 million on a reported basis due to the timing of higher operating expenses, offset by an improved gross margin. The organic operating income declined 6%. The operating margin of 31.5% contracted 250 bps from the 34% reported in the year-ago quarter.

Our model predicted an operating margin of 32.4%, suggesting a 170-bps contraction from the year-ago quarter’s actual.

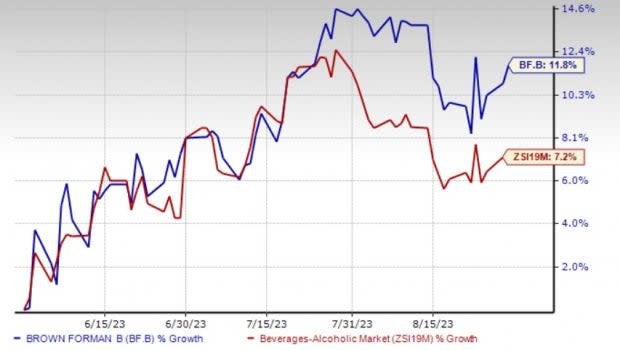

The Zacks Rank #2 (Buy) company’s shares have rallied 11.8% in the past three months compared with the industry’s growth of 7.2%.

Image Source: Zacks Investment Research

Market-Wise Performance

In first-quarter fiscal 2024, net sales growth was mainly driven by broad-based growth across emerging and developed international markets, as well as the Travel Retail channel. However, sales growth was partly negated by a decline in the United States due to a decrease in distributor inventories resulting from last year’s significant inventory build.

The emerging markets registered 27% net sales growth, whereas organic sales improved 32%. This was backed by strong growth of New Mix and Jack Daniel’s Tennessee Whiskey in the United Arab Emirates and Poland.

The developed international market reported sales growth of 5%, with flat organic sales. The improvement can be attributed to Gin Mare and Diplomático in Italy, and the launch of Jack Daniel’s Tennessee Apple in South Korea. This was partly offset by lower volumes for Jack Daniel’s RTDs in the U.K. and Australia.

Net sales in the Travel Retail channel advanced 13% on a reported basis and 9% on an organic basis due to higher volumes for Woodford Reserve and Jack Daniel’s super-premium expressions like Jack Daniel’s Single Barrel Tennessee Whiskey.

The company’s overall sales in the United States declined 8% on a reported and 9% on an organic basis. The decline resulted from lower volumes reflected in reduced distributor inventories, offset by improved prices across the portfolio led by Jack Daniel’s Tennessee Whiskey.

Category-Wise Performance

Net sales for whiskey products declined 1% year over year and were flat on an organic basis. The decline was led by Woodford Reserve and Gentleman Jack due to the estimated decline in distributor inventories. This was partly offset by improvements in Jack Daniel’s Tennessee Apple and Jack Daniel’s super-premium expressions like Jack Daniel’s Sinatra and Jack Daniel’s Bonded. Net sales for Jack Daniel’s Tennessee Whiskey were flat year over year.

The company continued to witness growth in the Ready-to-Drink (RTD) category, owing to consumer preference for convenience and flavor. Sales for New Mix improved 52% on a reported basis and 32% on an organic basis, driven by elevated volumes and prices, as well as positive currency effects. Jack Daniel’s RTDs/Ready-to-Pours reported flat sales both on a reported and organic basis, driven by lower Jack Daniel’s & Cola volume due to the launch of Jack Daniel’s & Coca-Cola RTD.

Brown-Forman’s tequila portfolio reported year-over-year sales growth of 15% and 12% on an organic basis. This was driven by double-digit sales growth for the el Jimador brand. The el Jimador reported year-over-year sales growth of 27% on a reported basis and 26% on an organic basis, driven by higher pricing, mainly in the United States, as well as higher volumes in Colombia. Sales increased 1% on a reported and declined 3% on an organic basis for the Herradura brand, driven by lower volumes in the United States due to an estimated decline in distributor inventories, offset by positive currency effects.

The company’s newly acquired Gin Mare and Diplomático led significant growth in the rest of the portfolio, with reported sales growth of 97% and organic sales growth of 5%.

Our model had predicted the tequila category to register sales growth of 12.7% in the fiscal first quarter. Meanwhile, other key categories, including wine, vodka and whiskey, were expected to report sales growth of 10.2%, 6.2% and 1.8%, respectively.

Balance Sheet & Cash Flow

The company ended first-quarter fiscal 2024 with cash and cash equivalents of $426 million, and long-term debt of $2,687 million. Its total shareholders’ equity was $3,338 million. As of Jul 31, 2023, BF.B used about $44 million in cash for operating activities.

In first-quarter fiscal 2024, the company returned nearly $99 million to stockholders via dividends. It recently announced a quarterly dividend of 20.55 cents per share on its Class A and Class B shares. The dividend is payable on Oct 2 to shareholders of record as of Sep 5. It has paid out regular quarterly dividends for 79 consecutive years and raised the dividend for 39 consecutive years.

Outlook

Management has reiterated its view for fiscal 2024. It anticipates organic sales growth of 5-7% for fiscal 2024, driven by its strong portfolio of brands, pricing strategy and robust consumer demand. The company remains optimistic about organic sales and organic operating income growth. BF.B predicts trends to normalize after two consecutive years of double-digit organic sales growth.

Brown-Forman expects the organic operating income to increase 6-8%, driven by lower supply-chain disruption costs, partly offset by continued input cost pressures. The effective tax rate is expected to be 21-23% for fiscal 2024. Capital expenditure is anticipated to be $250-$270 million.

Stocks to Consider

We have highlighted three better-ranked stocks from the Consumer Staples sector, namely Fomento Economico Mexicano FMX, Ambev ABEV and PepsiCo Inc. PEP.

Fomento Economico Mexicano, alias FEMSA, currently sports a Zacks Rank #1 (Strong Buy). The company has an expected EPS growth rate of 22.4% for three to five years. Shares of FMX have rallied 18% in the past three months. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FEMSA’s current financial year’s sales and earnings per share suggests growth of 31.9% and 58.3%, respectively, from the year-ago period’s reported figures. FMX has a trailing four-quarter earnings surprise of 6.1%, on average.

Ambev has a trailing four-quarter earnings surprise of 20.8%, on average. It currently carries a Zacks Rank #2 (Buy). Shares of ABEV have gained 3.9% in the past three months.

The Zacks Consensus Estimate for Ambev’s current financial-year sales suggests growth of 4.5% from the year-ago period's reported figure. Meanwhile, the consensus estimate for earnings indicates a decline of 5.6% from the year-ago quarter’s reported figure. ABEV has an expected EPS growth rate of 7% for three to five years.

PepsiCo has a trailing four-quarter earnings surprise of 6.3%, on average. It currently carries a Zacks Rank #2. Shares of PEP have declined 0.7% in the past three months.

The Zacks Consensus Estimate for PepsiCo’s current financial-year sales and earnings suggests growth of 6.7% and 10.2%, respectively, from the year-ago period's reported figures. PEP has an expected EPS growth rate of 8.1% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brown-Forman Corporation (BF.B) : Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Ambev S.A. (ABEV) : Free Stock Analysis Report